A new 10% tariff on goods from around the world took effect Tuesday — with a list of exemptions including beef. Other exemptions affecting the food and agriculture industries include…

Global Corn, Wheat Production Forecast at a Record, While El Niño “a Potent New Variable”

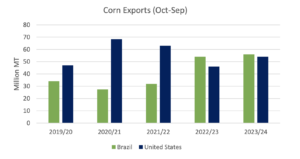

In its monthly Grain: World Markets and Trade report late last week, the USDA’s Foreign Agricultural Service (FAS) indicated that, “Global corn production is forecast to sharply increase, driven primarily by a forecast of continued high production in Brazil and rebounds in the United States and Argentina. Supplies in Ukraine are forecast to fall as the ongoing war limits production.”

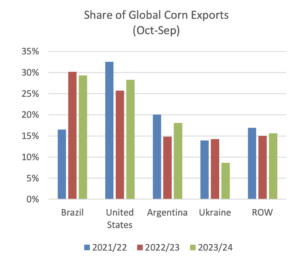

With respect to corn trade, FAS noted that, “Global trade will grow on record exportable supplies and lower prices from Brazil and a recovery in supplies from key exporters Argentina and the United States.

“Global consumption is also forecast up with expectations of lower corn prices encouraging demand for corn, largely for feed use, worldwide. Ending stocks are forecast up, almost entirely due to stock building in the United States.”

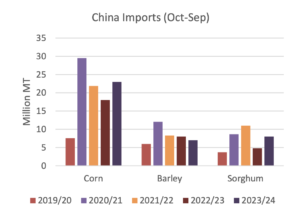

In a closer look at demand from China, last week’s report stated that, “China imports of corn, barley, and sorghum are projected to total 38.0 million tons, up from the revised 2022/23 estimate as higher corn and sorghum imports offset lower barley imports.”

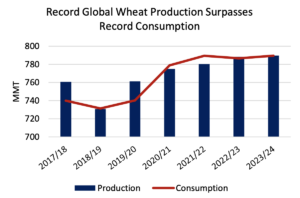

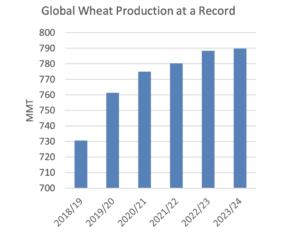

Turning to wheat, FAS stated that, “The global wheat outlook is for larger production and consumption with declining global trade and ending stocks.

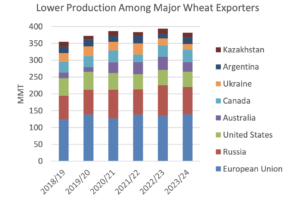

“Production is projected to increase with larger crops in Argentina, Canada, China, the European Union (EU), India, and Turkey more than offsetting large declines for Australia, Kazakhstan, Russia, and Ukraine.”

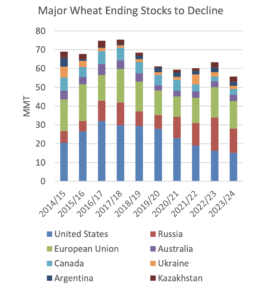

In a closer look at global wheat stocks, FAS pointed out that, “Global wheat stocks are forecast to shrink year over year, mostly on large declines for several major exporters.”

While addressing global wheat export variables, FAS indicated that, “Global trade is projected down slightly from last year’s record to 212.5 million tons with some shifts among major suppliers.”

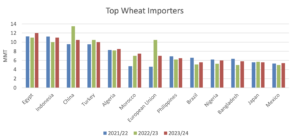

And regarding wheat imports, FAS explained that, “Egypt is forecast to be the largest global importer in 2023/24, with imports rebounding to 12.0 million tons as the country recovers from currency shortages and inflation.”

FAS added that, “China imports are forecast to remain robust at 10.5 million tons, though down from the previous year on a larger domestic crop. Food use continues to expand but feed use is down as corn becomes more price competitive.”

Meanwhile, David Uberti and Kirk Maltais reported in today’s Wall Street Journal that, “El Niño hasn’t even landed yet. That hasn’t stopped it from moving commodity markets around the world.

“The hard-to-predict climate pattern, when powerful, can usher in intense drought or rainfall, upend output from the world’s breadbasket regions, and whipsaw the prices of commodities. Brazilian sugar producers, American grain farmers and international traders are bracing for the phenomenon. But the cyclical shift in ocean temperatures can just as easily be a dud.

“El Niño occurs when trade winds moving west across the Pacific Ocean weaken and warmer-than-normal water sloshes toward the west coast of the Americas.

Meteorologists at the National Oceanic and Atmospheric Administration on Thursday gave 80% odds of at least a moderate El Niño appearing in the Northern Hemisphere by year’s end, with a 55% chance of a strong event.

The Journal writers explained that, “In the U.S., growing swaths of wheat-producing Plains states such as Nebraska, Kansas and Oklahoma are battling what the U.S. Drought Monitor describes as extreme or exceptional drought. Many farmers have abandoned scorched land in droves, and the U.S. Department of Agriculture expects them to harvest the smallest portion of acres planted with winter wheat since 1917. Benchmark prices for hard red wheat, often used in baked goods, have jumped about 10% this month.

“Some farmers fear those conditions could spread to the Corn Belt—and the expected switch to El Niño has added a potent new variable.”

Elsewhere, Reuters writer Naveen Thukral reported today that, “Chicago wheat gained more ground on Tuesday, climbing to its highest in a week as expectations of lower U.S. supplies in the next season and doubts over the renewal of a Black Sea export deal underpinned prices.”

“The UN aid chief said on Monday efforts will continue in coming days to extend a deal allowing the safe Black Sea export of Ukraine grain, a pact Russia has threatened to quit on May 18 over obstacles to its grain and fertilizer exports,” the Reuters article said.

Thukral added that, “After Monday’s market close, the USDA said the U.S. corn crop was 65% planted and soybean planting was 49% complete, both slightly behind trade expectations but still ahead of their respective five-year averages.”

And Reuters writer Pavel Polityuk reported yesterday that, “Ukraine’s grain exports for the 2022/23 season stood at 43.6 million tonnes as of May 15, Agriculture Ministry data showed on Monday.

“The ministry gave no exact comparative data for the same date a year ago but said Ukraine had exported 46.3 million tonnes of grain as of May 16, 2022.”

Reuters writer Sybille de La Hamaide reported today that, “Exports of Ukrainian corn are expected to fall 30% next season, with the war-torn country on course to harvest a much smaller crop this year, the Ukrainian Grain Association (UGA) said on Tuesday.

“The association projects Ukrainian corn exports in 2023/24 at 19 million tonnes, down from 27 million tonnes expected for 2022/23, UGA head Nikolay Gorbachov told Reuters on the sidelines of the GrainCom conference in Geneva.”