Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Black Sea Grain Exports Resume- at Slow Pace, as U.S. Corn Exports in Focus

Reuters writer Michelle Nichols reported yesterday that, “The United Nations said inspections resumed on Tuesday of outbound vessels under a deal allowing the safe Black Sea export of Ukraine grain, which Moscow has threatened to quit on May 18 over obstacles to its own grain and fertilizer exports.

“There were no inbound or outbound inspections of ships on Sunday or Monday.”

Nichols explained that, “Senior officials from the four parties [Russia, Ukraine, Turkey and the U.N.] are due to meet in Istanbul this week for talks. Russia has said it will not extend the pact beyond May 18 unless a list of demands is met to remove obstacles to its own grain and fertilizer exports.”

“Turkish Defence Minister Hulusi Akar on Tuesday described discussions ahead of the planned meeting on Wednesday and Thursday as ‘positive,'” the Reuters article said.

And today, Bloomberg writers Megan Durisin and Daryna Krasnolutska reported that, “Ukraine’s crop shipments are being throttled, even before the latest negotiations over extending an export deal that’s provided farmers with a vital outlet after Russia’s invasion.

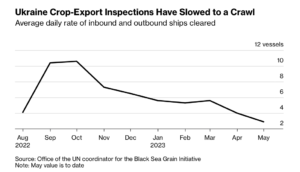

“Vessel inspections have been repeatedly disrupted, leaving grain flows through the Black Sea lagging behind previous months. That’s adding to restrictions on cargoes bound for eastern Europe, which is hampering sales ahead of the next harvest.”

Durisin and Krasnolutska explained that, “Ukraine has repeatedly blamed Russia for slowing grain flows. On average, inspections are clearing less than three inbound and outbound crop vessels a day in May, according to the UN, with no checks on Sunday or Monday. Another 62 ships are waiting to move to Ukrainian ports for loading.

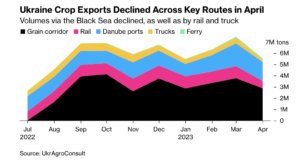

“As shipments through the Black Sea corridor dwindle, flows by road and rail via Ukraine’s European Union neighbors slumped to the lowest in at least 10 months, according to UkrAgroConsult. Some EU nations are curbing grain imports, arguing that a glut is threatening the livelihoods of their own farmers.”

Reuters writer Pavel Polityuk reported yesterday that, “Ukraine has alternative ways of transporting grain if a deal on safe Black Sea exports is not extended on May 18, and would not see that outcome as an ‘apocalyptic scenario,’ its agriculture minister said.”

The Reuters article indicated that, “‘We do not envisage any apocalyptic scenario due to a million circumstances. Ukrainian farmers and Ukrainian traders have shown that they can do a lot, and a lot of (export) routes can be laid,’ Agriculture Minister Mykola Solsky was quoted by his ministry as saying late on Monday.”

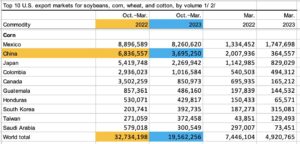

Elsewhere, Dow Jones writer Kirk Maltais reported yesterday that, “The USDA confirmed [Tuesday] morning that China has canceled more export sales of U.S. corn that it had previously agreed to, with 272,000 metric tons of U.S. corn now canceled for delivery into the U.S. for the 2022/23 marketing year. The announcement comes after a streak of cancellations announced by the USDA for exports to China late last month. It also comes amid indications of a strong crop coming in the U.S. – with concerns that demand won’t balance that production.”

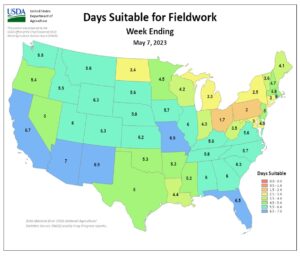

And Reuters writer Naveen Thukral reported today that, “Chicago soybean futures dipped on Wednesday as a fast pace of planting across the U.S. Midwest and slowing imports by top buyer China kept a lid on the market.”

.@usda_oce Wx: Producers in #Iowa planted 41% of their intended #corn acreage and 33% of their #soybeans during the week ending May 7. pic.twitter.com/gjojiMQh4O

— FarmPolicy (@FarmPolicy) May 9, 2023

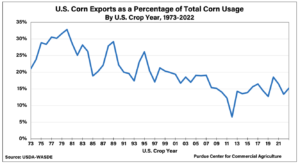

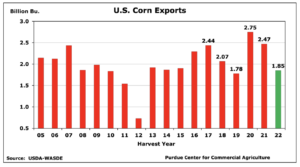

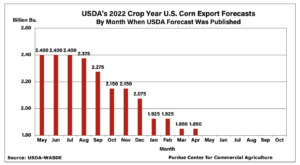

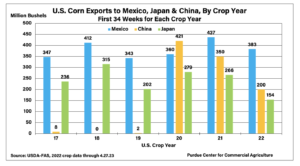

In a more detailed look at U.S. corn exports, Purdue University agricultural economist James Mintert indicated earlier this week (“U.S. Corn Exports Struggle To Meet USDA’s Weak Export Forecast“) that, “USDA’s most recent forecast of corn exports in the 2022 crop marketing year is just 1.85 billion bushels, down 25% from the 2.47 billion bushels exported during the 2021 crop year. However, that was not the expectation a year ago. USDA provided its first forecast of 2022 crop exports in May 2022 and from May through July USDA was much more optimistic about U.S. corn export prospects.

“Back in May 2022, USDA forecast that 2.4 billion bushels of the 2022 corn crop would be exported, nearly equal to the prior year’s export total. Since last summer, however, USDA has been ratcheting down its corn export forecasts, first dipping below a forecast of 2 billion bushels in the January WASDE before dropping to the current forecast of 1.85 billion bushels in the March and April WASDE reports.

“USDA’s 2022 corn crop export forecast is the 2nd weakest of the last 10 years with only 2019’s total of 1.78 billion bushels falling below this year’s forecast. Corn exports during the 2020 crop year were record large at 2.75 billion bushels with the 2021 crop year total of 2.47 billion bushels providing the second largest export total on record. Unfortunately, year-to-date actual corn exports have been below even USDA’s weak export forecast.

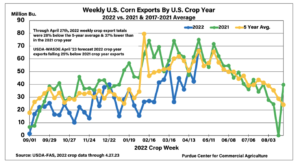

“Weekly export shipments data provided by USDA’s Foreign Agricultural Service during the 2022 crop marketing year through April 27th totaled 999 billion bushels, down from 1.576 billion bushels a year earlier.

“The year-to-year 37% export decline to date is even larger than USDA’s forecast of a 25% decline in corn exports and is 28% lower than the 5-year corn export average.”

Mintert added that, “Although weekly corn export shipments have improved since late winter, they have not increased enough to offset weak exports last fall and especially during much of the winter.

“Looking ahead toward summer, it will be a challenge for U.S. corn exports to even meet USDA’s weak export forecast in the 2022 crop marketing year.”