The world's farmers face soaring fertilizer and fuel prices as the war in the Middle East escalates, leaving some scrambling for supplies as the spring planting season approaches and causing…

China Soybean Imports “Highest on Record For the Quarter,” as “Lula Seeks Deeper Trade Ties in China Visit”

Reuters writers Qin Ningwei and Dominique Patton reported yesterday that, “China’s soybean imports in March rose 7.9% from the same month a year earlier, data showed on Thursday, as buyers in China stocked up ahead of expected strong demand.

“Total imports for the month came to 6.85 million tonnes, according to the General Administration of Customs, down 2% from February’s 7.04 million tonnes.”

The Reuters article pointed out that, “Arrivals for the first three months of the year came to 23 million tonnes, up 13.5% from a year earlier, the data also showed, and highest on record for the quarter.”

In a separate Reuters article from today, Dominique Patton reported that,

China’s agriculture ministry issued a three-year action plan on Friday to reduce soymeal use in animal feed as it continues to try to reduce its heavy reliance on soybean imports.

“The new plan proposes that soymeal ratios in animal feed should be reduced to under 13% by 2025, down from 14.5% in 2022.”

Patton explained that, “China buys more than 60% of the world’s traded soybeans, well over 90 million tonnes a year, largely from the United States and Brazil.”

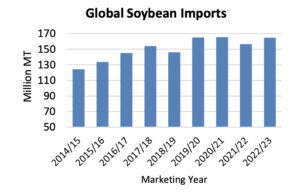

Meanwhile, the USDA’s Foreign Agricultural Service noted earlier this week in its monthly Oilseeds: World Markets and Trade report that, “In 2022/23, soybean trade is forecast well-above last year, owing mostly to record Brazil production and strong global demand. While import demand has plummeted in markets like Bangladesh, Pakistan, and Egypt, this is mostly offset by growth in markets including Argentina and China.”

And in its monthly Oil Crops Outlook report yesterday, the USDA’s Economic Research Service indicated that, “Brazil’s soybean production is raised this month by 1.0 million metric tons to 154.0 million metric tons on greater harvested acreage.”

Reuters writer Naveen Thukral reported today that, “Brazilian farmers will produce a record 153.6 million tonnes of soybeans this season, an increase of 2.2 million tonnes compared to a March forecast as harvesting draws to a close in the world’s biggest exporter of the oilseed.

“In a report released Thursday by the government’s food supply and statistics agency Conab, it cited adjustments in national average yield estimates as a factor for the upward revision.”

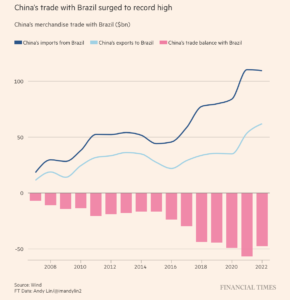

With this background in mind, Samantha Pearson and Austin Ramzy reported in today’s Wall Street Journal that, “[Brazil’s leftist President Luiz Inácio Lula da Silva will meet Chinese leader Xi Jinping in Beijing on Friday], the meeting marks a deepening of Brazil’s relationship with its largest trading partner, officials and Chinese scholars said, as Beijing looks to counter what it sees as American-led efforts to suppress the Asian nation diplomatically and economically.”

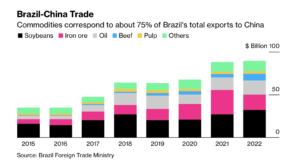

The Journal writers noted that, “Brazilian exports to China totaled some $89.7 billion last year, of which 36% was soybeans, 20% iron ore and 18% crude oil, according to government data.”

Financial Times writers Joe Leahy and Hudson Lockett reported yesterday that, “Bilateral trade has ballooned over the past decade to $150.4bn last year, with China buying Brazil’s agricultural commodities and minerals and investing in the Latin American country’s large consumer market and infrastructure sector. On Thursday, Lula also visited Huawei, the Chinese telecom equipment company that is subject to US sanctions.”

Bloomberg writers Simone Preissler Iglesias and Tatiana Freitas reported earlier this week that, “The [Brazil, China] talks will focus heavily on the environment — including satellite monitoring of destruction in the Amazon rainforest — as well as agriculture and commodities. Brazil’s environmental and agriculture ministers, Marina Silva and Carlos Favaro, will join Lula on the trip.”

And Moriah Balingit and Meaghan Tobin reported in today’s Washington Post that, “Brazil relies on Russia as the top supplier of fertilizer to its agricultural sector, which fuels its booming exports to China. Russia’s trade with both Brazil and China hit record highs in 2022.”