A new 10% tariff on goods from around the world took effect Tuesday — with a list of exemptions including beef. Other exemptions affecting the food and agriculture industries include…

Record U.S. Corn, Soybean Production Expected, as U.S. Wheat “Stockpiles to Fall to 16-Year Low”

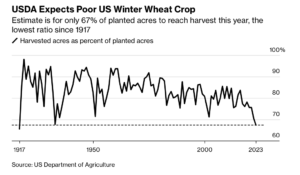

Bloomberg writers Michael Hirtzer and Tarso Veloso Ribeiro reported on Friday that, “America’s wheat fields have become so plagued by drought that farmers are now poised to abandon crops at the highest rate in more than a century.

“Producers are expected to harvest about 67% of their planted acres, the US Department of Agriculture said Friday. If realized, that would be the lowest harvest ratio since 1917, the agency said in a monthly report.

“Years of dry conditions on the US Plains have taken their toll on America’s famed fields of grain. Some wheat plants this season were so stunted by a lack of moisture that they won’t produce so-called heads of grain, leaving little reason to harvest them. Farmers can instead file crop-insurance claims for failed acres, or choose to plant something else.”

United States Winter #Wheat ConditionPercent Rated Good to Excellent, @usda_nass pic.twitter.com/n17lYaB2Ll

— FarmPolicy (@FarmPolicy) May 12, 2023

Hirtzer and Ribeiro explained that, “The USDA forecast that the high rate of abandonment will drag US wheat supplies to lower levels than analysts were expecting. That could keep domestic prices elevated, even with rival producers such as Canada and Argentina likely to boost output.”

Winter #Wheat Yield United States, @usda_nass pic.twitter.com/KKz5jb6Yef

— FarmPolicy (@FarmPolicy) May 12, 2023

The Bloomberg article added that, “Meanwhile, corn production in the US is expected to rise to a record, bringing up global grain supplies and giving relief to livestock producers hit by rising feed costs.”

Reuters writer Mark Weinraub reported late last week that,

U.S. corn and soybean supplies were expected to rise sharply in the coming year due to forecasts for a record harvest for both crops, the government said on Friday, raising the potential for further price declines for both commodities.

“But wheat supplies were seen falling to their lowest in 16 years, as a severe drought in the U.S. Plains wrecked the robust harvest potential from increased acreage.”

U.S. #Wheat Supply and Demand pic.twitter.com/QEPfLaeVj3

— FarmPolicy (@FarmPolicy) May 12, 2023

Weinraub pointed out that, “Corn production will reach 15.265 billion bushels, based on an average yield of 181.5 bushels per acre and soybean production will hit 4.510 billion bushels, with average yields pegged at 52.0 bushels per acre.

U.S. #Corn Supply and Demand pic.twitter.com/hLIUopmAjN

— FarmPolicy (@FarmPolicy) May 12, 2023

“If realized, the corn harvest will top the previous record of 15.148 billion bushels, set in 2016. The current biggest U.S. soybean crop of 4.465 billion bushels was harvested in 2021.”

U.S. #Soybeans Supply and Demand pic.twitter.com/C3VRUjJyEM

— FarmPolicy (@FarmPolicy) May 12, 2023

Dow Jones writer Kirk Maltais reported last week that, “Wheat inventories will likely drop to a 16-year low as a drought in the Southern Plains is expected to take out a sizable chunk production, the U.S. Department of Agriculture said Friday.”

While DTN reported on Friday that, “USDA projects farmers are in the midst of planting the country’s largest corn crop on record at 15.265 billion bushels (bb) and a record soybean crop at 4.51 bb with 2023-24 ‘new-crop’ ending stocks for corn projected at 2.22 bb and soybeans pegged at 335 million bushels (mb).”

Reuters writer Naveen Thukral reported today that, “Chicago soybean futures lost ground on Monday, while corn prices were little changed, with both markets weighed down by a U.S. government forecast for all-time high production.

“Winter wheat climbed almost 1%, adding to last session’s strong gains as expectations of crop losses in the drought-stricken U.S. Plains underpinned prices.”

“U.S. corn and soybean supplies were expected to rise sharply in the coming year due to forecasts for a record harvest for both crops, the USDA said on Friday.”

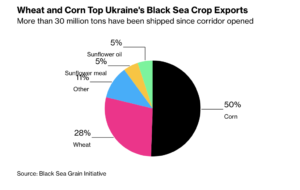

Meanwhile, Bloomberg writer Sophie Caronello reported yesterday that, “Grains prices will once again be a central focus in commodities markets this week after the latest talks to extend Ukraine’s safe-export corridor failed to produce a definitive agreement.”

The @UN brokered Black Sea Initiative to export #Ukraine grain + foodstuffs plus fertilizer exports from #Russia has hit the 30m tonnes mark as negotiations continue on extending the deal - vital for global food securityhttps://t.co/m4TwV3CiXo

— UN News (@UN_News_Centre) May 11, 2023

Caronello noted that, “Wheat and corn futures could be poised for a volatile week as uncertainty looms over the future of Black Sea trade from Ukrainian ports. Negotiations to extend a crucial grain-export accord ended in Istanbul last week without a deal, and Russia has threatened to withdraw from the pact by Thursday — 60 days after the last extension — unless its demands over removing obstacles to its own food and fertilizer trade are met.

“Exports from Ukraine have already slowed significantly due to repeated disruptions to vessel inspections through the crop corridor. Parts of eastern Europe have also set fresh restrictions on Ukrainian imports as they argued the influx was hurting local farmers.”