Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Wheat Falls as “Solidarity Lanes” Warrant Focus, and U.S. Corn, Soybeans in Drought Climb This Week

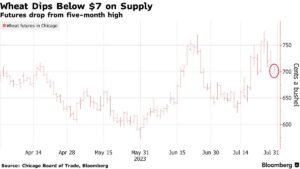

Bloomberg writer James Poole reported today that, “Wheat fell for a third day from the highest close in five months as the outlook for ample near-term supplies outweighed concerns over the impact of Russian attacks on Ukrainian port facilities.

“Prices of the food staple are now only up about 1% for the week, relinquishing most of the 8.6% jump on Monday. Russia has attacked port infrastructure in the Odesa region and a port on the Danube river since pulling out of the agreement allowing Ukrainian crop exports through the Black Sea on July 17.

“While the Russian actions are likely to further restrict exports from Ukraine, Russia itself is shipping huge volumes to world markets. The country could export as much as 60 million tons of grain in the new season, according to Russian Grain Union President Arkady Zlochevsky, citing another record crop.”

Also with respect to Russian exports, Bloomberg writer Aine Quinn reported yesterday that, “Russian President Vladimir Putin promised to send free grain to six African countries that have strong ties with Moscow.”

“Putin pledged 25,000-50,000 tons of grain each to Burkina Faso, Zimbabwe, Mali, Somalia, Central African Republic and Eritrea. Most of those nations have refrained from criticizing Putin’s invasion of Ukraine. The shipments would make up a significant chunk of imports for the likes of Zimbabwe and Eritrea, but a tiny portion of Russia’s sales,” the article said.

And Reuters News reported today that, “Russia will get buyers of its farm exports to pay in roubles rather than dollars as a way to circumvent western sanctions, Deputy Prime Minister Viktoria Abramchenko said on Friday.”

“Moscow has long demanded that its state agricultural bank be reconnected to the international SWIFT bank payments network from which it was shut off after Russia invaded Ukraine last year. Its failure to get reinstated was one of the reasons why Russia last week quit the Black Sea deal for Ukrainian grain,” the article said.

In a closer look at Ukrainian grain exports, an update yesterday from the Agricultural Market Information System (“Grain markets situation amid Black Sea trade disruptions“) explained that, “The Black Sea Grain Initiative allowed Ukraine to export close to 33 million tonnes of grains and other agricultural products, helping to sustain the country’s farming sector and lower international food prices.

In the absence of the Black Sea corridor, barge shipments and overland exports via truck and rail are the only viable alternatives for Ukraine’s grain exports.

“Indeed, thanks to significant investment and support especially of the European Union these so-called ‘Solidarity Lanes‘ were able to sustain monthly shipments of up to 2.5 million tonnes.

“However, the Solidarity Lanes also caused political backlash, especially in Ukraine’s neighboring countries where farmers complained about price pressures due to the influx of Ukrainian grain. To address these concerns, the European Union reached an agreement with Ukraine to not sell its grain in those markets, which is currently scheduled to expire on 15 September. However, even with this agreement in place, Ukrainian exports are competing for trucks, railcars, barges, and port facilities, leading to higher transportation costs for all EU grain producers in the region.

“The ongoing EU negotiations on grain transit through member states therefore need to be closely monitored as any obstruction to the Solidarity Lanes would further weaken Ukraine’s export capacity.”

Meanwhile, Reuters writers Julia Payne and Max Hunder reported yesterday that, “The European Commission has no immediate money in the budget and no clear way to help finance the extra transport costs Ukrainian grain exports will face with the end of the Black Sea deal, sources told Reuters, leaving an opportunity for Moscow to cash in.”

And a separate Reuters article from yesterday indicated that, “Moldova’s main farmers union asked the government on Thursday to create a fast-track customs lane for grain and oilseed exports, citing concern that their business could be hurt by the growing use of the country for transiting agricultural products from Ukraine.

“Despite political pressure from farmers who have staged protests, Moldova is allowing grain imports from neighbouring Ukraine, which has lost its traditional Black Sea export route during Russia’s invasion.

“Most of the arriving volumes transit towards Romania, and Moldovan farmers have warned of the risk of a shortage of storage capacity for its 2023 grain harvest due to the imports from Ukraine.”

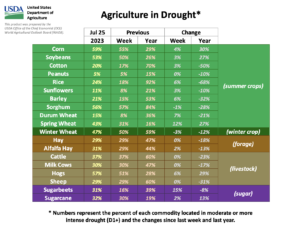

Elsewhere, in U.S. related news, Reuters writer Tom Polansek reported yesterday that, “Spring wheat yields in North Dakota, the top-producing state, will exceed the five-year average but fall short of last year as farmers grapple with an expanding drought, scouts on an annual crop tour said on Thursday.

30- Day Departure From Normal Precipitation pic.twitter.com/R82fuABf7N

— FarmPolicy (@FarmPolicy) July 27, 2023

“The Wheat Quality Council tour predicted an average yield of 47.4 bushels per acre, compared to the tour’s five-year average of 40.1 bushels and the 2022 tour’s estimate for 49.1 bushels.”

Also with respect to the U.S., Dow Jones writer Kirk Maltais reported yesterday that, “Thursday’s update of the U.S. Drought Monitor map showed a mixed array of effects on the Corn Belt, with Missouri receiving enough rain to break a pocket of extreme and exceptional drought while the severity of drought ramps up in Minnesota and Wisconsin.

“Hot and dry conditions are expected in most of the country over the next five to seven days, and grain traders are attempting to understand what that might mean for crop yields.”