Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Production Costs in Focus

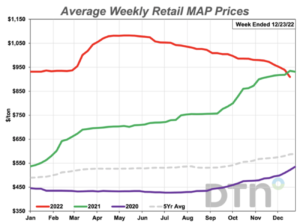

DTN writer Russ Quinn reported on Wednesday that, “Average retail fertilizer prices have begun to move noticeably lower for the fourth week of December 2022, according to sellers surveyed by DTN. Prices for all eight major fertilizers are now lower compared to last month.

“Three fertilizers were significantly lower compared to last month. DTN designates a substantial move as anything 5% or more.

“MAP, potash and urea were all 6% less expensive compared to last month. MAP had an average price of $909 per ton, potash $790/ton and urea $757/ton.”

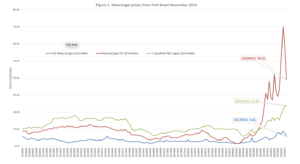

And last week, University of Nebraska-Lincoln Professors John Beghin and Lia Nogueira indicated in a report, “Better News on World Fertilizer Markets,” that, “Natural gas prices are shown in Figure 1 for the US, EU, and Japanese markets. Prices in Europe and the US peaked in the summer and have been falling.”

“While remaining elevated by any standards, the decrease in EU and US prices lowers pressures in fertilizer production cost.”

Beghin and Nogueira noted that, “Fertilizer prices are shown in Figure 2. The series show DAP (diammonium phosphate), Phosphate rock, Potassium chloride (potash), TSP (triple superphosphate), and Urea.

“The price of DAP, TSP, and Urea peaked around May 2022 and have continued their downward trajectory. These prices tend to follow the evolution of natural gas prices since these fertilizer mixes contain nitrogen produced with natural gas or rely on processes that are natural gas intensive (like TSP). These prices remain elevated and remain expensive, even with their downward trajectory. The prices of potash and phosphate rock remain at their highest levels, however.”

The University of Nebraska report added that, “In summary, while fertilizer prices remain high and uncertainty remains (energy prices, trade policies, the Ukraine-Russia war, etc.), there have been some recent good news due to declining fertilizer prices. Taking a more in-depth look at affordability suggests that technological advances have helped reduce the share of fertilizer use in crop production. While the share of fertilizer use to gross value has remained constant, the fertilizer cost/gross value risk for 2023 remains as grain prices are fluctuating and yields will not be revealed until fall 2023.”

Key Crop Inputs Costs Have Increased Sharply

— FarmPolicy (@FarmPolicy) December 20, 2022

December #Corn & #Soybean Outlook Update, https://t.co/WaNqObr0t5, @PUCommercialAg webinar. pic.twitter.com/SeBzcVYE7Q

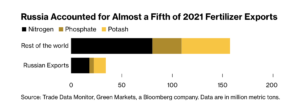

Meanwhile, Bloomberg News reported on Wednesday that, “Russian fertilizer billionaire Andrey Melnichenko is lobbying politicians in Africa to pressure the European Union into finding a solution to what he says are sanctions-related disruptions choking flows of food and vital crop nutrients.

While EU sanctions on Russia don’t target agricultural products or fertilizers, trade is still being affected, he said. That’s curbed fertilizer shipments by about 9 million tons so far this year, said Melnichenko, the founder of EuroChem Group AG.

The Bloomberg article noted that, “EU member states have been applying different sanctions policies among themselves to Russian fertilizer producers, Melnichenko, who is sanctioned himself, said on Wednesday.”

The Bloomberg article pointed out that, “Melnichenko flew to South Africa to lobby politicians on the sidelines of the ruling African National Congress’s electoral conference. He wants the continent’s most industrialized nation to back his pleas for the EU to resolve the issue, saying projected fertilizer shipments lost to sanctions over 12 months would grow enough grain to feed more than 200 million people.”

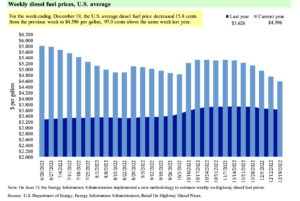

And in its weekly Grain Transportation report last week, the USDA’s Agricultural Marketing Service (AMS) pointed out that, “For the 6th straight week, diesel prices continued to decline. For the week ending December 19, the U.S. average diesel fuel price decreased 15.8 cents from the previous week to $4.596 per gallon—97.0 cents above the same week last year. Following the previous 2 weeks’ declines of 17.4 cents and 21.3 cents, this was the third week in a row the diesel price had a double-digit drop, as well as the first time since February 28 the price dipped below $4.60 per gallon.

“In the Midwest, the diesel price fell 17.4 cents per gallon to $4.477, which was also the lowest Midwest price since February 28, when it was $3.968.”

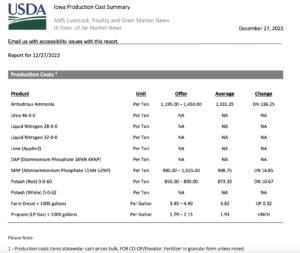

And a separate report this week from USDA’s AMS provided a recap of some cost of production variables for Iowa producers: