Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Flooding Impacts Upper Mississippi Barge Traffic, as “Corn Hit its Lowest in Nine Months”

In its weekly Grain Transportation Report yesterday, the USDA’s Agricultural Marketing Service (AMS) indicated that, “On April 24, American Commercial Barge Line reported it had no boats on the Upper Mississippi River above St. Louis, MO, because of flooding conditions and lock closures. Currently, above Lock 17 (which is near New Boston, IL), all locks and dams are closed, and no freight is being accepted along the Twin Cities and Mid-Mississippi portions of the river.

The locks and dams are expected to stay closed for the next 3 weeks.

“Also, around May 5, as far south as Lock 22 (located near Saverton, MO) locks and dams could potentially be forced to close and stay closed for approximately 2 weeks, because of possible high water. The closures and slower-than-normal export grain sales have resulted in below-normal barge freight rates. In turn, low barge rates may lead some companies to reduce the number of barges they have in service.”

Reuters writer P.j. Huffstutter reported yesterday that, “Though it is not a busy export period for the United States, the closures will affect the delivery of any remaining soybeans or grain for the export market, said Mike Steenhoek, executive director of the Soy Transportation Coalition.

“It’s also creating a logistical headache for fertilizer suppliers and buyers, who typically rely on northern-bound barges to haul their goods to the Midwest ahead of spring planting.”

Yesterday’s AMS Report also pointed out that, “For the week ending April 20, total inspections of grain (corn, wheat, and soybeans) for export from all major U.S. export regions totaled 1.68 million metric tons (mmt). Total grain inspections were down 18 percent from the previous week, down 36 percent from last year, and down 33 percent from the 3-year average. Inspections of grain were also at their lowest since the start of January.

“Wheat inspections rose 44 percent from the previous week—primarily, because of higher volumes to Asia and Africa. The rise in wheat, however, could not offset the combined declines of 26 percent for corn and 29 percent for soybeans. Grain inspections were down 3 percent in the Pacific Northwest (PNW) and down 28 percent in the Mississippi Gulf. During the last 4 weeks, grain inspections were 30 percent below last year and 25 percent below the 3-year average.”

Dow Jones writer Kirk Maltais reported yesterday that, “Export sales of U.S. row crops were reduced as many countries canceled previously announced purchases, the U.S. Department of Agriculture reported Thursday.”

“The USDA confirmed that Mexico, Colombia, Peru, China and El Salvador all reported reductions to the amount of corn they were receiving,” Maltais said.

Also yesterday, Reuters writer Karl Plume reported that, “Chinese importers have scrapped more U.S. corn purchases, the U.S. Department of Agriculture (USDA) confirmed on Thursday, the latest in a series of cancellations as the major feed grain buyer awaits newly harvested grain from Brazil.

“The USDA, in a daily ‘flash sales’ announcement, said sales of 233,000 tonnes of corn slated for export to China in the 2022/23 marketing year were canceled.

“The agency had reported 327,000 tonnes in cancellations on Monday, and weekly export sales data released on Thursday showed 64,300 tonnes were also canceled in the week ended April 20.”

In a separate Dow Jones article yesterday, Kirk Maltais reported that, “Previously announced sales of U.S. corn exports continue to be canceled, with China withdrawing an order for 233,000 metric tons scheduled for delivery in the 2022/23 marketing year. That makes it 560,000 tons of corn exports canceled by China this week, which traders see as a reaction to the availability of cheaper exports from Brazil. As a result, CBOT corn futures fell below the $6 per bushel mark for the first time since July 2022.”

Reuters writer Naveen Thukral reported today that, “Chicago wheat futures slid on Friday and were set for their biggest monthly drop since last November, as forecasts of rains in U.S. Plains and expectations of ample world supplies weighed on the market.

“Corn hit its lowest in nine months while soybeans ticked lower.”

Meanwhile, Reuters writer Roberto Samora reported yesterday that, “Chinese demand for Brazilian soybeans this year is lower than expected, which explains why Brazil’s record harvest has not yielded monthly export records, the chief of commodity trader Cargill’s Brazil unit said in an interview.”

Elsewhere, Reuters writer Adriana Barrera reported yesterday that, “Trade consultations requested by the United States on Mexico’s plan to limit the use of genetically modified corn are an ‘unacceptable violation’ of Mexican law and feed the interests of seed ‘oligopolies,’ a top Mexican official said on Thursday.

“The United States, Mexico’s main trading partner, requested the consultations in early March under the United States-Mexico-Canada (USMCA) agreement, which calls for a science-based approach to domestic regulations.”

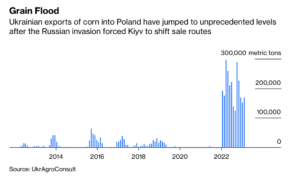

And Bloomberg Opinion Columnist Javier Blas indicated yesterday that, “Earlier this month, Poland, perhaps the staunchest supporter that Kyiv has in Europe, unilaterally closed its domestic grain market to Ukrainian famers. In quick succession, Hungary, Slovakia, and Bulgaria have followed. ‘We remain in solidarity with Ukraine, but the bankruptcy of Bulgarian farmers will not contribute to its cause,’ explained Bulgarian Prime Minister Galab Donev.”

Blas explained that, “The solution favored by Brussels is to allow Ukrainian grain to move overland in sealed containers without stopping inside the EU. On paper, Ukrainian grain would flow via Poland to the Baltic Sea ports of Gydnia and Gdansk, and via Romania and Bulgaria to the Black Sea ports of Constanta and Varna. From there, it can reach the international market.

“Even if that was possible logistically in greater quantities than now — it isn’t — the plan misunderstands the business of commodity trading. As long as Ukrainian grain competes for limited export capacity with domestic grain in Poland, Romania, and Bulgaria, local prices at the ports will remain under pressure. It doesn’t matter whether the grain is meant to only transit the EU territory. The transit — and the use of limited port export capacity — itself has a big price impact. Ask any trader and they would tell you that plentiful supplies of Ukrianian wheat and corn at the Polish and Bulgarian ports would suppress local prices.

“How to support both the Ukrainian farmers, key to the economic survival of the country, and the Polish farmers, a politically important community in a key ally of Kyiv? The only solution, you may have guessed already, is money: Subsidize the Eastern European farmers to allow Ukrainian grain to flow.”