As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Kansas City Fed: Farm Real Estate Debt Climbs, But Farm Finances Strong

In a recent update from the Federal Reserve Bank of Kansas City, “Farm Debt Climbs but Financial Stress Remains Limited,” Nate Kauffman and Ty Kreitman indicated that, “Farm real estate debt continued to climb and led to a notable increase in agricultural loan balances at commercial banks. The pace of farm loan growth increased further in the third quarter and was faster among agricultural banks than those with less concentrated agricultural lending portfolios. Despite the increases in loan balances, farm finances remained strong and delinquency rates on agricultural loans reached an all-time low. As interest rates edged higher, increases in both agricultural and non-agricultural lending also supported earnings for farm lenders.

“The outlook for the agricultural economy through the end of 2022 was generally positive, but some pressures remained looking ahead to next year. Profit opportunities for most producers across the sector remained favorable and continued to support farm finances. Agricultural credit conditions also remained strong, but improvement has been more measured in recent months alongside the pressures associated with uncertainty about commodity prices, intense drought and higher expenses.”

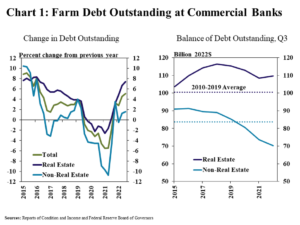

Kauffman and Kreitman pointed out that, “Growth in farm real estate loans picked up in the third quarter while increases in production lending remained more measured. Real estate and non-real estate loans grew about 7% and 2% from a year ago, respectively.”

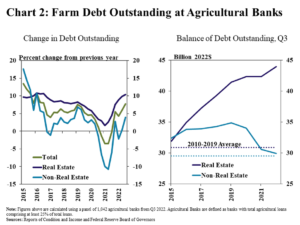

The Kansas City Fed update noted that, “Considerable growth in farm real estate lending drove a faster pace of growth in lending among agricultural banks. Real estate and non-real estate loan balances at agricultural banks in the third quarter were 10% and 4% higher than a year ago, respectively. The quick rise in farmland lending pushed real estate loan balances at those banks to historically high levels and production loans continued to move towards the recent average.”

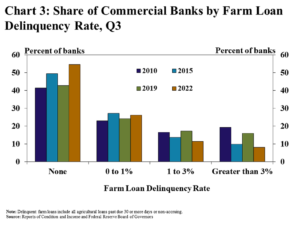

Kauffman and Kreitman added that, “Farm loan performance continued to strengthen steadily, and improvement has been broad. In fact, farm loan delinquency rates were less than 1% in about 80% of commercial banks with agricultural loans, and about half of all lenders reported no past dues.

“Moreover, less than 10% of commercial banks reported farm loan delinquencies greater than 3%, which was the lowest share on record.”