As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

December Corn and November Soybean Futures Ratio Favoring Corn Plantings

Bloomberg writer Sophie Caronello reported yesterday that, “Traders have been betting on corn ahead of the US Department of Agriculture’s prospective plantings report due on Friday.

The closely tracked ratio between December corn and November soybean futures has been favoring corn plantings since earlier this month, meaning its comparatively stronger performance will push more farmers to plant the grain at the expense of the beans.

“That’s as top producer Brazil is harvesting a record soy crop while corn supplies in No. 1 grower the US were depleted by drought last year.”

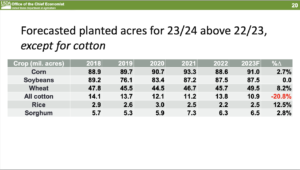

Meanwhile, Reuters writer Julie Ingwersen reported late last week that, “A U.S. planting intentions survey conducted by Farm Futures magazine and released on Friday indicated that growers expect to plant 87.677 million acres of corn in 2023, down 1% from the 88.579 million acres seeded a year ago.

“Soybean plantings for 2023 forecast at 89.620 million acres, up 2.5% from USDA’s 2022 estimate of 87.450 million.”

As a reminder, last month, Reuters News reported that, “Corn seedings were pegged at 91.0 million acres, up from 88.6 million in 2022, and soybean seedings at 87.5 million acres, unchanged from last year, the USDA said at its annual Agricultural Outlook Forum.”

Elsewhere, Reuters writers Mei Mei Chu and Rajendra Jadhav reported today that, “Traders are also assessing uncertainties over the Black Sea grains deal after Russian business newspaper Vedomosti on Friday reported that Moscow could recommend a temporary halt in wheat and sunflower exports.

“Later, sources told Reuters that Russia had no plans to halt wheat exports but wanted exporters to ensure prices paid to farmers were high enough to cover average production costs.”

And late last week, Reuters writer Pavel Polityuk reported that, “Ukraine’s grain exports so far in the 2022/23 season totaled 36.6 million tonnes as of March 24, hit by a smaller harvest and logistical difficulties caused by Russia’s invasion, agriculture ministry data showed on Friday.

“The ministry gave no comparative data for the same date in 2022. It said Ukraine had exported 44.8 million tonnes of grain as of March 27, 2022.”

With respect to export demand variables, Reuters writers Qin Ningwei and Dominique Patton reported today that, “China’s sow herd increased by 1.7% in February compared with a year earlier, 5% more than the targeted capacity, state media said on Monday.

“The herd reached 43.4 million sows, said China Central Television (CCTV), citing data from the Ministry of Agriculture and Rural Affairs (MARA), although it contracted by 0.6% compared with the prior month.”

“Hog farm managers and analysts said earlier this month that a surge in African swine fever infections in China would lead to a reduction in hog production later this year, pushing up prices in China as demand recovers,” the article said.