Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Following Black Sea Grain Deal Extension, Wheat Falls, as WSJ Highlights Soybean Oil Variables

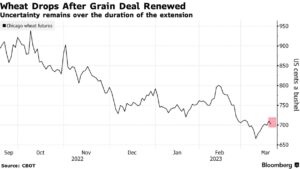

Bloomberg writer Keira Wright reported today that, “Wheat dropped following the renewal of an agreement that allows Ukraine to safely export grains out of key Black Sea ports, although the duration of the latest extension was disputed.

“Ukraine’s Infrastructure Minister Oleksandr Kubrakov said over the weekend that the pact had been prolonged for another 120 days, but Russia and an unnamed Turkish official said the extension was only for 60 days. The top two commodities shipped under the deal are wheat and corn, which also fell.”

The Bloomberg article noted that, “Despite Monday’s declines, the discrepancy between Russia and Ukraine on the length of extension will likely add a risk premium compared to if both sides agreed from the get go, said Dennis Voznesenski, an agriculture analyst at Rabobank Group based in Sydney.”

Wright added that,

Ten regions in Ukraine have started planting spring wheat and barley crops earlier than in 2022, according to the Ukrainian Agrarian Ministry. However, the country’s farmers may only sow 8.7 million hectares of grain crops this year, more than 20% lower than the previous year, preliminary estimates show.

Also today, Reuters writer Pavel Polityuk reported that, “Ukraine’s 2023 combined grain and oilseed harvest is seen falling to a preliminary 63 million tonnes from 70 million tonnes harvested in 2022, Ukrainian Agriculture Minister Mykola Solsky told Reuters on Monday.”

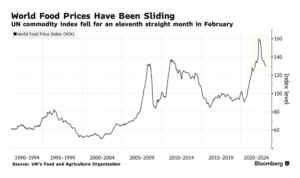

And Bloomberg writer Sophie Caronello reported this week that, “Keep an eye on food prices. While an agreement that safely allows Ukraine to export grains and other crops out of key Black Sea ports has been renewed, uncertainty lingers over the pact’s duration, casting a shadow over the future state of global supplies. That has the potential to add more pressure to food costs, which — while still elevated — have retreated since Russia’s invasion of Ukraine just over a year ago. The UN’s price index, which tracks five major exported food groups, is at the lowest level since September 2021 after surging to a record last year.”

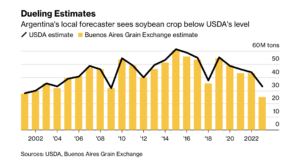

Caronello also noted that, “The Buenos Aires Grain Exchange, which last week slashed its soybean estimate by four million tons, will update its 2023 outlook on Thursday. The local forecaster’s current projection is eight million tons lower than the US Department of Agriculture’s estimate.

“It’s a stark difference, but the two agencies’ final figures have historically aligned. Argentina is the biggest global exporter of soy meal for livestock feed and soy oil for cooking and biofuels, so any more cuts risks further denting the global trade matrix.”

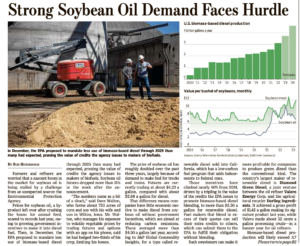

In a closer look at soy variables, Bob Henderson reported in today’s Wall Street Journal that, “Farmers and refiners are worried that a nascent boom in the market for soybean oil is being stalled by a challenge from an unexpected source: the Environmental Protection Agency.

“Prices for soybean oil, a byproduct left over after crushing the beans for animal feed, soared to records last year owing to growing government incentives to make it into diesel fuel. Then, in December, the EPA proposed to mandate less use of biomass-based diesel through 2025 than many had expected, pruning the value of credits the agency issues to makers of biofuels. Soybean oil futures dropped more than 15% in the week after the announcement.”

Henderson indicated that, “The price of soybean oil has roughly doubled over the past three years, largely because of demand to make fuel for trucks and trains. Futures are currently trading at about $4.23 a gallon, compared with about $2.68 a gallon for diesel.

“That difference means companies have little economic motive to make diesel from soybean oil without government incentives, which are aimed at reducing carbon emissions. Those averaged more than $4.50 a gallon last year, according to S&P Global Commodity Insights, for a type called renewable diesel sold into California, which has a low-carbon fuel program that adds inducements to federal ones.”

The Journal article added that, “‘For decades, oil was the residual product that companies had to figure out a way to get rid of after selling meal, the really valuable stuff,’ said Scott Irwin, an agricultural economist at the University of Illinois Urbana-Champaign.

“An old rule of thumb, said Mr. Irwin, was that oil made up about a third of a soybean’s value. But oil’s diesel-driven rally had that fraction flirting with 50%, at least until the EPA’s proposal.”