Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Iowa Farmers Worried, “Profits Per Acre Are a Concern,” China Food Security in Focus

Donnelle Eller reported on the front page of the Sunday Des Moines Register that, “Iowa farmers have a lot on their minds as they hook tractors onto planters this year: Skyrocketing interest rates are helping drive a 20% hike in the cost to plant the crop, along with higher seed, fertilizer, chemical and land costs, said Chad Hart, an Iowa State University agricultural economist.

U.S. farmers will spend a record $459 billion raising crops this year, USDA data shows. When costs are adjusted for inflation, that’s second only to 2014.

“At the same time, prices for corn and soybeans, the dominant crops in Iowa, are lower than a year ago: Iowa corn for delivery this fall is trading around $5 a bushel, while soybeans are hovering around $12, close to prices farmers need to cover their expenses. They’re about $1 a bushel lower than last year’s prices.”

The Register article indicated that, “Expenses ‘all dollar up pretty quickly,’ said Dennis Friest, who farms about 1,600 acres in Hardin County, in north central Iowa, with his son, Brent, and raises pigs. ‘Profits per acre are a concern.’

“With summer grain supplies expected to tighten and the possibility for a weather scare, Hart said prices could improve.

“‘It definitely still has the potential to be a profitable year,’ he said, noting that the USDA has corn averaging $5.60 a bushel this year and soybeans at $12.90.

“Nationally, U.S. farm income is expected to be 16% lower than the record set in 2022.”

Yesterday’s article noted that, “Mike Naig, Iowa’s agriculture secretary, said one of his biggest worries is how long high production costs will linger. The USDA said last year’s 19% increase in U.S. production expenses was the largest on record, and it forecasts an additional 4% increase this year.

“‘So far, commodity prices have been high enough … to cover those costs. But at some point, those dynamics will change,’ said Naig, whose family farms in northwest Iowa near Cylinder.”

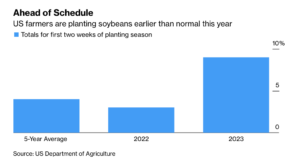

Meanwhile, Bloomberg writer Sophie Caronello reported yesterday that, “Favorable dry weather in key parts of the US crop belt is allowing farmers to jumpstart soybean plantings. Data due Monday from the Department of Agriculture will signal just how far ahead they are this season. A report last week showed a record 9% planted in the first two weeks of the season, much higher than the 3% at the same time in 2022.

“Traditionally, farmers would plant corn before soybeans in the spring, but that has started to change due to shifting expectations that early planting will help boost yields.”

Reuters writer Naveen Thukral reported today that, “Chicago wheat futures slid on Monday, with prices trading close to last week’s lowest in almost two years, as rain in the U.S. Plains improved the outlook for crops.”

Elsewhere, Bloomberg writer Hallie Gu reported today that, “After more than 30 years growing crops on the plains of northern China, a farmer who asked to be identified as Zhang is struggling over what to plant in the coming months.

President Xi Jinping’s government has just one answer: sow more soy.

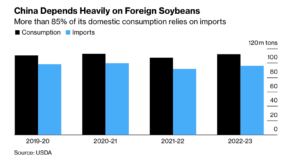

“In the latest drive to bolster food security in a nation that accounts for about one-fifth of humanity but only one-tenth of its arable land, China is pressing farmers to increase soybean production, using a combination of subsidies, government stockpiling and public pressure. Like generations of Chinese leaders before him, Xi sees the country’s reliance on food imports as a national security issue and soy is one of the weakest links.”

The Bloomberg article stated that, “A trade war with the US, as well as disruptions to food supply chains from the Covid-19 pandemic and Russia’s war in Ukraine, mean China is doubling down on efforts to bolster domestic food production.”

“The nation’s low self-sufficiency for a crop used in everything from animal feed to cooking oil is seen as a critical vulnerability, according to the government. In staples like wheat and rice, China is generally able to feed itself, though imports of wheat have been surging,” the Bloomberg article said.

And The Wall Street Journal editorial board indicated yesterday that, “The European Union agreed Friday to exempt Ukrainian crops from tariffs for another year. The tentative deal is welcome news for Ukraine’s battered agricultural industry. But more troubles await as Vladimir Putin continues to disrupt the global food supply.”

The Journal column explained that, “But Russia continues to occupy large swathes of farmland Ukraine, which has become ‘the largest mined territory in the world, surpassing such former frontrunners as Afghanistan and Syria,’ according to a new paper by the Slovakia-based think tank GLOBSEC. Some 50,000 square kilometers of farmland are now unusable, says Ukrainian Agrarian Council’s chairman Andriy Dykun.

“Russia has inflicted some $8.7 billion in harm to Ukraine’s agricultural and land resources, including more than $4.65 billion in damaged and destroyed machinery, according to an April report by the Kyiv School of Economics. The recruitment of working-age men for the military has led to a shortage of farm labor.

“Between the 2021 and 2022 harvest years, Ukraine’s corn production fell 36%, wheat 33% and sunflower 41%, according to GroIntelligence, which tracks agricultural markets. Mykola Solskyi, Ukraine’s minister of agrarian policy and food, says he anticipates another 10% to 15% reduction in corn, wheat and other grains this year. The World Food Programme estimates that more than 345 million people face acute food insecurity and 43.3 million are at serious risk of famine.”