A prolonged military conflict in the Middle East could potentially upend key commodity markets due to Iran’s control of the Strait of Hormuz, one of the world’s most important trade…

Global Wheat Production Forecast at a Record

In its monthly Wheat Outlook report this week, the USDA’s Economic Research Service indicated that, “Global wheat production is forecast at a record 800.2 million metric tons (MMT), up 10.4 MMT from the May forecast. The European Union is currently forecast as the top wheat producer at 140.5 MMT, up 1.5 MMT on favorable growing conditions in France, Hungary, and Italy. While China and India are the second and third leading producers, production in those countries is largely unavailable to the global market.

“China’s production forecast is unchanged at 140.0 MMT and India is raised 3.5 MMT to 113.5 MMT. Russia and Southern Ukraine received beneficial spring precipitation boosting yields. Russia is forecast up 3.5 MMT to 85.0 MMT which is down 7.0 MMT from last year’s record 92.0 MMT. Ukraine is up 1.0 MMT from the May forecast to 17.5 MMT. The increase in global production supports higher consumption, increased trade, and larger ending stocks.”

#Wheat Production, June pic.twitter.com/heYT3Qu4pR

— FarmPolicy (@FarmPolicy) June 13, 2023

ERS added that, “U.S. wheat production for the 2023/24 marketing year is forecast at 1,665 million bushels, up 6 million from the May estimate and less than 1 percent above the previous year.”

U.S. #Wheat Supply and Demand pic.twitter.com/H1BqV02S1z

— FarmPolicy (@FarmPolicy) June 9, 2023

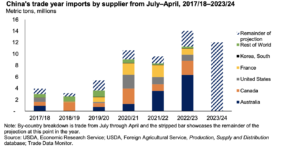

Tuesday’s report also explained that, “In 2022/23, China remains the top wheat importer and is projected to import 14.0 MMT of wheat in the July/June TY largely from Australia. China has imported over 1.0 MMT each month since October with April exports at a record 1.7 MMT. Australia’s record crop in 2022/23 placed it in a key position to supply China’s needs along with Canada. Rains at harvest time resulted in a higher proportion of feed-quality wheat for Australia. As a result, China’s feed and residual use is estimated at 33.0 MMT.

“Torrential rains swept through China’s Henan Province during winter harvest resulting in a decline in wheat quality for its 2023/24 wheat crop, projected at a record 140.0 MMT. As a result of more feed-quality wheat expected in China, feed and residual is forecast up 2.0 MMT to 34.0 MMT. While China imported wheat dominantly for feeding in 2022/23, this could shift its need to milling wheat in 2023/24. China’s TY imports are forecast up 1.5 MMT to 12.0 MMT. If realized, it will be the top wheat importer for the second consecutive year.”

Dow Jones writer Kirk Maltais reported yesterday that, “The support grain futures have gotten from predictions for dry weather in growing areas appears to be leveling off today, with traders reacting to a shift towards a wetter forecast by selling.”

Maltais noted that, “The effect of dry weather may only be limited, with traders generally mired in malaise as demand for U.S. grain exports stays flat.”

And today, Dow Jones writer Yusuf Khan reported that, “Rising food costs and lower purchasing power is pushing consumers in lower-income countries to consume less food, with imports expected to fall in 2023, according to the United Nations.

“Food imports are expected to fall by 1.5% this year in the group of Least Developed Countries, according to a new report from the UN’s Food and Agriculture Organization. For net food-importing developing countries, or NFIDCs, imports are seen declining by 4.9%.”

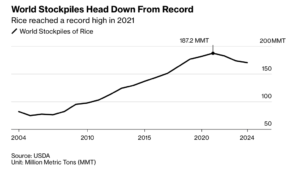

Meanwhile, Bloomberg writer Napat Kongsawad reported yesterday that, “The world is awash in rice with global stockpiles at close to record levels. El Niño’s arrival will put those reserves to the test.”

The Bloomberg article pointed out that, “Historically, rice yields have been lower during El Niño years, and in some cases, much less. Last week, the US announced the official arrival of the weather phenomenon, with a high chance of it exceeding moderate strength. The stronger the current cycle is, the more likely rice supplies will be affected.”

Also yesterday, Reuters writer Pavel Polityuk reported that,

Ukraine’s agricultural sector could take 20 years or more in parts to recover from the ravages of Russia’s full-scale invasion, according to a Kyiv-based research centre.

And in news regarding China, John Hudson reported in today’s Washington Post that, “Secretary of State Antony Blinken will travel to China this week in a sign that relations between Beijing and Washington are improving after a massive feud erupted in February with the downing of a suspected Chinese surveillance balloon that breached U.S. airspace and loitered near sensitive military sites as it traversed much of the country.

On June 14, State Councilor and Foreign Minister Qin Gang spoke with Secretary Blinken on the phone. Secretary Blinken will visit China from June 18 to 19. pic.twitter.com/pPzrGNJm8e

— Xie Feng 谢锋 (@AmbXieFeng) June 15, 2023

“The top U.S. diplomat is planning to meet with Foreign Minister Qin Gang and potentially President Xi Jinping as part of a months long effort to reopen lines of communication between the world’s two largest economies amid historically poor relations.”