Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Senate Blocks Rail Strike, World Food Prices Fall, China Moves to Ease “Zero COVID,” While EPA Issues Draft Biofuel Proposal

Tony Romm and Lauren Kaori Gurley reported on the front page of today’s Washington Post that “The Senate on Thursday adopted a measure that forces a deal between warring national freight railroads and their unions, averting a potential Dec. 9 strike that could have crippled U.S. travel and commerce ahead of the busy holiday shopping season.

“The overwhelmingly bipartisan, 80-15 vote sends the measure to President Biden’s desk, as he requested earlier this week — though lawmakers were unable to provide rail workers with any of the paid sick leave benefits that union leaders vigorously sought in recent months.”

The Post article noted that, “The deal mirrors the terms the White House brokered with railroads and union leaders this September, clinching what many at the time thought was an end to the standoff. Initially, eight of the country’s 12 rail unions approved the arrangement, hoping to avert a strike. But four other rail labor organizations opted in November to reject the proposal — opposition that constituted slightly more than half of all rail workers.

“The outcome landed the negotiations in the lap of Congress, where some Democrats and Republicans seemed reluctant to wade into the talks — but resigned to the reality that inaction could cripple the economy.”

Katy Stech Ferek and Esther Fung reported on the front page of today’s Wall Street Journal that, “The move is expected to end the standoff between Union Pacific Corp., CSX Corp. and other freight railroads and more than 115,000 workers. Under the Railway Labor Act, Congress can make both sides accept an agreement to prevent harm to the U.S. economy.

“[Pres.] Biden as well as Republican and Democratic lawmakers said that they didn’t like getting in the middle of the dispute but that they couldn’t risk a strike.”

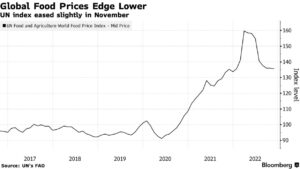

Meanwhile, Bloomberg writer Aine Quinn reported today that, “Global food prices fell for an eighth month in November, in a sign that inflationary pressures may be easing.

“A United Nations gauge of food prices declined 0.1% last month to the lowest since January. The renewal of Ukraine’s grain-export deal sent wheat and corn prices tumbling, while the threat of a global recession is curbing food demand.”

Reuters writer Gus Trompiz reported today that, “Last month’s agreement to prolong a U.N.-backed grain export channel from Ukraine for another 120 days has tempered worries about war disruption to massive Black Sea trade.

“The slight decrease in November meant that the FAO food index is now only 0.3% above its level a year earlier, the agency said.”

Trompiz added that, “In separate cereal supply and demand estimates, the FAO lowered its forecast for global cereal production in 2022 to 2.756 billion tonnes from 2.764 billion estimated last month.”

In a related article, Bloomberg writer Tarso Veloso Ribeiro reported yesterday that, “Cargill Inc., the world’s top agricultural commodities trader, has started to export crops from this year’s harvest in war-torn Ukraine, a move that could help further ease global food prices.

“Shipments are flowing since Russia agreed to renew an agreement to keep export corridors open, Chief Executive Officer David MacLennan said in an interview. The additional shipments are helping push down world food costs, which jumped to a record in March after Russia’s invasion of Ukraine choked off supplies from a key producer.”

Also, Wall Street Journal writers Jared Malsin, Anna Hirtenstein and Alistair MacDonald reported on the front page of today’s paper that,

Vessels linked to Russia’s largest grain trader shipped thousands of tons of stolen Ukrainian grain to global buyers, using a sophisticated system of feeder vessels and floating cranes, according to an investigation by The Wall Street Journal.

“The ships are linked either through their management or ownership to companies controlled by Russian businessman Peter Khodykin, who in turn owns RIF Trading House LLC, the country’s largest grain exporter and a big player in global grain markets, according to corporate and legal documents reviewed by the Journal.”

Elsewhere, Lyric Li reported in today’s Washington Post that, “China offered the clearest sign so far that it might end its three-year pursuit of ‘zero covid,‘ with major cities loosening some control measures even as cases continued to climb. But authorities also imposed tighter censorship controls and issued stark warnings of a crackdown ahead of potential protests.”

Today’s article added that, “Analysts say Beijing is adopting a two-track approach. On the one hand, it will loosen some virus restrictions to appease public anger. On the other, it will use censorship, propaganda and force to prevent the protests from escalating into a movement that could pose an existential threat to the regime.”

In other developments, Benoît Morenne reported in today’s Wall Street Journal that, “The Environmental Protection Agency on Thursday issued a draft proposal that would force oil refiners to use more biofuel to blend with their products.

“The proposal sets the volumes of renewable fuel that refiners are required to blend with transportation fuel under federal standards to 20.82 billion gallons in 2023 up from 20.63 billion gallons in 2022, an amount that would gradually rise to reach 22.68 billion gallons in 2025.”

Today’s article indicated that, “The proposal would also incorporate electricity generation from renewable biomass into the program for the first time, the agency said. The EPA plan would create a credit awarded when power generated through biomass is used to power electric vehicles.”

Donnelle Eller reported on the front page of today’s Des Moines Register that, “In a historic and potentially controversial move, the Biden administration is calling for adding energy used to produce power for electric cars and trucks to a federal mandate that has, for nearly two decades, dictated how much ethanol, biodiesel and other renewable fuel should be blended into the nation’s fuel supply.”

“This is the first time the EPA has had a free hand in deciding the renewable fuel blending requirements. The volumes previously dictated by Congress under the RFS expire this year,” Eller said.

The Register article pointed out that, “Ethanol supporters on Thursday generally praised the proposed rule, which outlines blending requirements for the next three years, saying it strongly supports corn-based ethanol. The rule calls for 15 billion gallons of conventional or corn-based ethanol to be blended in the nation’s fuel supply in 2023, as well as an additional 250 million gallons to meet a 2017 court order. It would require the same amount ― 15.25 billion gallons ― in both 2024 and 2025.”

“But there was also dissatisfaction with the proposal, particularly among biodiesel and renewable diesel advocates who said the measure would significantly shortchange their industry,” today’s article noted.

DTN writer Todd Neeley reported yesterday that, “When it comes to biomass-based diesel, EPA proposes an increase from 2.76 billion gallons in 2022 to 2.82 billion gallons in 2023, 2.89 billion gallons in 2024 and 2.95 billion gallons by 2025, according to the proposal.”

And Bloomberg writers Jennifer A Dlouhy and Kim Chipman reported yesterday that, “The plan may spur an overhaul that could shift the program from one narrowly focused on gasoline, diesel and other liquid fuels to an initiative broadly aimed at decarbonizing transportation.”

“The EPA would also create an eRIN credit awarded when electricity from certain renewable sources — such as natural gas harvested from landfills and at farms — is used as fuel to power EVs. Under the proposal, automakers alone could generate the credit, though its value could be shared with other parties, such as the generators of biogas-powered electricity,” the Bloomberg article said.

Dlouhy and Chipman added that, “Biodiesel producers also took aim at the proposed quotas, which would offer only a modest boost over the current 2.76-billion-gallon requirement, despite a predicted surge in demand and new production capacity next year.”

In his DTN article, Todd Neeley also indicated that, “The EPA has scheduled a virtual public hearing for Jan. 10, 2023, on the proposal, with the possibility of an additional hearing on Jan. 11 if necessary, according to the agency.”