Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Fertilizer Prices Continued to Fall in March

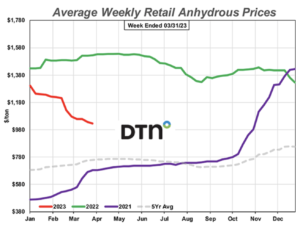

DTN writer Russ Quinn reported last week that, “All average retail fertilizer prices were down from last month in the fourth full week of March 2023, according to sellers surveyed by DTN. However, after weeks of prices for several fertilizers being considerably lower, only one fertilizer — anhydrous — was substantially less expensive.

“Once again, all eight of the major fertilizer prices are lower compared to last month. DTN designates a significant move as anything 5% or more.

“Leading the way lower was anhydrous. The nitrogen fertilizer was 5% lower compared to last month and had an average price of $1,026 per ton.”

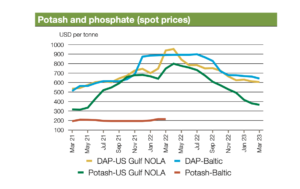

The DTN article noted that, “The remaining seven fertilizers were all just slightly lower compared to last month. DAP had an average price of $818 per ton, MAP $810/ton, potash $644/ton, urea $626/ton, 10-34-0 $741/ton, UAN28 $428/ton and UAN32 $513/ton.”

Quinn added that, “All fertilizers are now double digits lower compared to one year ago. 10-34-0 is 17% less expensive, DAP is 21% lower, MAP is 23% less expensive, potash is 26% lower, UAN32 is 28% less expensive, both anhydrous and UAN28 are 33% lower and urea is 39% less expensive compared to a year prior.”

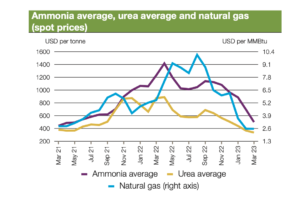

Meanwhile, in a Quarterly Report from Cobank this month, Kenneth Scott Zuckerberg indicated that, “In contrast to the first quarter of 2022 when fertilizer prices hit decade highs, fertilizer prices continued to fall during the first quarter of 2023. This occurred amidst downward pressure on grain, energy, other commodity prices, and general inflation.”

Zuckerberg noted that, “The current situation contrasts sharply with a year ago, when fertilizer and natural gas prices spiked following Russia’s invasion into Ukraine. Several factors are at play. One, fertilizer production came back online in Europe following the planned idling of capacity during fall 2022 as Europe built up natural gas reserves through imported liquid natural gas. Two, overall consumption was down in both Europe and the U.S. as unseasonably warm weather reduced residential and commercial heating demand. With the futures curve forecasting higher natural gas prices by summer, we may be now nearing a low point for nitrogen prices in 2023.”

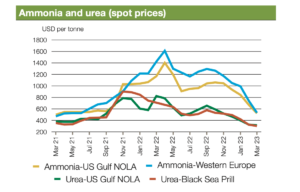

And in its April Market Monitor report, the Agricultural Market Information System (AMIS) indicated that, “Fertilizer prices continued to fall in March due to weakening demand and further easing of supply constraints, especially for nitrogenous fertilizers where price declines were particularly pronounced.

“The supply situation looks fairly optimistic for ammonia and urea in view of declining production costs, while DAP and potash supply remains relatively constrained due to trade restrictions and sanctions.”

The AMIS report explained that, “Natural gas prices decreased slightly in March. Inventories are replenishing and are at high levels as the heating season draws to a close in the Northern Hemisphere.”

“Ammonia prices dropped substantially across major markets despite the absence of shipments from the Russian Federation via the Black Sea. Abundant supply in the global market combined with lack of demand has contributed to falling prices. Buyers have additionally delayed purchases until the tonnage is needed, on speculation that prices will fall further,” the Monitor said.