As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Chicago Fed: 2022 Farmland Values Saw Annual Increase of 12 Percent

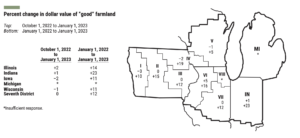

On Thursday, in the Federal Reserve Bank of Chicago’s quarterly AgLetter, David Oppedahl explained that, “In 2022, the District saw a strong annual increase of 12 percent in its farmland values (see table and map below).

“Although this result may seem like a letdown after the even larger increase in 2021, 2022’s annual gain was the second largest in the past ten years. In the final quarter of 2022, Illinois, Indiana, Iowa, and Wisconsin still had double-digit year-over-year increases in their agricultural land values, but Indiana was the only District state to have an increase that was larger than in the fourth quarter of 2021.

On the whole, the District’s farmland values were unchanged in the fourth quarter of 2022 from the third quarter, ending a string of eight consecutive quarterly increases.

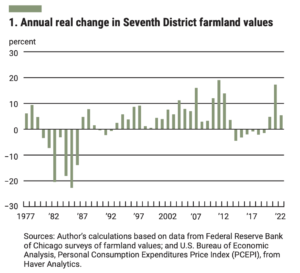

The AgLetter stated that, “Adjusted for inflation by the Personal Consumption Expenditures Price Index (PCEPI), District farmland values experienced an annual increase of around 5 percent in 2022—the second-largest real increase of the past ten years (see chart 1).

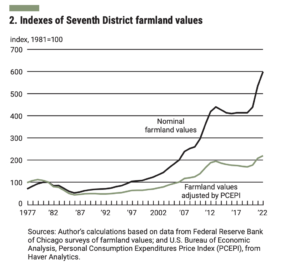

“District farmland values climbed to a new peak in 2022. At the end of 2022, District farmland values were up 12 percent from their prior peak (in 2013) in real terms; they were up 36 percent from their 2013 peak in nominal terms (see chart 2).”

Mr. Oppedahl added that, “Stronger agricultural credit conditions for the District also contributed to the optimism of farmers. The share of the District’s farm loan portfolio assessed as having ‘major’ or ‘severe’ repayment problems was 1.2 percent in the fourth quarter of 2022—lower than the share reported in any final quarter since collection of these data began in 1998.”

What impact did the avian influenza have on poultry shortages and #egg prices in the fourth quarter of 2022? Read the latest AgLetter from senior economist David Oppedahl to find out. https://t.co/mfbESNylHJ pic.twitter.com/bmYd80X2WO

— ChicagoFed (@ChicagoFed) February 9, 2023

And the Chicago Fed indicated that, “Agricultural interest rates—in both nominal and real terms—jumped higher during the fourth quarter of 2022. As of January 1, 2023, the District’s average nominal interest rates on new operating loans (7.50 percent), feeder cattle loans (7.54 percent), and farm real estate loans (6.80 percent) were the highest since the fourth quarter of 2007. In real terms (after being adjusted for inflation with the PCEPI), the average interest rate on farm real estate loans moved into positive territory in the fourth quarter of 2022, after the average real interest rates on operating and feeder cattle loans had done so in the previous quarter. In real terms, all of these loan rates were last higher at the end of the first quarter of 2021. According to an Illinois banker, ‘The higher interest rates have not yet discouraged borrowing for real estate.'”

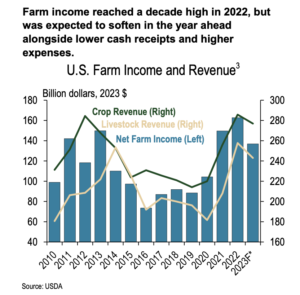

Also on Thursday, a Fourth Quarter Ag Bulletin from the Federal Reserve Bank of Kansas City stated that, “U.S. farm income was historically high in 2022 but is expected to moderate in 2023 alongside persistent cost pressures and lower revenue.

“Agricultural prices decreased 1% in the fourth quarter but remained nearly 20% higher than a year earlier. Despite a modest decline in corn and soybean prices in the fourth quarter, prices of major row crops remained elevated alongside intense drought in some areas and reduced crop production.”

USDA’s first forecast for farm income in 2023 shows an expected decline from last year, but looks very similar to the average of the past 3 years, which were even higher than the lofty incomes of a decade ago. pic.twitter.com/brIHNQEsYG

— Nathan Kauffman (@N_Kauffman) February 9, 2023

The Bulletin added that, “Farm finances remained solid in the fourth quarter, even as interest expenses continued to rise and debt obligations edged higher.”