As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

A Closer Look at China’s Pork Production, “A Strategic Imperative”

Writing on the front page of the Business Section in Friday’s New York Times, Daisuke Wakabayashi and Claire Fu reported that, “The first sows arrived in late September at the hulking, 26-story high-rise towering above a rural village in central China. The female pigs were whisked away dozens at a time in industrial elevators to the higher floors where the hogs would reside from insemination to maturity.

This is pig farming in China, where agricultural land is scarce, food production is lagging and pork supply is a strategic imperative.

“Inside the edifice, which resembles the monolithic housing blocks seen across China and stands as tall as the London tower that houses Big Ben, the pigs are monitored on high-definition cameras by uniformed technicians in a NASA-like command center. Each floor operates like a self-contained farm for the different stages of a young pig’s life: an area for pregnant pigs, a room for farrowing piglets, spots for nursing and space for fattening the hogs.”

Friday’s article explained that, “Feed is carried on a conveyor belt to the top floor, where it’s collected in giant tanks that deliver more than one million pounds of food a day to the floors below through high-tech feeding troughs that automatically dispense the meal to the hogs based on their stage of life, weight and health.

“The building, on the outskirts of Ezhou, a city on the southern bank of the Yangtze River, is hailed as the world’s biggest free-standing pig farm, with a second, identical hog high-rise opening soon. The first farm started operating in October, and once both buildings reach full capacity this year, it is expected to raise 1.2 million pigs annually.”

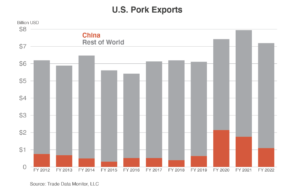

Wakabayashi and Fu added that, “Today, no country eats more pork than China, which consumes half the world’s pig meat. Pork prices are closely watched as a measure of inflation and carefully managed through the country’s strategic pork reserve — a government meat stockpile that can stabilize prices when supplies run low.

“But pork prices are higher than in other major nations where pig farming went industrial a long time ago. In the last few years, dozens of other mammoth industrialized pig farms have sprung up across China as part of Beijing’s drive to close that gap.”

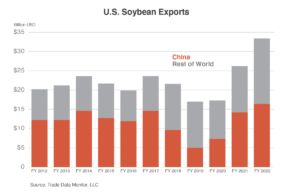

More broadly on the issue of Chinese agricultural productivity, the Times article stated that, “Six decades after a famine killed tens of millions of its people, China still trails most of the developed world when it comes to efficient food production. China is the biggest importer of agricultural goods, including more than half the world’s soybeans, mostly for animal feed. It has about 10 percent of the planet’s arable land for around 20 percent of the global population.

Its crops cost more to produce, and its farmlands yield less corn, wheat and soybean per acre than other major economies.

Friday’s article also noted that, “And no protein is more important for the Chinese rice bowl than pork. The State Council, China’s cabinet, issued a decree in 2019 stating that all government departments needed to support the pork industry, including financial aid for more large-scale pig farms. In the same year, Beijing also said it would approve multistory farming, which allowed pig farming to go vertical to raise more hogs on relatively smaller parcels.”

Recall that Bloomberg News reported on “Hog Hotels” last year with a focus on biosecurity issues, although the Times article pointed out that, “Brett Stuart, founder of Global AgriTrends, a market research firm, said hog towers and other giant pig farms exacerbated the biggest risk facing China’s pork industry: disease. Raising so many pigs together in a single facility makes it harder to prevent contamination. He said large U.S. pork producers spread out their farms to reduce biosecurity risk.”

And in June of 2021, Bloomberg News reported that China’s pig population had approached a return to normal after a resurgence in African Swine Fever.

In related news regarding China, Reuters writer David Lawder reported late last week that, “U.S. chief agricultural trade negotiator Doug McKalip wants China to keep striving to meet U.S. farm goods purchase commitments under the 2020 ‘Phase 1’ trade deal, but told Reuters that he also is pushing to diversify exports beyond the biggest U.S. grain customer.

“In his first media interview on Thursday since his Dec. 23 Senate confirmation of his U.S. Trade Representative office post, McKalip said that his top priority was opening new markets for U.S. agricultural products.”

And Wall Street Journal writer Patrick Thomas reported on Saturday that, “The U.S. agriculture industry is projecting another strong year, with elevated crop prices and China’s rebound from Covid-19 expected to boost farmers, chemical suppliers and grain traders.

“Grain-trading middlemen, including Archer Daniels Midland Co. and Bunge Ltd., said demand for crops, vegetable oils and livestock feed will remain strong in 2023. China is also expected to increase its crop imports as Covid-19 restrictions in the country ease, executives said.”

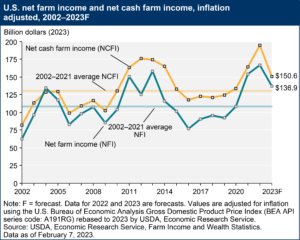

Thomas added that, “U.S. net farm income is projected at $137 billion this year, down 16% from last year, when it hit its highest level in decades, and down from $141 billion in 2021, according to a February report from the U.S. Department of Agriculture. Total production expenses are forecast to increase 4% in 2023. Farm income this year would still be above the 20-year average of $108 billion in inflation-adjusted dollars.”