Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

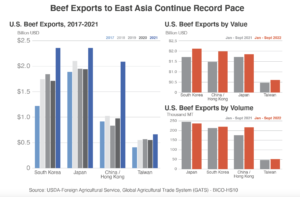

FAS: U.S. Beef Exports to East Asia in 2022, Again on Record Pace

In a report yesterday from USDA’s Foreign Agricultural Service (FAS), “U.S. Beef Exports to East Asia on Record Pace,” Ivan Lee indicated that, “U.S. beef exports to East Asia in 2022 are again on record pace after a record year in 2021. Despite economic uncertainties due to the COVID-19 pandemic, continued global supply chain challenges, and a competitive global beef market, U.S. beef exports to East Asia, both in value and volume, were outstanding in the first half of 2022. East Asia’s relatively robust middle class has supported the demand for high-quality beef, and a developed e-commerce retail sector has provided flexible avenues for suppliers to promote beef products during the pandemic.”

Lee explained that, “East Asia is the top regional market destination for U.S. beef exports. During the first three quarters of 2022 (January – September 2022), U.S. beef exports to East Asia, including the Republic of Korea (South Korea), Japan, China/Hong Kong, and Taiwan, were a record $6.6 billion, exceeding last year’s exports of $5.4 billion, a 22 percent increase on a value basis. On a volume basis, exports were up 6.4 percent. Despite surging food prices in recent months, higher-volume shipments indicate a continued demand for beef products and that East Asia’s relatively stable middle class with high disposable household income has been willing to absorb the rising costs.”

The FAS report added that, “U.S. beef exports to China/Hong Kong surpassed $2 billion for the first time in 2021. Exports in 2022 have already reached $2.0 billion by September 30, a 34.1 percent increase in value during the same period last year; exports on a volume basis increased 23.2 percent. Unlike competition in other East Asian economies, where the United States and Australia are the two main suppliers, in China/Hong Kong the United States competes with several South American suppliers, namely Brazil, Argentina, and Uruguay.”

“From a policy perspective, how economies combat inflationary pressure will have an impact on East Asia’s demand for beef imports,” the FAS report said.

In other news regarding beef demand, Tony Briscoe reported on the front page of today’s Los Angeles Times that, “Could ordering a McChicken, as opposed to a Big Mac, help in the fight against climate change?”

Briscoe pointed out that, “In a study published Tuesday in the Journal of the American Medical Assn., researchers polled more than 5,000 adults nation- wide to gauge whether placing climate-impact labels on fast-food menus might persuade customers to make more environmentally friendly choices.

“They found customers were 23% less likely to order red meat at a fast-food restaurant if the menu had labels warning that those meals had a negative effect on the climate. Customers were nearly 10% more likely to order a more climate- friendly option, such as chicken or fish, if those items had labels promoting them as climate-friendly.”

Meanwhile, Reuters writer Naveen Thukral reported today that, “Chicago soybean futures rose on Wednesday, gaining for a third consecutive session, as a lack of rains in key supplier Argentina and dismantling of COVID-19 restrictions in China underpinned the market.”

.@usda_oce Wx: During the recent cold wave, winter #wheat🌾 had little or no protective snow cover across roughly the southern half of the Plains, with temperatures falling to 0°F or below on December 22 and 23 as far south as #Texas’ northern panhandle.

— FarmPolicy (@FarmPolicy) December 27, 2022

“For the wheat market, strong winds and temperatures well below freezing levels have threatened dormant hard red winter wheat crops across the U.S. Great Plains, especially where a lack of snow cover leaves the plants vulnerable to damage from the cold,” the Reuters article said.