As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

ERS: “U.S. Export Competitiveness in Select Crop Markets,” Focus on Corn, Soybeans and Wheat

In a report yesterday from the USDA’s Economic Research Service (ERS), “U.S. Export Competitiveness in Select Crop Markets,” Samantha Padilla, Danielle J. Ufer, Stephen Morgan, and Noah Link stated that, “Export shares and exports-to-production ratios indicate the United States continues to be the top exporter of corn, tree nuts, and cotton, while other competitors have penetrated the global wheat and soybean markets. Over the last decade, the United States lost its position in the global wheat market as the European Union (EU), Russia, and Ukraine gained market shares. Similarly, Brazil and Argentina continue to pose a challenge to U.S. soybean exports. For instance, since 2021, Brazil has been the largest exporter of soybean oilseed.

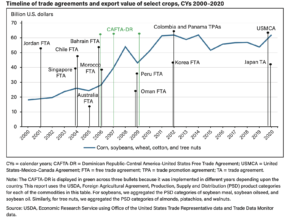

“The United States’ involvement in trade agreements, particularly with emerging markets, contributes to its export competitiveness.

However, from 2012 through 2020, the United States did not establish any new free trade agreements (FTAs), potentially limiting U.S. export opportunities in some emerging markets while other competitors signed multiple FTAs during that same period.

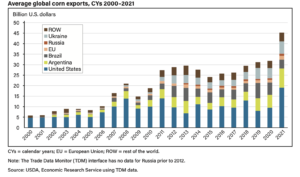

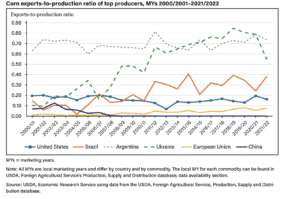

More narrowly, the ERS report noted that, “The United States remains the world leader in corn exports, though competition from Brazil, Argentina, and Ukraine has increased in the last decade.

“U.S. corn exports were valued at over $9.2 billion in calendar year (CY) 2020 and $18.7 billion in CY 2021.

“U.S. corn represents a large share of the corn imported by China, Japan, South Korea, Mexico, and Colombia—all countries with a U.S. trade agreement in place.”

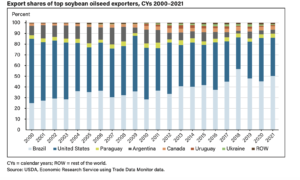

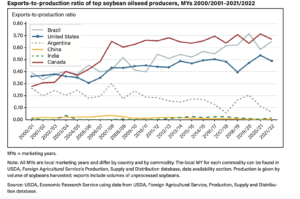

With respect to soybeans, ERS pointed out that, “Soybeans continue to be the most valuable commodity exported by the United States, valued at $25.5 billion in CY 2020 and $27.4 billion in CY 2021.

“Though U.S. soybean (including soybean meal and oil) trade has trended upward since 2000, it faces competition from Brazil and Argentina.

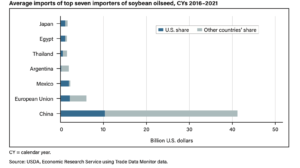

“China remains the largest market for U.S. soybean oilseed, which accounted for over $50 billion of U.S. soybean exports from 2016 to 2020.

“A potential threat to U.S. soybean exports is the heavy dependence on China for purchase.”

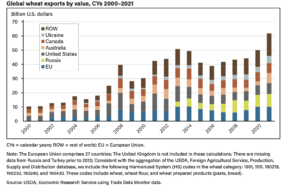

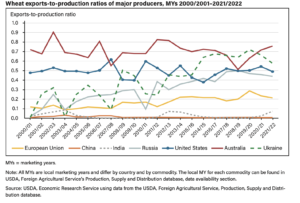

And regarding wheat, the ERS authors explained that, “The United States is one of six major global wheat exporters—the others being the EU, Russia, Canada, Australia, and Ukraine. Jointly these exporters accounted for over 70 percent of global wheat exports by value in CY 2021.

“However, the U.S. wheat market share has trended downward since 2000.

“In CY 2021, U.S. exports of wheat products were valued at $7.7 billion. Major U.S. wheat export destinations shifted since 2000, with U.S. wheat exports to Egypt declining and wheat exports to Mexico and the Philippines increasing over the last decade. Drought and producer preference for higher value crops (e.g., corn and soybean oilseed) may reduce U.S. wheat production and exports.”