As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Federal Reserve Ag Credit Surveys- 2023 First Quarter

Late last week, the Federal Reserve Banks of Chicago, Kansas City and Minneapolis released updates regarding farm income, farmland values and agricultural credit conditions from the first quarter of 2023. The Federal Reserve Bank of Dallas also released its Agricultural Survey for the first quarter in late March.

Federal Reserve Bank of Chicago

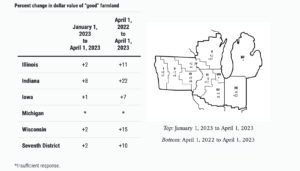

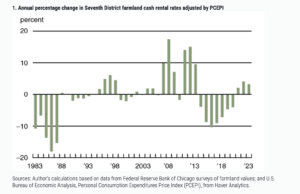

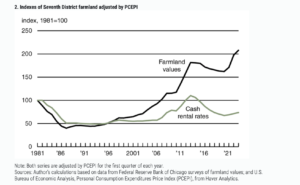

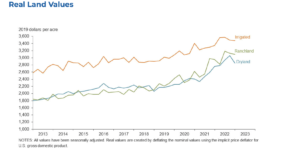

David Oppedahl, a Policy Advisor at the Chicago Fed, explained in the AgLetter that, “Despite experiencing its smallest year-over-year gain (10 percent) in agricultural land values since the second quarter of 2021, the District still extended its streak of double-digit farmland value increases to eight quarters in the first quarter of 2023. Farmland values rose 2 percent in the first quarter of this year from the fourth quarter of last year. After being adjusted for inflation with the Personal Consumption Expenditures Price Index (PCEPI), the year-over-year gain in District farmland values for the first quarter of 2023 was 5 percent (the tenth consecutive quarter of real increases that were at least as large).”

The AgLetter stated that, “Cash rental rates for District farm acres increased by 8 percent from 2022 to 2023, after rising somewhat faster (by 11 percent) from 2021 to 2022. For 2023, average annual cash rents for farmland were up 10 percent in Illinois, 2 percent in Indiana, 10 percent in Iowa, and 4 percent in Wisconsin (not enough survey responses were received from bankers in Michigan to report a numerical change for that state). After being adjusted for inflation with the PCEPI, District cash rental rates were up about 3 percent from 2022.

“This was the third consecutive annual increase in cash rents (both in nominal and real terms), following a seven-year stretch of annual decreases. In real terms, the index of farmland cash rental rates peaked in 2013.”

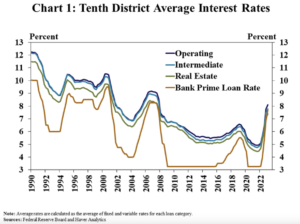

Mr. Oppedahl added that, “In the first quarter of 2023, agricultural credit conditions for the District were once again in good shape, despite the jump in farm interest rates over the past year. As of April 1, 2023, the average nominal interest rates on operating loans (7.97 percent), feeder cattle loans (7.93 percent), and agricultural real estate loans (7.14 percent) were higher than at any time since the third quarter of 2007. Yet, after being adjusted for inflation using the PCEPI, average agricultural interest rates had only reached levels last seen in the first quarter of 2021.”

Federal Reserve Bank of Kansas City

Nate Kauffman and Ty Kreitman, writing in last week’s Ag Credit Survey from the Kansas City Fed, noted that,

Agricultural credit conditions in the Tenth District remained strong and farm real estate values continued to increase, but growth has softened. Strength in farm real estate markets eased, but farmland values continued to increase despite downward pressure from higher interest rates.

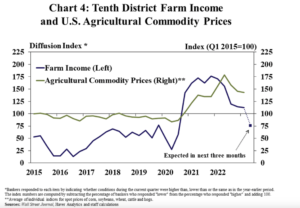

“Farm income moderated alongside a slight pullback in commodity prices during the first quarter slowing the pace of increase in loan repayment rates. While improvement in farm finances and credit conditions steadied and some lenders expected a degree of deterioration in the months ahead, multiple years of strong incomes continued to keep credit stress low.

“The outlook for the U.S. farm economy in 2023 remained favorable as prices of key commodities were at multi-year highs. Elevated production expenses, higher interest rates and drought continued to present headwinds for many producers, but current commodity prices kept profit opportunities within reach. Higher production expenses pushed many producers to increase lines of credit, but others also pursued cost-cutting measures or utilized cash to reduce financing needs, dampening loan demand at many banks. Financial performance and liquidity at agricultural banks remained solid and farm lenders appeared well-positioned to meet higher credit demand through the early months of 2023.”

The Ag Credit Survey indicated that, “Farm loan interest rates rose alongside further increases in benchmark rates. The average rate charged on agricultural loans was about 30 basis points higher than the previous quarter and nearly 300 basis points higher than a year ago.”

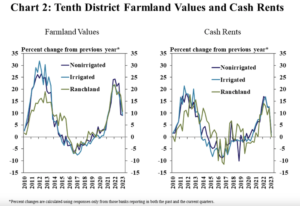

With respect to land values, the Kansas City Fed pointed out that, “Growth in farm real estate markets has softened as interest rates have risen, but land values still continued to increase in the first quarter. The pace slowed from the rapidly accelerating growth in early 2022, but the value of agricultural land increased about 10% from a year ago. Cash rents on farmland have increased alongside growth in land values, but steadied quickly in the first quarter.”

The Survey added that, “The acceleration in farm real estate values also slowed alongside a moderation in farm income. About 40% of respondents reported that income was higher than a year ago and 25% reported that income was lower.

“The prices of some key commodities have retracted from historically high levels in recent months and production costs remained elevated, putting downward pressure on profit margins and tempering the outlook for liquidity and farm income.”

Federal Reserve Bank of Minneapolis

In an article Thursday, “District farmers head into planting in solid financial condition, but outlook is uncertain,” Joe Mahon pointed out that, “The growth in land values seen over the past several years continued but tapered off, and cash rents also grew. Ninth District nonirrigated cropland values increased by more than 11 percent on average from the first quarter of 2022, though compared with the most recent quarter they actually fell slightly. Irrigated cropland values also rose, by 10 percent from a year ago, while ranchland and pastureland values edged up 3 percent. The district average cash rent for nonirrigated land rose by almost 8 percent from a year ago. Rents for irrigated land increased 10 percent, while ranchland rents increased 7 percent. Changes in land values and rents were generally consistent across district states.”

Federal Reserve Bank of Dallas

In late March, in its Agricultural Survey, the Dallas Fed noted that, “Ranchland, irrigated cropland and dryland values fell this quarter. But according to bankers who responded in both this quarter and first quarter 2022, ranchland, irrigated cropland and dryland values rose at least 8 percent year over year in Texas, with some segments seeing much higher increases.

“The anticipated trend in farmland values index bounced back into positive territory, suggesting respondents expect farmland values to increase.”