As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

“A Flurry of Chinese Purchases of U.S. Corn,” as Brazil Seeks Further Ag Trade Opening with China

Reuters writer Mark Weinraub reported on Friday that, “Falling prices have sparked a flurry of Chinese purchases of U.S. corn, as the world’s top buyer of the grain scrambles to make up for a slow start to its import program, traders and analysts said.

“The latest deal, announced by the U.S. Department of Agriculture (USDA) on Friday, saw China buying 204,000 tonnes of American corn, its eighth confirmed purchase in the past nine business days.

“U.S. corn futures fell 7.3% during February and hit a seven-month low on March 10, before China began its buying spree.

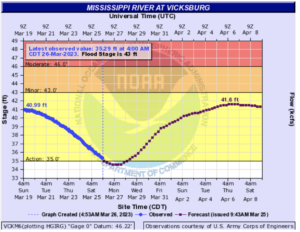

“The price drop, combined with uncertainty about exports from rival supplier Ukraine and improved shipping conditions along the Mississippi River, made U.S. supplies the most attractive to Chinese buyers.”

Weinraub explained that, “Export sales of U.S. corn to China totaled 2.245 million tonnes in the week ended March 16, the third biggest weekly total on record, USDA data show. Since then, Chinese buyers have booked deals for another 832,000 tonnes of corn.

#Barge movements on the #Mississippi River, https://t.co/rp04hH7eqO pic.twitter.com/6w3sZA6C1m

— FarmPolicy (@FarmPolicy) March 23, 2023

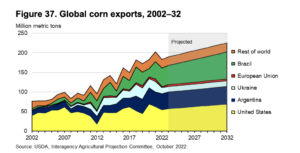

The Reuters article added that, “With Argentina’s crop potential severely reduced by a devastating drought, traders said the U.S. will remain the dominant supplier for China until Brazil’s second corn crop, or safrinha, is harvested in June.

“China, which imported just 7.58 million tonnes of corn in the 2019/20 marketing year, previously relied on domestic production to meet local demand. It quickly stepped up imports as soy production became a bigger national priority, said Darin Friedrichs, co-founder of Sitonia Consulting in Shanghai.

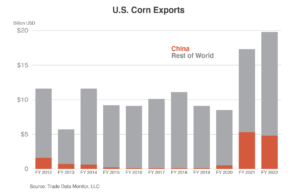

More broadly, recall that U.S. agricultural exports to China set a record in fiscal year fiscal 2022 ($36.4 billion), surpassing the previous year’s record.

Regarding fiscal year (FY) 2023 exports, last month, in its quarterly agricultural trade update, the USDA’s Foreign Agricultural Service noted that, “China is forecast to remain the largest market for U.S. agricultural exports at $34.0 billion, unchanged from the previous forecast.”

China also imported record volumes of soybeans in the first two months of 2023.

With respect to Brazil’s safrinha crop and China, recall that Reuters News reported earlier this month that, “China is actively buying Brazil’s second corn, known as ‘safrinha,’ even as farmers grapple with planting delays in the world’s third biggest producer of the cereal.”

For more background on China’s increasing interest in Brazilian corn, see this FarmPolicyNews update from earlier this month.

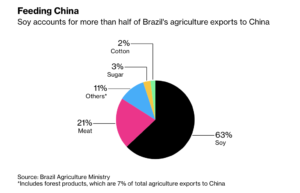

Also on Friday, Bloomberg writers Dan Murtaugh and Tatiana Freitas reported that, “Hundreds of Brazilian agribusiness leaders flooded Beijing this week even before the arrival of President Luiz Inacio Lula da Silva, who’s betting a high-stakes trip to China will further open the world’s biggest commodities importer for his country’s products, helping him make peace with a sector that overwhelmingly supported his predecessor in last year’s election.

“Brazil’s Agriculture Minister Carlos Favaro, who landed on Wednesday alongside the unusually large business delegation, has been laying the groundwork for several potential agreements between the two countries. In an interview on Friday, he said his mission is to re-establish warm ties between the countries, and refrained from giving explicit targets for bilateral commerce.”

The Bloomberg article noted that, “Soybean crushers want to see a boost too, after China last year allowed Brazil to begin exporting the soybean meal. The two countries also reached a deal last year to resume shipments of corn, an agreement that has already led to spikes in Chinese purchases and is likely to generate even more this year.

“That threatens to displace US farmers from one of their key markets, while strengthened ties with China could also propel Brazil closer to its goal of unseating the US as the world’s top cotton exporter, said Alexandre Schenkel, head of Abrapa, an association of Brazilian cotton producers. Brazil will launch a new certification for cotton quality this week aimed at helping win the trust of China.”

However on Sunday, Bloomberg News reported that, “Brazilian President Luiz Inacio Lula da Silva postponed a business trip to China because of illness, potentially setting back his plan to strengthen relations with his country’s largest trading partner.”

The Bloomberg article added that, “Chinese President Xi Jinping sent a message to the Brazilian leader on Sunday, wishing him a speedy recovery, China state television reported. Xi said he hoped Lula would visit China at the earliest convenient date, according to the report.”

“Brazil’s delegation includes hundreds of agribusiness leaders and government officials, many of whom are already in China, as part of an effort by Lula to gain greater access for his country’s exports of commodities,” the article said.