Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Kansas City Fed: “Signs of Softening” in Farmland Values, as Interest Rates Climb

In an update last week from the Federal Reserve Bank of Kansas City, “Growth in Farmland Values Slows Amid Higher Interest Rates,” Cortney Cowley and Ty Kreitman indicated that, “Farm real estate values increased considerably in 2022 but showed signs of softening during the final months of 2022 as interest rates rose sharply. Interest rates on farm loans jumped to decade highs alongside increases in the federal funds rate.

While the value of most types of farmland continued to rise, the increase was the slowest since early 2021.

“Agricultural credit conditions remained strong in the fourth quarter and continued to be bolstered by broad strength in the farm economy throughout 2022.”

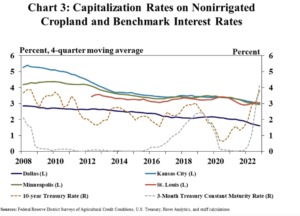

Cowley and Kreitman explained that, “Interest rates on farm loans jumped to decade highs as benchmark rates rose further. The average rate charged on agricultural loans at banks in reporting Federal Reserve Districts increased nearly 150 basis points from the previous quarter and were about 300 basis points higher than the same time a year ago. Rates rose to the highest level since 2008 and pushed up financing costs considerably.”

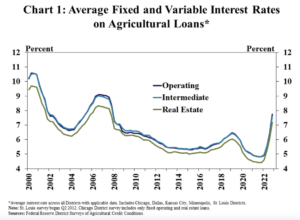

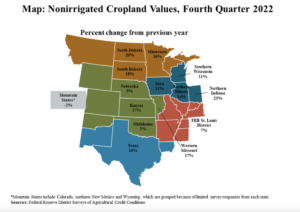

Last week’s update noted that “Farmland values increased sharply in 2022, but growth slowed during recent quarters in some regions alongside higher interest rates. The value of nonirrigated cropland increased by an average of 15% from the previous year across all regions, following growth of more than 20% in early 2022.”

“Nonirrigated cropland values grew by more than 15% in about half the states within the participating Federal Reserve Districts, but also increased less than 15% in half of states,” according to the Kansas City Fed.

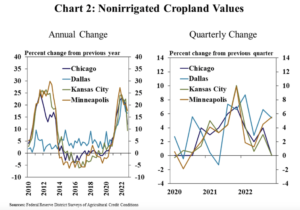

Cowley and Kreitman added that, “Benchmark interest rates surpassed returns to farmland owners in recent months, which could put some downward pressure on growth in farmland values going forward.”