Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

ERS: “China’s Agricultural Imports Appear to Remain Short of Their Full Potential”

In an Amber Waves article last week from the USDA’s Economic Research Service (ERS), “Removing Nontariff Import Barriers Could Increase China’s Imports of Pork, Beef, Corn, and Wheat, ERS Research Shows,” Stephen Morgan, Fred Gale, Jayson Beckman, Ethan Sabala, Danielle J. Ufer, Adriana Valcu-Lisman, and Wendy Zeng indicated that, “China imported more than $205 billion of agricultural products in 2021, including more than $37 billion from the United States.

Despite this value of trade, China’s agricultural imports appear to remain short of their full potential, especially for certain commodities.

“Over the past two decades, China has opened trade borders through tariff cuts and by reducing direct Government intervention in foreign trade. For example, the U.S. Economic and Trade Agreement (Phase One) with China, signed in 2020, included provisions that address dozens of such barriers. Still, impediments to bilateral trade growth remain, including nontariff measures such as quotas, differences in standards, bans on certain inputs, bans due to disease, detection of weed seeds for foreign material in shipments, or strict certification requirements for exporters. The existence of these barriers limit trade even with tariff reductions.”

The ERS researchers explained that, “Nontariff measures impede China’s trade in two ways. First, they directly limit the volume of imports and restrict the supply of commodities in China. They also keep Chinese prices high, thus encouraging more domestic production to substitute for imported commodities. One of the outcomes of China’s import barriers, therefore, is a ‘price wedge‘ in which domestic commodity prices are often higher than international prices.”

“Price wedges calculated in 2020 varied from 13 percent for soybeans and 15 percent for cotton, to 38 percent for wheat, 43 percent for beef, 48 percent for corn, and 181 percent for pork. The wedges for cotton and soybeans—commodities that consistently have been traded in large volumes—are relatively modest. However, the larger wedges for wheat, corn, beef, and pork suggest that barriers other than tariffs might be impeding the flow of imports for these commodities.”

More narrowly, the Amber Waves article stated that, “The U.S. share of China’s pork imports, however, has been limited by factors such as China’s zero-tolerance policy for the use of ractopamine—a feed additive that promotes lean muscle growth—and the risk of bans in response to disease outbreaks. A commitment in the Phase One agreement for China to set science-based limits on use of ractopamine has yet to be carried out. In addition, U.S. pork was subject to Sections 232 and 301 retaliatory tariffs, which China initiated in 2018 in response to U.S. tariffs on Chinese steel and aluminum as well as other products. Chinese authorities granted some importers exclusions from Section 301 tariffs in 2020 after the Phase One agreement was signed, but the Section 232 tariffs were still assessed on U.S. pork.”

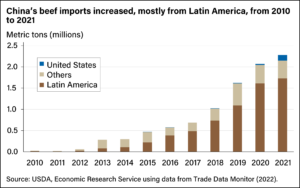

Regarding beef, ERS pointed out that, “In 2017, China lifted a 14-year ban on U.S. beef stemming from the discovery of bovine spongiform encephalopathy (BSE), but imports were slow to recover as few U.S. facilities were eligible to export to China. The Phase One agreement reduced trade barriers, and as a result, U.S. share of China’s beef imports rose above 1 percent in 2020 for the first time in recent years, before increasing to 6 percent in 2021.”

In a closer look at Chinese corn imports, the ERS researchers pointed out that,

The share of China’s corn imports from the United States rose from 7 percent to 70 percent in the 2 years from 2019 to 2021.

“In 2020, China’s corn imports surged to a record level after the Phase One agreement and reports of diminished Chinese stockpiles that prompted a surge in Chinese corn prices that year. Imports exceeded the tariff rate quota for the first time in 2020, by over 4 million metric tons. The next year, in 2021, imports exceeded the quota by nearly fourfold. It was unclear how imports reached this level as imports outside the quota are assessed a 65-percent tariff that would likely make such imports unprofitable.”

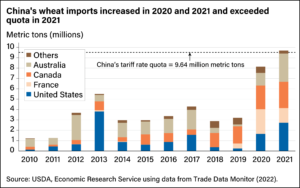

And with respect to wheat, the ERS article noted that, “As with corn, China has protected its domestic wheat producers from international competition with a TRQ that applies a 1-percent tariff to the first 9.64 million metric tons of wheat imported into China and a 65-percent tariff to any imports beyond the quota. Also, 90 percent of the wheat import quota is reserved for one state-trading enterprise, leaving 10 percent for other importers. China’s wheat TRQ had not been filled until 2021, when imports reached 9.7 million metric tons. With those policies in place, the price of imported wheat typically has been considerably lower than the domestic price. The volume of wheat imports is influenced by Chinese authorities’ accumulation and release of reserve stockpiles.”

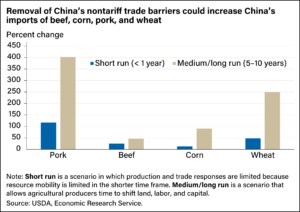

The Amber Waves article added that, “In the short run, removal of nontariff barriers is expected to increase China’s imports by 13 to 117 percent across the four commodities. In the medium and long run, estimates suggest increases from 46 to 402 percent.”

“Researchers project that removing these nontariff barriers eventually would increase sales for wheat producers in the United States and other exporting countries while lowering food prices for China’s consumers.”