Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

DTN: Fertilizer Prices “Moved Lower Again” -But– “Remain Above Historical Averages,” WSJ Says

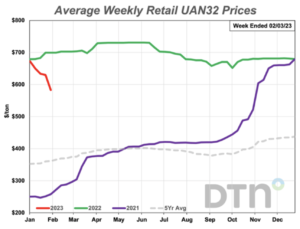

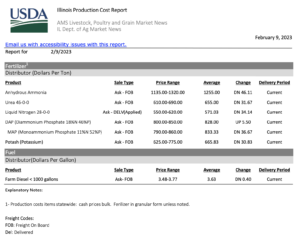

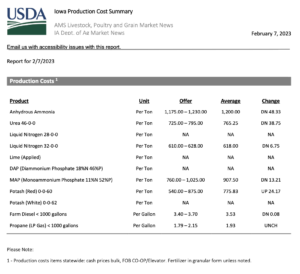

DTN writer Russ Quinn reported last week that, “Average retail fertilizer prices moved lower again the last week of January 2023, continuing a trend that has been present since just before the beginning of the year, according to retailers surveyed by DTN.

“Once again, seven of the eight major fertilizers are less expensive compared to last month. Of these seven, five were markedly lower compared to last month. DTN designates a significant move as anything 5% or more.

“Leading the way lower are UAN32 and UAN28. UAN32 was 13% lower in price compared to last month and had an average price of $583 per ton. UAN28 was 10% less expensive looking back a month and had an average price of $518/ton.”

Quinn explained that, “All fertilizers are now lower compared to one year ago. DAP is 3% less expensive, MAP is 8% lower, 10-34-0 is 9% less expensive, potash is 13% lower, UAN28 is 14% less expensive, UAN32 is 17% lower, anhydrous 18% less expensive and urea is 23% lower compared to a year prior.”

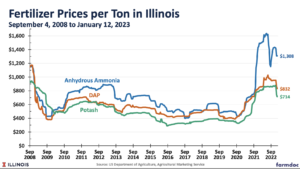

Wall Street Journal writer Patrick Thomas reported in today’s Wall Street Journal that, “Fertilizer prices have come down from record-high prices a year ago but remain above historical averages, while energy prices, labor, land and equipment costs are still higher for farmers, said Jay Debertin, chief executive of CHS Inc., a Minnesota-based farm cooperative and major grain shipper and retailer of agriculture products.”

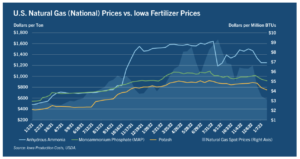

Elsewhere, CoBank’s Kenneth Scott Zuckerberg indicated last week that, “Fertilizer production is bound to natural gas — as a feedstock, an energy source, or both depending on nutrient type. Thus the drop in gas prices tends to lead to an across-the-board fall in fertilizer prices, but most notably for nitrogen. From peak-to-trough over the past nine months, U.S. natural gas prices have declined by 67%, compared to price drops of 24% for anhydrous ammonia, 16% for phosphate (MAP) and 18% for potash.

“Assuming this recent and rapid drop in natural gas prices holds through spring, we would expect fertilizer prices to continue their downward trajectory in the coming weeks and months. This could change, however, should the Chinese economy reopen and/or the European economy recover, either of which could lead to higher energy prices. And should the Black Seas conflict escalate, a voluntary or involuntary reduction in Russian fertilizer exports could drive up fertilizer prices.”

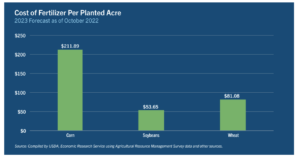

Zuckerberg added that, “That brings us to spring planting. When fertilizer prices decline by double digit rates ahead of planting season, the next question is whether falling prices of fertilizer — the largest operating cost line item for most crop farmers — might influence their spring planting intentions. The assumption is that lower fertilizer prices ought to drive greater corn acres relative to soybean acres. This is because corn uses more expensive nitrogen fertilizers (such as anhydrous ammonia) than soybeans use. (USDA estimates that the total operating and overhead costs to raise U.S. corn is approximately $870 per acre compared to $591 per acre for U.S. soybeans, largely due to the fertilizer-intensive nature of corn.)

“While the argument works in theory, it tends to fail in practice for at least two reasons. According to our farm supply cooperative customers, most farmers have already pre-paid for a sizable portion of their 2023 fertilizer needs based on their crop plans, and thus unlikely to switch acres now. The other factor is that farmers who plan to plant spring corn often apply nitrogen to fields in the fall. Since nitrogen is generally not used in soybean production, farmers will stick with their corn crop decision unless they skipped the fall application.”

The CoBank report noted that, “Bottom line, we do not think that fertilizer prices will be a major driver of planting decisions this spring, but stay tuned. We will be paying close attention to USDA’s annual Agriculture Outlook Forum in February and Prospective Plantings report on March 31, as well as private farmer planting intention surveys, temperatures and precipitation levels now through late March, and futures prices for late summer and fall harvest.”