Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

U.S. Seeks New USMCA Consultations Over Canadian Dairy Quotas; Brazil Corn Exports Climb

Bloomberg writer Ana Monteiro reported yesterday that, “The US is requesting dispute-settlement consultations for a third time over Canada’s dairy quotas, saying it has found more areas of ‘deep concern‘ and that the nation’s measures are inconsistent with its obligations under a North American trade pact.

“Washington is expanding its challenge to include Canada’s use of a market-share approach for determining the quotas, the Office of the US Trade Representative said in a statement Tuesday. It said Ottawa’s method prohibits eligible applicants — including retailers and food-service operators — from accessing allocations.”

@SecVilsack and I are committed to enforcing our trade agreements to ensure equity for American workers, farmers, and dairy producers to export their products to Canada.

— Ambassador Katherine Tai (@AmbassadorTai) December 21, 2022

The Bloomberg article noted that, “This is the third time Washington is challenging Ottawa over the dairy issue using provisions in the US-Mexico-Canada agreement, after raising concerns in both January and in May. If the countries aren’t able to resolve the matter through consultations, the US may request the establishment of a panel under the USMCA, the USTR said.”

It’s vital that we hold our trading partners accountable and ensure U.S. dairy gets a fair shake. I’m thankful @USTradeRep and @USDA are continuing to work toward a solution. https://t.co/WE8AnxQdTF

— Rep. Dusty Johnson (@RepDustyJohnson) December 20, 2022

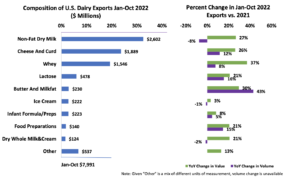

Meanwhile, in its biannual Dairy: World Markets and Trade report yesterday, USDA’s Foreign Agricultural Service (FAS) indicated that, “Thus far in 2022 record exports- on a value basis- are being set across all dairy commodities, driven by strong international dairy product prices. Through October, dairy export values are up 25 percent, with robust growth across the major product groups including skim milk powder (NDM/SMP), whey, lactose, cheese, and butter; however, from a volume perspective, average export growth across commodities is a more modest 5 percent. Nowhere is this dichotomy more prevalent than with NDM, where export quantities have fallen 8 percent over this period while export values have increased 27 percent.”

FAS added that, “Through October, whey and cheese exports saw similar activity with volume growth of 7 percent and 13 percent, respectively, while values grew 38 percent and 26 percent, respectively. Butter was the one major dairy product where export volume growth has outpaced export value growth, reflecting significantly lower unit values to Mexico and Canada.”

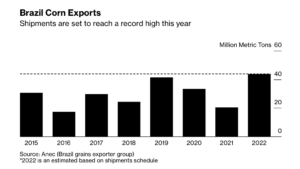

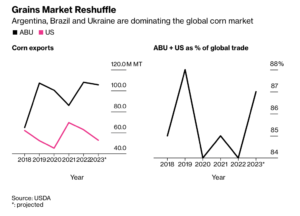

In other trade news, earlier this week, Bloomberg writers Tatiana Freitas and Tarso Veloso Ribeiro reported that, “Brazil’s bumper corn harvest couldn’t have come at a better time for global food supplies as calamities from war to drought stymie exports from the world’s biggest producers.

“Corn exports from South American’s biggest nation are on pace to more than double this year to a record 44 million tons, according to Brazil’s grain exporter group Anec. Shipments have accelerated since October, when low-water levels in the Mississippi River snarled US exports.”

The Bloomberg article stated that, “Brazil’s monster crop has been key to containing corn prices as shipping bottlenecks in the US and war in Ukraine — the world’s first and fourth-largest suppliers, respectively— leave grains stranded. Corn futures have declined almost 20% since the year’s peak in late April, partly due to higher output in Brazil, a welcome reprieve for consumers who have grappled with surging food costs as Russia’s war upended global trade patterns.”

Elsewhere, Dow Jones writer Dan Molinski reported yesterday that, “While the war in Ukraine, one of the world’s top agricultural producers and exporters, has garnered less attention than during the early days of Russia’s invasion, Thu Lan Nguyen at Commerzbank said ‘the situation there remains extremely tense,’ and thus remains a key factor for agricultural markets investors to consider. ‘As the latest Russian missile attacks testify, which have once again caused widespread power outages in Ukraine,’ she said. ‘Though it seems that ports were not affected this time, the risk of disruptions to grains exports nonetheless remains high in view of the ongoing attacks on critical infrastructure in Ukraine.'”

Also yesterday, Reuters writer Pavel Polityuk reported that, “Ukraine’s Danube river ports have boosted grains transshipments by 42 times to an all-time high of 6.1 million tonnes so far in 2022, Ukraine’s seaport authority said on Tuesday.

“Three small ports – Izmail, Reni and Ust-Dunaisk – offered the only maritime routes for cargo exports for almost six months after Russia invaded Ukraine in late February.

“The authority said on Facebook that overall turnover at the Danube ports had risen by 294% to 14.5 million tonnes so far this year.”

The Reuters article reminded readers that, “Three leading Ukrainian Black Sea ports were unblocked at the end of July under a deal between Moscow and Kyiv brokered by the United Nations and Turkey.”