Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Despite Russian Attacks on Danube, Romania Seeks to Double Alternative Shipping Capacity, as “Russia Squeezes Ukraine’s Ability to Export” Grain

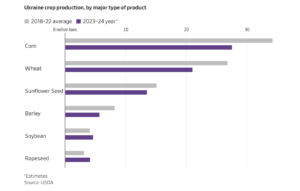

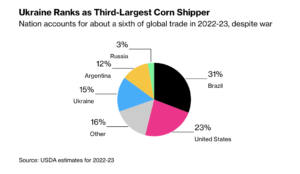

Alistair MacDonald and Oksana Pyrozhok reported on Saturday at The Wall Street Journal Online that, “As Russia squeezes Ukraine’s ability to export its huge grain harvests, it is farmers like Valery Kolosha who are counting the cost.

“Russia last month pulled out of an international agreement that facilitated Ukrainian exports via the Black Sea and has since launched a series of attacks on port facilities in the country. Together, those actions have hindered the exit points for three-quarters of Ukraine’s grain.

“At the sharp end of these moves are Ukrainian farmers, whose tough lot just got harder. Kolosha says he now can’t sell his grains and will struggle to break even this year, as his transport costs rise and his income falls.”

The Journal article pointed out that, “Ukrainian farmers currently get paid up to about $160 a metric ton for wheat they deliver to ports on the Danube River, less than before the deal collapsed, analysts say. Just across that same river, Romanian farmers can get around $215 a metric ton for wheat.

‘Today, the market is dead…I am just trying to keep my head above water,’ said Kolosha, who farms in Ukraine’s Chernihiv region, northeast of Kyiv.

MacDonald and Pyrozhok explained that, “This season, Ukraine is set to export around 57 million metric tons of grains and edible oils, according to the Ukrainian Grain Association. Ukraine’s land borders with the EU only have capacity to export 15 million to 16 million tons a year, meaning the country’s Danube ports will have to handle the rest without an improvement in capacity at land borders, the UGA said. Around half of Ukraine’s grain exports, or some 29 million metric tons, went out via the Black Sea corridor during the last harvest season of 2022 to 2023, according to the association.”

“The cost of exporting grains over land or via the Danube is typically far greater than going out via the Black Sea, according to the UGA. Last November, it cost around $29 a ton to ship grain from central Ukraine out via the Black Sea but $124 a ton from Danube ports, the UGA said. Around the same time, it cost $140 a ton to export over land and out of the Polish port of Gdansk,” the Journal article said.

Today is the 8th attack on 🇺🇦port infrastructure since russia has withdrawn from the #BSGI. 270K tonnes of grain have been destroyed so far.

— Oleksandr Kubrakov (@OlKubrakov) August 23, 2023

Tonight several private grain terminals & storage facilities, cargo infrastructure, 13K tons of grain intended for shipment to Egypt &… pic.twitter.com/IjhFJ8bo9D

On Friday, Bloomberg writers Aine Quinn and Megan Durisin reported that, “Russia’s efforts to obstruct Ukraine’s food exports are working. First, Moscow quit a pact that had allowed safe passage of crops from Black Sea ports. Then it sent drones to bombard grain terminals along the Danube river — the next most important shipping route. Ukrainian farmers worried their grain wouldn’t find its way to foreign buyers now plan to plant less for the next season, and that’s stoking worries about global supplies.”

Meanwhile, Marton Dunai reported on Saturday at The Financial Times Online that, “Romania will double the capacity of its main Black sea port and Danube shipping lanes within two months to help Ukraine ship its grain out of Russia’s reach, according to the country’s prime minister.

“Marcel Ciolacu told the Financial Times his plan would be implemented irrespective of Russian attacks on Ukrainian ports on the other side of the Danube river on the border with Romania.

“‘Ukraine will have about 40mn tons of grain for export in 2023,’ Ciolacu said. ‘In order to [facilitate] that, we have increased the capacity both in Constanța harbour and the pathways leading to Constanța harbour to make this happen. We mobilised to the best that we could.'”

The FT article indicated that, “In his first interview with international media since becoming prime minister in June, Ciolacu said Bucharest would not be intimidated by Moscow and expressed confidence that his country’s Nato membership would deter Russia from any direct hostilities.”

Reuters writer Manoj Kumar reported on Saturday that, “A senior European Union official urged Russia on Saturday to renew a deal to allow the safe export of Ukrainian grain through Black Sea ports, after Russia quit the agreement last month.

“European Commission Executive Vice President Valdis Dombrovskis said Russian restrictions on shipping of Ukrainian grains via the Black Sea were creating problems not only for Kyiv but for many developing countries as well.”

On Friday, Reuters News reported that, “The United States sees viable routes to export Ukrainian grain through the country’s territorial waters and overland after Russia withdrew from the grain deal, a senior U.S. official said, adding that they aim to return to exporting at prewar averages from Ukraine over the next months.

“‘I think we see there are viable routes through Ukraine’s territorial waters and overland, and we are aiming … over the next couple of months to return to exporting at kind of prewar averages from Ukraine,’ James O’Brien, head of the State Department’s Office of Sanctions Coordination, told Reuters in an interview.”

The article added that, “A senior agricultural official said on Monday that Ukraine is considering using its newly tested wartime Black Sea export corridor for grain shipments after other cargo ships follow the first successful evacuation of a vessel on the route last week.”

Reuters also reported on Friday that, “Russian President Vladimir Putin is expected to hold talks in person with Turkey’s President Tayyip Erdogan soon, the Kremlin said on Friday, as Ankara attempts to persuade Moscow to return to the Black Sea grain deal.”