A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Additional Brazilian Firms Cleared to Export Corn to China- Background and Issues

Reuters writer Roberto Samora reported late last week that, “Brazil’s agriculture ministry said on Friday that 90 local firms have been cleared to export corn to China in the first two months of the year, taking the total to 446.

“The information comes as Brazil forecasts its corn exports to reach a fresh record this year, potentially beating the volume shipped by the United States, according to a statement.”

Background

Recall that back in November, Reuters News reported that, “Chinese customs updated its list of approved Brazilian corn exporters on [November 2, 2022], a move a Brazilian agriculture official said could jumpstart sales of corn to the world’s second-largest economy.

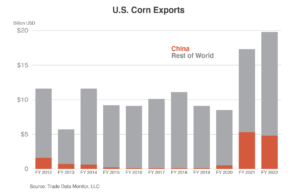

“The approvals could reshape global trade flows and result in fewer sales for farmers in the United States, the world’s top corn supplier. China relied on the United States and Ukraine for most of its corn supplies but Russia’s invasion of Ukraine has disrupted exports.”

Also in November, Bloomberg News reported that, “The first vessel carrying Brazilian corn to China is set to sail [November 23, 2022] after a deal earlier this year between the two nations.”

This November Bloomberg article explained that, “China made the decision to start buying Brazilian grains back in May [2022] in part to reduce dependence on the US and replace supplies from Ukraine cut off by the Russian invasion. In October [2022], China approved over 130 facilities for export. The US accounted for about 70% of Chinese purchases in the 2020-2021 season.”

And last month, in its monthly Grain: World Markets and Trade report, the USDA’s Foreign Agricultural Service (FAS) indicated that, “Brazil 2022/23 corn exports (Oct-Sep) are forecast to equal those of the United States at 51 million tons on expanding production and strong exports in the second half of its 2021/22 marketing year (Mar 2022-Feb 2023). Brazil corn exports have exceeded those of the United States only one other time, in the drought year of 2012/13. Since October 2022, Brazil has exported about 25 million tons of corn, far exceeding the same period in any prior year. In contrast, U.S. corn exports have been off to a slow start. Production in 2022/23 was smaller than initially forecast and logistical concerns on the Mississippi River in the months after harvest kept U.S. prices elevated and volumes low, especially as U.S. corn competed with competitively priced supplies from other exporters.”

The FAS report noted that, “If U.S. corn production returns to a more historically normal level, the United States will likely return to being the world’s top corn exporter. However, the continued and persistent expansion of Brazilian agriculture could mean that the United States will find itself fighting Brazil for the crown more often in the coming years.”

And in January, FAS indicated in a report, “China: Grain and Feed Update,” that, “With the arrival of the first vessel of Brazilian corn in early January 2023, China will likely turn to Brazil for a substantial amount of its corn imports. Brazil is projected to have 40-50 MMT corn export capacity in MY2022/23. China agreed to temporarily waive a key clause in the phytosanitary protocol re-signed with Brazil in May 2022, in part to reduce dependence on the United States and replace supplies cut off from Ukraine owing to Putin’s brutal war of aggression and the volatility surrounding the Black Sea Grain Initiative (BSGI). In October, China approved over 130 Brazilian facilities for export. Industry sources reported close to 2 MMT of Brazilian corn was planned to sail to China from November 4 2022. According to industry contacts, over 900,000 MT was loaded by mid-December and was en route with additional shipments expected in the first few months of 2023.”

China- Current Developments

With this background in mind, Bloomberg writer Hallie Gu reported over the weekend that,

China will push to increase grain production capacity by 50 million tons under the nation’s drive to bolster food security and meet rising demand.

“Keeping grain output above 650 million tons is crucial to ensure adequate supply and maintain stable prices, the National Development and Reform Commission — the top economic planner — said in a report to the annual parliamentary gathering in Beijing on Sunday.

“‘We should keep total grain acreage at a stable level, promote the production of oilseed crops, and launch a new drive to increase grain production capacity,’ Premier Li Keqiang said in his final government work report to the National People’s Congress.”

The Bloomberg article explained that, “Authorities in Beijing have refocused on food security since the Covid-19 pandemic disrupted global agricultural supplies and as Russia’s war in Ukraine severely restricts trade in essential fertilizers. While China is the world’s biggest grain producer, the country has grown more dependent in recent decades on imports from suppliers like the US and Brazil.”

And The Financial Times reported yesterday that, “China will aim for an economic expansion of ‘around 5 per cent’ for 2023, its lowest target for more than three decades, as President Xi Jinping seeks to restore pre-pandemic levels of growth and prepares to further centralise power in his own hands.”

China's economy is seen rebounding this year (From Bloomberg's "Next China" Email Newsletter). pic.twitter.com/tIanfMCPB1

— FarmPolicy (@FarmPolicy) March 3, 2023

Meanwhile, Bloomberg News reported yesterday that, “China’s anxieties over its reliance on overseas suppliers to feed its vast population and supply the raw materials it needs are never far from the forefront of government policy, but the combination of Covid disruptions and Russia’s invasion of Ukraine placed both toward the top of the list of this year’s concerns.

“Some of extra spending will be deployed on projects to enhance energy and food security, including an increase in the country’s capacity to produce grain.”

Additionally, Lily Kuo reported in today’s Washington Post that, “In February, a high-altitude Chinese balloon discovered floating over the United States caused Washington to cancel a scheduled visit by U.S. Secretary of State Antony Blinken, which was meant to put a floor on spiraling U.S.-China ties.”

“Beijing also continues to face scrutiny over its friendship with Russia and reticence to condemn the invasion of Ukraine, amid allegations from Washington that Beijing is considering helping Moscow’s war effort,” the Post article said.