A new 10% tariff on goods from around the world took effect Tuesday — with a list of exemptions including beef. Other exemptions affecting the food and agriculture industries include…

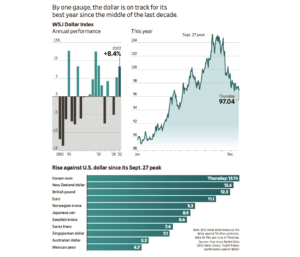

After September Peak, Dollar Rally Eases- Trade Implications

Chelsey Dulaney reported in Friday’s Wall Street Journal that, “The U.S. dollar’s rally in 2022 gave the world a reminder of the currency’s ability to inflict pain on the global economy. Investors are optimistic that the dollar’s strength has now run its course.

“As of Dec. 28, the dollar has risen 8.9% this year as measured by the WSJ Dollar Index, which tracks its value against 16 other currencies. That would mark its biggest yearly rise since 2014. The index peaked in late September at the highest level in data going back to 2001.

“But the dollar is ending the year on the defensive, having given back roughly half of its gains since that high-water mark, as investors bet that U.S. inflation is slowing.”

Dulaney explained that,

Swings in the dollar tend to be felt worldwide because of its role as the primary currency for trade and finance. Its rise has made commodities such as wheat and American goods more expensive for buyers outside of the U.S.

“That added to inflation in other countries and weighed on the businesses of U.S. firms who rely on business abroad.

“In some poorer nations, the currency’s rise has been devastating. Sri Lanka nearly ran out of dollars this year as it burned through its pile of currency reserves, already depleted by the pandemic, to pay for imports of basics such as fuel and food.

“‘While major emerging markets didn’t experience anything near a crisis, there is a quieter crisis that has hit many parts of the world, especially a lot of low-income economies that don’t tend to get a lot of attention,’ said Eswar Prasad, a trade policy professor at Cornell University. ‘For many of them the surge in food and commodity prices, both of which tend to be significantly denominated in U.S. dollars, was an enormous hit.'”

The Journal article added that, “Analysts at JPMorgan Chase & Co. are more cautious about calling for an end of dollar strength and forecast that the dollar will rise another 5% against major trading partners next year.”

And an update posted on Saturday at The Financial Times Online reported that, “Support for the dollar has come from investors’ search for a haven to park their cash as rising inflation and Russia’s invasion of Ukraine have hammered global financial markets.

“Now, US inflation appears to be turning lower and the dollar is, too. Slowing US economic growth and growing expectations of a so-called Federal Reserve ‘pivot’ to slower rate rises, or even cuts, in 2023 amount to a ‘recipe for a weaker dollar,’ says Kit Juckes, a macro strategist at Société Générale.”

The FT article pointed out that, “Others are not so sure. The greenback may have peaked, they argue, but that does not mean it is set to continue tumbling next year.

“‘Our baseline view is that central banks’ tightening into recessions will keep the dollar supported a little longer than most expect,’ says Chris Turner, global head of markets at ING. George Steer.”