As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

U.S. Pork and Beef Exports at a Glance, Recent USDA Reports

In its monthly Livestock, Dairy, and Poultry Outlook report this week, USDA’s Economic Research Service (ERS) indicated that, “Although fourth-quarter pork exports had a solid finish—shipments of almost 1.7 billion pounds were about 1.6 percent higher than a year earlier, mostly on the strength of year-over-year larger shipments to Mexico and China—total U.S. exports ended 2022 at 6.3 billion pounds, about 10 percent below volumes in 2021.”

ERS explained that, “Most of the shortfall in 2022 was due to lower shipments to China\Hong Kong, for reasons attributable to recovery in the Chinese pork sector as well as to disruptions in the Chinese economy throughout the year, both of which had the effect of reducing demand for foreign pork.

Chinese Government data indicate that China’s 2022 pork imports declined by more than 50 percent, with all major pork exporters absorbing part of the steep reduction.

(Note: For a closer look at pork production issues in China, see this recent FarmPolicyNews update).

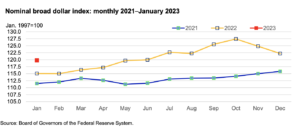

The Outlook report also noted that, “U.S. pork confronted major headwinds in foreign markets last year, as the U.S. dollar exchange rate appreciated in tandem with higher U.S. interest rates resulting from the U.S. Federal Reserve’s tighter monetary policy aimed at slowing recent high rates of inflation. Early in 2023, the Federal Reserve’s Nominal Broad Dollar Index indicates that the dollar has depreciated somewhat compared to last fall. This should enhance competitivity of U.S. pork, especially in Asian markets where competition with European and Canadian exported pork is always fierce.”

“In 2023, 6.4 billion pounds (23.1 percent of U.S. commercial pork production) is expected to be exported to foreign markets. Export forecasts by quarters are as follows: first quarter: 1.6 billion pounds; second quarter: 1.6 billion pounds; third quarter, 1.5 billion pounds; and for the fourth quarter, 1.7 billion pounds,” ERS said.

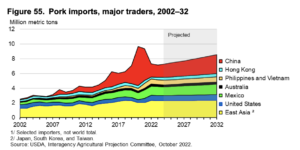

Also, this week’s 10-year projections for the food and agricultural sector from USDA indicated that, “Imports by major pork-importing countries are projected to rise 2 percent annually from 2024, increasing by almost 1.6 million tons to about 10.5 million tons in 2032. China and Hong Kong, Mexico, Vietnam, and the Philippines exhibit the largest increases in import demand over the projection period, accounting for a little over 71 percent of the total projected increase in world pork imports by 2032.”

With respect to beef, the ERS Outlook pointed out that, “Annual beef exports in 2022 reached a record at 3.536 billion pounds, a year-over-year increase of 3 percent. The annual value of exports also set a record at nearly $11 billion dollars, an increase of more than 10 percent over the previous year. The chart below shows the year-over- year changes in export volumes and values to the top markets. Higher beef prices bolstered export values.

“Exports to China increased nearly 17 percent, while the value of those exports increased over 31 percent. The largest decrease was in exports to Mexico, continuing a 4-year trend. Exports to Japan were also lower year over year, but as shown in the table below, the country maintained its position as the top market for U.S. beef in 2022, followed closely by South Korea. China, the third-largest market, was the only top market with a significant increase in its share of U.S. exports over 2021.”

ERS added that, “The export forecast for 2023 is unchanged from last month at 3.090 billion pounds. If realized, this would represent a year-over-year decrease of about 13 percent. Production is forecast to decrease about 6 percent, reducing exportable supplies and bolstering prices; additionally, U.S. beef will face more competition from Oceania in the global market. The forecast is still relatively high, as this would be the third highest annual export volume behind 2022 and 2021, reflecting sustained strong demand for U.S. beef.”

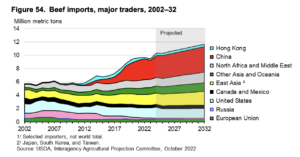

In its 10-year projections, USDA noted that, “Between 2024 and 2032, major beef-importing countries are projected to increase annual imports by 1.5 million tons, reaching 13.2 million tons in 2032. Demand by markets in Asia will fuel much of the increase.”

USDA added that, “Beef imports by China and Hong Kong account for the largest share of world trade in 2032 at 28.5 percent. China and Hong Kong imports are projected to increase 14.7 percent to 4.2 million tons between 2024 and 2032, as demand outpaces domestic production growth.”