A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

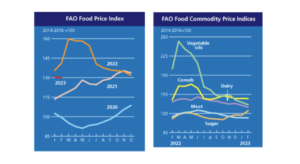

The FAO Food Price Index Drops in February, For the Eleventh Consecutive Month

Bloomberg writer Agnieszka de Sousa reported today that, “Global food costs edged down again, extending their retreat to the lowest in 17 months, although consumers continue to feel the pinch at grocery stores.

“A United Nations’ index of food-commodity costs eased 0.6% in February, down for an 11th month in the longest run of losses in data going back three decades. Last month’s fall was driven by cooking oils and dairy, and the overall gauge is down 19% from a record set a year ago when Russia’s invasion of Ukraine disrupted grain exports.

“A year into the war, wheat prices are under pressure from ample harvests in producers like Russia and Australia, while vegetable oils and meat costs have also slid. Still, it takes time for that to filter through to stores, where prices are also kept high because of energy, labor and transport costs.”

Reuters writer Nigel Hunt reported today that, “The Food and Agriculture Organization’s (FAO) price index, which tracks the most globally traded food commodities, averaged 129.8 points last month against 130.6 for January, the agency said on Friday. It was the lowest reading since September 2021.”

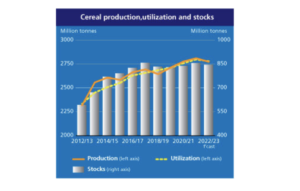

The Reuters article pointed out that, “In a separate report on cereals supply and demand, the FAO issued a first preliminary forecast for global wheat production in 2023, with a year-on-year decline to 784 million tonnes seen although the crop would still be the second highest on record.”

Hunt noted that, “The decline was partially offset by an expected rise in U.S. production to 51 million tonnes, with high prices leading to an increase in wheat sowings to the highest level since 2015.

“The FAO raised its forecast for world cereal production in 2022 by 9 million tonnes to 2.77 billion tonnes, although that would still be 1.3% lower year-on-year.”

And Dow Jones writer Will Horner reported today that, “Grain prices were particularly impacted by the conflict, thanks to Ukraine’s key pre-war role as a major supplier of wheat, corn and other crops. Global grain prices have come down significantly from the highs they hit in the months after Russia’s invasion but have stabilized at historically elevated levels.

“The FAO’s index of cereal prices was unchanged last month, while wheat prices rose slightly due to fresh concerns about supplies from Ukraine and dry weather conditions in the U.S. crimped crop expectations.

“While global prices for grain, a staple food source, have come down significantly in recent months, local prices in many countries remain at exorbitant levels. Coarse grain prices in Ghana were 150% higher than last year, while grain prices in Malawi and Zambia are at record levels, the FAO said.”