A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

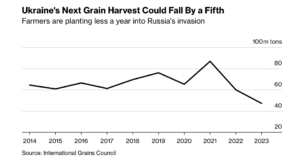

Ukraine Grain Output Could Fall by a Fifth Compared to Last Year

Bloomberg writers Megan Durisin, Kateryna Choursina and Aine Quinn reported yesterday that, “Oleksandr Klepach’s fields in southern Ukraine would normally be teeming with shoots of wheat and rapeseed in spring. This March, they’re infested with weeds instead.

“The farmer couldn’t plant autumn-sown crops on his 1,000 hectares (2,471 acres) because the area was occupied by Russian forces. Troops have since retreated, but mines still need to be cleared, costs for inputs like fuel and pesticides have soared and he hasn’t been able to find enough seed to sow barley now.”

Farmers are cutting fertilizer use, idling land and switching to cheaper-to-grow oilseeds — all of which risk slashing grain output by a fifth from last year’s already-low level.

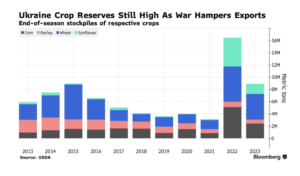

The Bloomberg writers pointed out that, “Last year, the bulk of Ukraine’s wheat was planted before Russia invaded, buffering production. Growers also had a financial cushion from the country’s record 2021 harvest, [Kateryna Rybachenko, vice president of the Ukrainian Agribusiness Club] said.

“Those reserves have since dwindled, exports have weakened, and plantings of major winter crops — like wheat — declined. Spring varieties are now being sown, but the total area of staple grains is still expected to sink.

“The challenges facing farmers could slash Ukraine’s grain output to 47 million tons, about half its pre-war level, the International Grains Council forecasts. The drop will contribute to the smallest global stockpiles in nearly a decade, heightening the need for big crops elsewhere to maintain the retreat in world food prices.”

Durisin, Choursina and Quinn added that, “Hazy prospects for the Black Sea crop-export deal renewed over the weekend add to uncertainty about how much will eventually cross borders. Russia said it has only agreed to extend the pact through mid-May, ahead of 2023 harvests.”

Also yesterday, Reuters writer Pavel Polityuk reported that, “Ukraine, which expects a 15.2% decrease in the 2023 corn harvest, may lower its crop forecast further, a senior Ukrainian agriculture official said on Wednesday.

“Corn is a key Ukrainian export and has accounted for around 58% of its overall grain exports so far in the 2022/23 July-June season.

“The agriculture ministry said this week the country’s 2023 corn production could fall to 21.7 million tonnes from 25.6 million tonnes last year after an expected decrease in the sowing area to 3.6 million hectares from more than 4 million.”

Meanwhile, Dow Jones writer Kirk Maltais reported yesterday that, “Wheat for May delivery declined 2.9% to $6.63 1/2 a bushel on the Chicago Board of Trade on Wednesday, falling to the lowest level since July 2021 as Russian exports continue to squeeze world prices.”

And Reuters writer Naveen Thukral reported today that, “Chicago soybeans edged higher on Thursday, rising for the first time in three sessions and recovering from a three-month low, although expectations of an all-time high production in Brazil limited gains.

“Wheat rose from its lowest in eight months, while corn also edged higher.”

Today’s article indicated that, “Brazil’s soybean output and exports will be higher than expected in 2023, Brazilian oilseed lobby Abiove said, as local farmers harvest a bumper crop, Chinese demand remains strong and Argentine growers grapple with weather issues.

“Abiove now estimates Brazil’s soy production at a record 153.6 million tonnes, 1 million more than the projection in January.”