As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Global Soybean Production Forecast at Record Level, on Record Crops in Brazil, U.S.

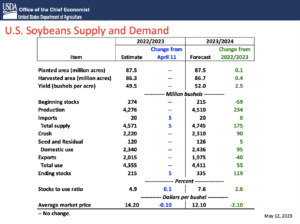

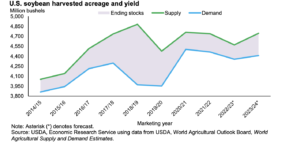

In its monthly Oil Crops Outlook report yesterday, the USDA’s Economic Research Service (ERS) indicated that, “U.S. soybean production for the 2023/24 marketing year (MY) is projected to climb by more than 5 percent to a record high of 4.5 billion bushels based on higher yield and marginally higher planted area. The yield forecast of 52.0 bushels per acre is based on a weather-adjusted trend, assuming normal weather during the growing season.”

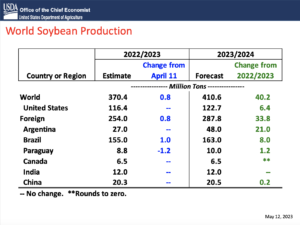

ERS explained that, “Global soybean production is forecast to reach a record 410.6 million metric tons, up 40.2 million metric tons from 2022/23 on an increase in planted area and a trend yield.

“Record soybean crops are forecast for Brazil and the United States as well as a normal crop in Argentina after a drought year.”

The Outlook pointed out that, “Although domestic demand of U.S. soybeans is expected to strengthen in 2023/24, foreign demand for U.S. soybeans is expected to subside on strong competition from South America. The result of these forecasts indicates 2023/24 U.S. soybean ending stocks will showcase a 120-million-bushel year-over- year increase to 335 million bushels.

“Consequently, the average price received by soybean farmers is expected to fall from $14.20 in 2022/23 to $12.10 in 2023/24.”

In addition, ERS stated that, “In Brazil, soybean production for 2023/24 is forecast to grow by more than 5 percent to 163.0 million metric tons on a 4-percent increase in harvested acreage (45.6 million hectares) and a yield of 3.58 tons per hectare. If realized, this would be another record-high soybean crop following the record 155.0 million metric tons in MY 2022/23 that was revised up by 1.0 million metric tons this month.

With a record supply and weak currency, Brazil is positioned to lead global soybean trade and increase its global share to 56 percent in 2023/24.

“Soybean exports for MY 2023/24 are raised by 3.5 million metric tons to 96.5 million metric tons with China as a major export destination for Brazil.”

Yesterday’s report added that, “In Argentina, soybean production is forecast at 48.0 million metric tons on higher harvested area and average yield of 2.9 tons per hectare assuming normal weather.”

ERS also noted that, “China’s soybean imports in MY 2023/24 are forecast up 2.0 million metric tons to 100.0 million metric tons, nearly 60 percent of the world’s total soybean imports.”

Meanwhile, Bloomberg writers Megan Durisin and Aine Quinn reported yesterday that, “Only seven crop vessels remain in the Ukraine crop corridor as Russia threatens to exit the grain pact later this week, bringing traffic grinding to a halt.

“No fresh inbound ships have cleared inspection through the corridor in more than a week, after a disagreement between parties at the Joint Coordination Centre in Istanbul that’s tasked with checking all boats. That’s left only a trickle of outbound traffic transiting the safe passage, lineups posted by the United Nations show.”

Durisin and Quinn noted that, “The UN said that of the seven ships still in the system, one is in port, one is transiting the corridor and the rest were awaiting inspection. Wheat traded in Chicago edged 0.4% lower on Tuesday, after gaining 4.1% on Monday.

“The current hiatus is paralyzing shipments, according to Dmitry Timotin at Inzernoexport GmbH Agency in Odesa, which typically arranges port calls for three vessels a month.”

Reuters writer Michelle Nichols reported today that, “The last ship left a port in Ukraine on Wednesday under a deal allowing the safe Black Sea export of Ukraine grain a day before Russia could quit the pact over obstacles to its grain and fertilizer exports.

“The DSM Capella has left the port of Chornomorsk carrying 30,000 tonnes of corn and was on its way to Turkey, according to data issued by the United Nations.”

Also today, Reuters News reported that, “The Kremlin said it would not enter into ‘hypothetical discussions’ on what Russia will do if the Black Sea grain deal lapses on Thursday.

“Moscow has said it will quit the deal, under which Russia allows Ukraine to export grain safely from Black Sea ports despite the war raging on land, on Thursday unless a list of demands for its own agricultural trade are met.”

Elsewhere, Reuters writer Pavel Polityuk reported today that, “Ukraine, a traditional grower of winter wheat, is likely to sow a record 285,000 hectares to spring wheat in 2023, the Ukrainian agriculture ministry said on Wednesday.

“Farmers have already sown 247,000 hectares of the commodity, it said in a statement. The ministry gave no comparative data for 2022 but said that Ukraine sowed 160,200 hectares of spring wheat in 2021.”