As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

USDA, USTR Officials Meet in Mexico on Corn-Import Law; Wheat Dips

Bloomberg writer Eric Martin reported yesterday that, “Mexico’s proposed changes to a planned ban on imports of US corn are insufficient, the Biden administration warned, saying that it continues to consider all of its rights to respond under the free-trade agreement between the nations.

“‘Mexico’s proposed approach, which is not grounded in science, still threatens to disrupt billions of dollars in bilateral agricultural trade, cause serious economic harm to US farmers and Mexican livestock producers, and stifle important innovations needed to help producers respond to pressing climate and food security challenges,’ the US Trade Representative’s office said in a statement.”

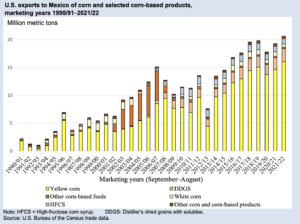

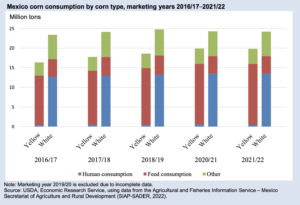

The Bloomberg article explained that, “The Mexican government at the end of 2020 announced plans to phase out genetically modified yellow corn for livestock feed by early 2024.

2022, FDS-22l, U.S. Department of Agriculture, Economic Research Service, December 13, 2022.

“In December, it offered to postpone parts of its planned ban for a year, people familiar with the situation said said at the time, asking not to be identified because the details were private.

2022, FDS-22l, U.S. Department of Agriculture, Economic Research Service, December 13, 2022.

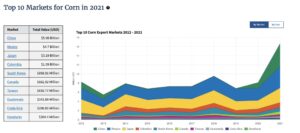

“Lopez Obrador in November had signaled that he was considering allowing imports of GMO yellow corn for livestock feed, which would provide relief for US farmers, as Mexico is their second-largest export market. Most US corn exports to Mexico are of the yellow variety, primarily used as livestock feed, while Mexico grows its own white corn, used for tortillas and other dishes.”

A significant development on biotech corn exports to Mexico... We are thankful to @SecVilsack and @AmbassadorTai for making it crystal clear that they are going to make the Mexican government abide by what it agreed to under USMCA. #standingupforfarmershttps://t.co/INnBoXpoBb pic.twitter.com/sIZJZWEttn

— National Corn (NCGA) (@NationalCorn) January 23, 2023

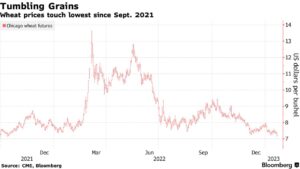

Elsewhere, Bloomberg writer Kim Chipman reported yesterday that, ”

Wheat touched the lowest price since September 2021 as good winter crop weather and big plantings in the US help calm worries of global grain shortfalls.

“Dry areas of Kansas, a top producer, benefited from snow over the weekend and more precipitation is forecast for the Southern Plains this week. The moisture boost comes as money managers have raised their bearish bets on Chicago wheat to the highest in almost four years, as supply concerns ease over weather setbacks and exports out of the war-torn Black Sea.”

.@usda_oce Wx: Parts of #Texas, including Amarillo, San Angelo, & Dallas-Fort Worth, last received measurable precipitation more than a month ago.

— FarmPolicy (@FarmPolicy) January 23, 2023

Many winter #wheat production areas from #Colorado & #Kansas northward retain a protective snow cover, following recent storminess. pic.twitter.com/WhCgMW7nFL

Chipman pointed out that, “The March Chicago wheat contract fell as much as 3.9% to $7.125 a bushel, the lowest since September 2021. Most-active hard red winter wheat futures dropped as much as 4.4% to $8.11 a bushel, the biggest percentage decline since early November. Spring wheat declined as much as 3% in Minneapolis.

“Also pressuring prices is lackluster demand for us wheat amid tough global competition for grains, including from Russia.

“Good crop weather also sent soybeans and corn down, with Chicago futures falling for a fourth straight drop as rains relieved parched crops in parts of Argentina, aiding global supplies.”

Dow Jones writer Kirk Maltais reported yesterday that, “Wheat futures led the grains complex lower in trading through the day as South American moisture in parched areas pressured the complex overall. But wheat in particular was pressured by better conditions seen for U.S. winter wheat crops.”

Reuters writer Naveen Thukral reported today that, “Chicago wheat ticked higher on Tuesday, as the market recovered from its lowest in 16 months on bargain-buying, although the gains were limited by snowfall in parts of the U.S. Plains which brought much needed moisture to the winter crop.”

Meanwhile, Reuters News reported yesterday that, “Russian Foreign Minister Sergei Lavrov said on Monday that the terms of the Black Sea grain initiative, which facilitates the export of Ukrainian grain from its southern Black Sea ports, were ‘more or less being fulfilled.’

“However Lavrov, speaking at a news conference during a visit to South Africa, also said that Russia still faced problems exporting its own agricultural products.”