As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Kansas City Fed: Gradual Increase in Farm Lending Persists

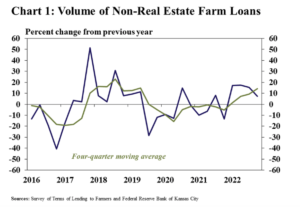

In an update last week from the Federal Reserve Bank of Kansas City, “Rebound in Farm Lending Continues,” Cortney Cowley and Ty Kreitman indicated that, “Farm lending activity continued to increase gradually alongside further growth in loan sizes.

“The average size of non-real estate farm loans was about 20% higher than a year ago and drove an increase in lending volumes for the fourth consecutive quarter.

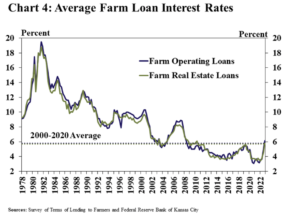

At the same time, average interest rates on farm loans rose sharply alongside higher benchmark rates and reached a 10-year high, putting additional upward pressure on financing costs.

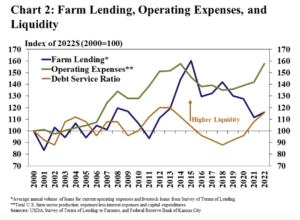

“The outlook for farm finances remained favorable alongside elevated commodity prices, but increased interest rates, challenging weather conditions, and high production costs remained key concerns.

“Higher expenses contributed to a rebound in lending during 2022, but strong farm income and liquidity likely has limited financing needs of many producers.

“Looking ahead, however, elevated operating expenses could put additional upward pressure on loan demand.”