Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

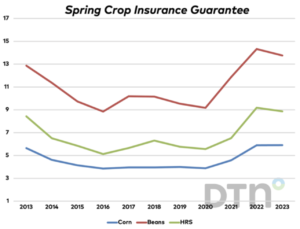

Crop Insurance Guarantee: $5.91 for Corn and $13.76 for Soybeans

Reuters writer Julie Ingwersen reported yesterday that, “Crop insurance policies that guarantee prices for the 2023 growing season are the highest since 2011 for corn and the second-highest on record for soybeans after last year’s peak, reflecting tight global grain supplies, analysts said.

The U.S. Department of Agriculture (USDA) set the guarantees, which act as a floor price below which farmers with insurance can receive payments, at $5.91 per bushel for corn and $13.76 a bushel for soybeans across most of the U.S. crop belt.

“The prices reflect the average settlement for Chicago Board of Trade December corn and November soybean futures during the month of February.”

Ingwersen added that, “The insurance guarantee for spring wheat was $8.87, down from $9.19 a year ago, based on the average price of Minneapolis Grain Exchange September spring wheat futures during February.

“The insurance price for corn is up a penny from $5.90 in 2022 and the highest since the 2011 price projection of $6.01. The soybean price is down from last year’s record high of $14.33, but still relatively strong.”

Also this week, DTN Farm Business Editor Katie Dehlinger reported that, “Spring reference prices for crop insurance were set at $5.91 per bushel of corn, $13.76 per bushel of soybeans and $8.87 per bushel of spring wheat, as the market closed on Tuesday, Feb. 28.

The prices are an essential component of revenue protection crop insurance policies, the most popular subsidized insurance option among U.S. farmers.

“The spring reference prices are computed by averaging the daily closing price of the December corn, November soybean and September spring wheat contracts throughout February. Those numbers are combined with the farm’s actual production history (APH) to determine a level of revenue to establish the crop insurance guarantee. Farmers can elect to insure up to 85% of that revenue, with most choosing to purchase 75%, 80% or 85% depending on what the premiums are in their area.”