A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

AMIS: War in Ukraine, Black Sea Grain Deal- “Uncertainty Continues to Hang Over Agricultural Markets”

In its March Market Monitor report, the Agricultural Market Information System (AMIS) indicated that, “With no end in sight to the war in Ukraine and threats of further escalation, uncertainty continues to hang over agricultural markets.

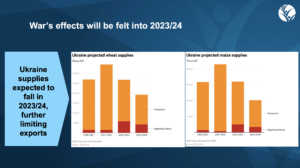

Supplies are tight. Reduced plantings in Ukraine mean that other countries will need to produce additional grains and oilseeds to help rebuild global stocks and moderate price levels.

“The world has so far been relatively fortunate: a combination of good weather and strong producer supply response has kept market prices from rebounding back to the high levels of early 2022. However, tight stocks will mean increased price volatility, particularly during periods of uncertainty such as planting times and the Northern Hemisphere growing seasons. In addition, uncertainty over events like the renewal of the Black Sea Grain Initiative will continue to roil markets.”

The AMIS report noted that, “Despite efforts to alleviate the impact of the crisis, especially the partial reopening of food shipments from Ukraine’s Black Sea ports, several risks remain mostly in the areas of Ukraine’s storage, processing and transport capacities; international trade policy measures; and food price levels and volatility. On the positive side, provisional forecasts for this year’s world production of wheat – one of the grains most affected by the crisis – points to a robust outturn, which could help assuage international markets.”

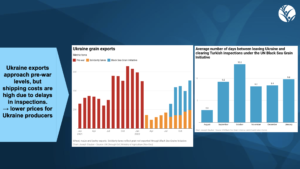

The Market Monitor stated that, “The conflict has caused significant damage to the infrastructure and logistics capacities in Ukraine, including inland transportation networks, seaports, as well as storage and processing facilities. As a consequence, these damages have significantly lowered Ukraine’s exporting capacity and raised the cost of trading grain. While significant efforts have been made to compensate for some of these disruptions, solutions are frequently insufficient or only provide temporary relief.”

The Monitor added that, “The conflict has also impacted maritime trade logistics, disrupting the operations of key seaports in the global grain trade. To mitigate these challenges, the Black Sea Grain Initiative and other international programmes have been instrumental, including the promotion of alternative transportation methods, such as train and river freight through the so-called Solidarity Lanes. However, these efforts have yet to restore the pre-war export pace and continue to be costly.”

Looking ahead, the AMIS report explained that, “As regards the near-term outlook of global grain markets, early indications point to a strong wheat output this year, which could reach the second largest on record following the all-time high in 2022. Though total production is seen retreating, following four consecutive years of growth, world prospects are buoyed by expectations of area increases in several leading producers in 2023, amid the still attractive prices.”