As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Kansas City Fed- Nonirrigated Farmland Values Up About 9%; Minneapolis Fed- Nonirrigated Cropland 18% Higher

Last week, the Federal Reserve Banks of Kansas City and Minneapolis released updates regarding farm income, farmland values and agricultural credit conditions. Today’s update contains highlights from the Fed reports.

Federal Reserve Bank of Kansas City

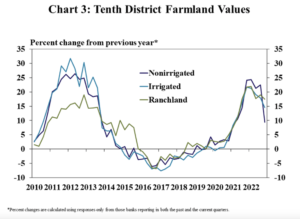

Francisco Scott and Ty Kreitman, writing in Friday’s Ag Credit Survey from the Kansas City Fed, noted that, “Growth in farm real estate values remained strong, but showed signs of easing alongside higher interest rates. The average interest rates on farm loans increased from record lows at the beginning of the year to decade highs by December. Despite the rapid rise in rates, the value of farmland continued to increase, but at a more tempered pace than earlier in the year. The growth in farmland values has softened most for lower-priced land and in states most heavily affected by drought. Looking ahead, a majority of bankers expect higher interest rates to have a negative effect on farm real estate and some anticipated a decline in values.”

Friday’s update explained that, “Farm finances and credit conditions were supported by strong commodity prices in 2022 and the outlook for 2023 remained positive despite some persistent risks. Elevated prices for most major commodities continued to support profit opportunities for many producers, but higher expenses and adverse weather conditions remained key concerns. Cost pressures have been particularly notable for livestock producers in recent months and higher expenses across the sector are likely to increase demand for financing. Farm income and liquidity remained strong through the end of the year, but improvement slowed in the fourth quarter and bankers in some areas of the region were less optimistic about the outlook for the months ahead.”

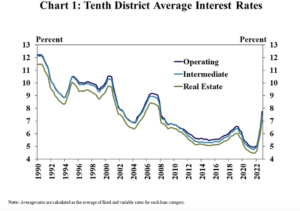

More narrowly, Scott and Kreitman indicated that, “Farm loan interest rates increased sharply alongside benchmark rates and reached the highest levels in a decade.

The increase in interest rates for farm operating loans from a year ago is financially equivalent to a yield cut of about 2.5 bushels per acre for a relatively average corn farmer in the Midwest. Not trivial, but also not severe.

— Nathan Kauffman (@N_Kauffman) February 16, 2023

“Average interest rates on all types of loans were more than 100 basis points higher than the previous quarter, marking the third consecutive quarter of sharp rate hikes.

“Interest rates on farm loans reached the highest levels since 2007, putting considerable upward pressure on financing costs for some producers.”

The Ag Credit Survey indicated that, “Farmland values continued to increase despite the rapid increase in interest rates, but showed further signs of softening.

The value of nonirrigated farmland increased about 9% from the previous year, the slowest pace since early 2021.

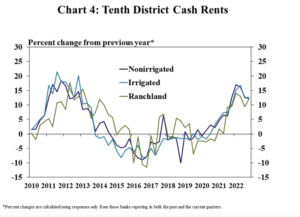

The Survey added that, “Cash rents also continued to increase and showed less pronounced signs of softening than farmland values. Rental rates on all types of farmland increased about 12% from the previous year, which was a pace similar to previous quarters. Following rapid acceleration in farmland values earlier in 2022, rents continued to rise more steadily through the fourth quarter.”

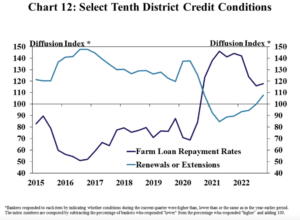

Scott and Kreitman also pointed out that, “Credit conditions continued to improve gradually alongside ongoing strength in farm income. Multiple years of strong farm income has bolstered the financial position of many producers and farm loan repayment rates continued to improve at a gradual pace.

“However, as growth in farm income and liquidity softened, renewal and extension activity in the region was slightly higher than a year ago.”

Federal Reserve Bank of Minneapolis

In an article last week, “Another strong finish to the year for Ninth District farmers,” the Minneapolis Fed pointed out that, “Inflation was the big economic story of 2022. For agriculture, while rising prices complicated decision-making, they generally broke in producers’ favor, with commodity prices outpacing rising input costs by enough to remain profitable, according to the latest survey of farm bankers by the Federal Reserve Bank of Minneapolis.

“Farm incomes overwhelmingly increased in the final three months of 2022, said lenders responding to the Minneapolis Fed’s quarterly agricultural credit conditions survey, conducted in January. The growth in incomes also led to increased loan repayment rates, while loan demand decreased and renewals held steady. Farmland values increased from a year earlier, and cash rents increased as well. The outlook for the beginning of 2023 remained positive, with survey respondents predicting further growth in farm incomes and spending.”

The Minneapolis Fed added that, “Cropland values continued to climb in the final three months of 2022, and cash rents also increased.

Nonirrigated cropland values increased 18 percent on average across the district compared with a year earlier, while cash rents for that land increased 10 percent.

“Irrigated farmland values rose 16 percent on average, while ranchland values rose 12 percent.”

Recall the the Chicago Fed released its quarterly AgLetter earlier this month.