Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Western Grain Traders Pull Back in Russia, but “What Changes? Not Much.”

Reuters writers Polina Devitt, Sybille de La Hamaide and Olga Popova reported yesterday that, “Viterra, part-owned by Switzerland-based mining and trading giant Glencore, has decided not to continue its origination and export programmes out of Russia after July 1, it said in a statement.

“‘After this decision, our main task is to save jobs and support the remaining infrastructure. Management plans to continue its grain export business as a new independent Russian exporter, aiming to maintain the competitiveness of Russian grain on the global market and provide the most viable conditions for Russian producers,’ [the head of its Russian office, Nikolai Demyanov] said.”

The Reuters article noted that, “Viterra’s announcement comes a day after rival Cargill said it would take a further step back from the Russian grain market.

“Russia’s agriculture ministry said in a separate statement that Viterra’s decision will not affect the amount of Russia’s grain exports.”

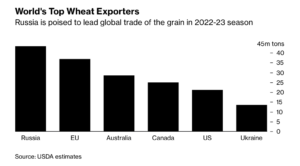

Also yesterday, Bloomberg writers Isis Almeida, Agnieszka de Sousa and Tarso Veloso Ribeiro reported that, “Archer-Daniels-Midland Co. is weighing options to exit its main Russian operations, potentially adding to the list of Western agriculture traders pulling back from the world’s top wheat exporter.”

“ADM’s possible move comes as rivals Cargill Inc. and Glencore-backed Viterra, the two biggest Western exporters of Russian grain, pull back from the market. The shift will give local firms and Moscow more control over the nation’s vast food resources,” the article said.

Bloomberg writers Aine Quinn, Megan Durisin and Agnieszka de Sousa reported today that,

In the span of just two days, the future of Western grain traders in Russia has been quickly rewritten.

“The shift comes a year after Russia’s invasion of Ukraine and will leave the grain trading market more in control of local companies,” the Bloomberg writers said.

The Bloomberg article added that, “Chicago wheat futures headed for a sixth monthly loss on Friday.”

Bloomberg Opinion columnist Javier Blas indicated yesterday that, “Despite the exit of top Western traders, Russian grain and other crops will continue to flow into global markets. Inside the country, local traders will replace the foreign ones. And outside it — where the authority of Russian ports ends and the activity of foreign-flagged ships begins — Western traders will continue shipping Russian grain.”

“What changes? Not much. The Kremlin will carry on collecting grain export taxes to finance its war against Ukraine. Moscow will also keep using its food exports as a diplomatic lever in the Global South. Russian grain ends up in countries like Egypt, Bangladesh and Turkey, all sympathetic to Putin — or, at least, uncritical,” Blas said.

Meanwhile, Reuters writer Pavel Polityuk reported earlier this week that, “Ukraine’s grain exports have reached 5.1 million tonnes so far in March compared to 1.4 million tonnes in March 2022, the agriculture ministry data showed on Wednesday.”

Polityuk noted that, “A major grain producer and exporter, Ukraine is likely to see a drop in grain output to about 53 million tonnes in clean weight in the 2022 calendar year from a record 86 million tonnes in 2021…[and]…The government has said Ukraine can harvest 44.3 million tones of grain, including 16.6 million tonnes of wheat, in 2023.”

And Reuters writers Alan Charlish and Marek Strzelecki reported yesterday that, “European Agriculture Commissioner Janusz Wojciechowski would support curbs on trading with Ukraine if Poland proposed such a move, he said on Thursday, amid anger among some European farmers over an influx of cheap Ukrainian grain.”

“Logistical bottlenecks mean large quantities of Ukrainian grains, which are cheaper than those produced in the EU, have ended up in central European states, hitting prices and sales of local farmers,” the article said.