As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Dryness Concerns Impact Corn Price, as China is “Actively Seeking to Add New Suppliers of Corn”

Reuters writer Julie Ingwersen reported yesterday that, “U.S. corn futures rose to a nearly two-month high on Monday as traders fretted about disappointing weekend rains and dry conditions stressing crops in portions of the Midwest crop belt, analysts said.”

30- Day Percent of Normal Precipitation pic.twitter.com/riEsJbzZG2

— FarmPolicy (@FarmPolicy) June 12, 2023

“Chicago Board of Trade July corn settled up 13 cents at $6.17-1/4 per bushel after reaching $6.23-3/4, its highest since April 21.”

Month To Date Observed Precipitation pic.twitter.com/XEQe96tqWP

— FarmPolicy (@FarmPolicy) June 12, 2023

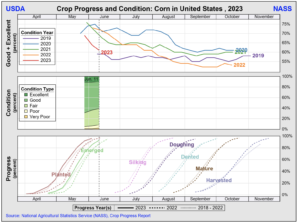

Ingwersen explained that, “Crop weather and dry soils in portions of the Midwest remained the focus. After the CBOT close, the U.S. Department of Agriculture (USDA) rated 61% of the U.S. corn crop in good to excellent condition, down 3 percentage points from a week ago and below the average of estimates in a Reuters poll.

“The USDA also lowered its U.S. soybean crop rating by 3 percentage points to 59% good to excellent, below the average analyst estimate of 60%.”

.@usda_oce Wx: Corn Belt- - - During the weekend, hit-or-miss showers locally boosted topsoil moisture but left some areas still in need of rain.

— FarmPolicy (@FarmPolicy) June 12, 2023

Also yesterday, Dow Jones writer Kirk Maltais reported that, “Corn was driven by the expectation that a drier outlook for weather in the U.S. will negatively impact the new crop – with planting essentially completed.”

Maltais added that, “Conditions in the western Corn Belt have been afflicted by drought conditions all spring, but farmers in the eastern Corn Belt are struggling with drying soil moisture as well.”

Approximately 45% of #corn production is within an area experiencing #drought. pic.twitter.com/MBCPgsXiJW

— FarmPolicy (@FarmPolicy) June 11, 2023

Today, Reuters writer Matthew Chye reported that, “U.S. corn futures edged lower on Tuesday as traders locked in profits after a recent rally, following concerns over crop stress amid dry conditions in the U.S. midwest crop belt.”

Chye noted that, “Looking forward, the corn market should also see residual support from the stalemate in extending the Black Sea grain corridor and from pockets of dryness in Europe, the note [from commodities research firm Hightower] added.

“Brazilian farmers have harvested through last Thursday 2.2% of the area planted for their second corn crop in the center-south region, agribusiness consultancy AgRural said on Monday, up 0.8 percentage points from the previous week.”

Elsewhere, Dow Jones writer Kirk Maltais reported yesterday that, “Inspections of U.S. grain exports continue to trend lower from previous weeks, the U.S. Department of Agriculture reported.

“In its latest grain export inspections report for the week ended June 1, the USDA said corn export inspections totaled 1.17 million metric tons, soybean inspections totaled 140,179 tons, and wheat inspections totaled 246,559 tons. All three of these totals were slightly down from last week’s figures.”

And Reuters writer Pavel Polityuk reported yesterday that, “Ukraine’s grain exports for the 2022/23 season stood at 46.7 million tonnes as of June 12, Agriculture Ministry data showed on Monday.

“The ministry didn’t give an exact comparison for the same date a year ago but said Ukraine had exported 47.8 million tonnes of grain as of June 17, 2022.”

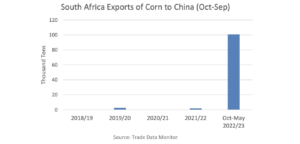

In a closer look at corn trade variables, in its monthly Grain: World Markets and Trade report from Friday, the USDA’s Foreign Agricultural Service (FAS) indicated that, “Since the start of 2023, South Africa has exported more than 100,000 tons of corn to China, the largest amount from Africa’s leading corn producer since the signing of an export protocol in 2014. Ample exportable supplies in South Africa and a continued decline in the South African Rand (ZAR) have timed well with sustained demand in China.”

FAS stated that, “Relative to the size of China’s demand, recent purchases of a little more than 100,000 tons of yellow corn are small.

However, China is actively seeking to add new suppliers of corn in part due to the ongoing war in Ukraine and uncompetitive prices out of its chief supplier, the United States.

“Burma, an exporter of comparable size to South Africa, received phytosanitary permissions from China on February 18, 2022, enabling cross-border corn trade to begin. The first shipment recorded in 2022 was only 16,000 tons. However, marketing year-to-date China Customs data reports corn imports from Burma of more than 300,000 tons – a volume higher than its previous 3 years of exports without the phytosanitary protocol combined. South Africa could similarly benefit from renewed interest in this partnership.”