As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Federal Reserve Ag Credit Surveys- 2023 Second Quarter

Yesterday, the Federal Reserve Banks of Chicago and Kansas City released updates regarding farm income, farmland values and agricultural credit conditions from the second quarter of 2023. The Federal Reserve Bank of Dallas released its Agricultural Survey for the second quarter in July.

Federal Reserve Bank of Chicago

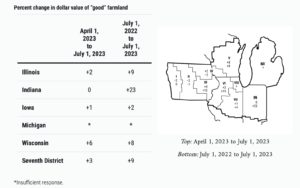

David Oppedahl, a Policy Advisor at the Chicago Fed, explained in the AgLetter that, “At 9 percent, the year-over-year increase in District farmland values for the second quarter of 2023 was nearly as large as that for the first quarter. However, the second quarter marked the first time that the year-over-year percent gain in District farmland values had dipped into single digits since the first quarter of 2021. Once again, Indiana exhibited the largest year-over-year increase in agricultural land values; Illinois, Iowa, and Wisconsin exhibited more modest year-over-year gains than Indiana, having tailed off from their stronger gains of previous recent quarters. ‘Good’ farmland values in the District increased 3 percent in the second quarter of 2023 relative to the first quarter.”

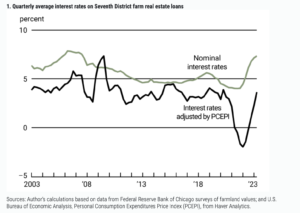

The AgLetter stated that, “On the whole, agricultural credit conditions in the second quarter of 2023 improved from a year ago yet again, although interest rates on farm loans continued to move up. As of July 1, 2023, the District’s average nominal interest rates on new operating loans (8.24 percent), feeder cattle loans (8.19 percent), and farm real estate loans (7.33 percent) were at their highest levels since the third quarter of 2007. In real terms (after being adjusted for inflation with the Personal Consumption Expenditures Price Index), these agricultural interest rates increased rapidly during the second quarter of 2023, as inflation decreased. The average real interest rate for farm real estate loans continued to rise more sharply in the second quarter of 2023 than the average nominal interest rate—in line with the pattern that began in the third quarter of 2022; the average real interest rates on farm operating and feeder cattle loans followed similar patterns.”

Mr. Oppedahl added that, “A majority of survey respondents were of the view that District farmland was overvalued (only a single respondent was of the view that it was undervalued). Looking ahead to the third quarter of 2023, just 9 percent of survey respondents anticipated farmland values to rise, 86 percent anticipated them to be stable, and 5 percent anticipated them to fall.”

Federal Reserve Bank of Kansas City

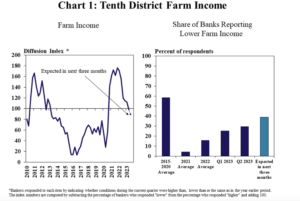

Cortney Cowley and Ty Kreitman, writing in yesterday’s Ag Credit Survey from the Kansas City Fed, noted that, “Agricultural credit conditions in the Tenth District moderated in the second quarter and farmland values continued to increase. Following multiple years of considerable improvement, farm income softened, and borrower liquidity retracted somewhat alongside continued cost pressures and lower prices for most agricultural commodities compared to a year ago. Although cost increases have been more modest in 2023 than last year, many agricultural lenders expected loan demand to increase and repayment rates to decline in coming months.

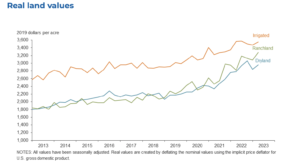

Despite sharp increases in interest rates and a notable slowdown in cash rents, farmland values still grew at a strong pace.

The Ag Credit Survey indicated that, “Farm incomes in the Tenth District have moderated alongside more tempered conditions in the agricultural economy. The changes in farm income across the region were flat in the second quarter following two years of considerable strength.”

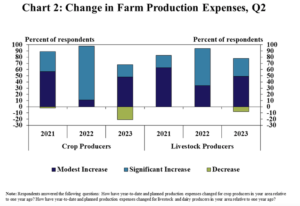

The Survey added that, “Income growth has flattened alongside elevated production expenses, but cost pressures showed signs of easing. Well over half of respondents reported that production expenses for all types of producers continued to increase, but the degree of increase was notably more modest than last year.”

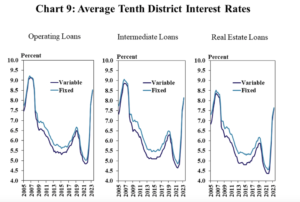

With respect to interest rates, the Kansas City Fed noted that, “Average interest rates increased from the previous quarter alongside further increases in the federal funds rate, and the spread between variable and fixed rates narrowed. In the second quarter, interest rates on operating and intermediate loans increased by about 40 basis points from the previous quarter, and rates on real estate loans were more than three percentage points higher than in 2021.”

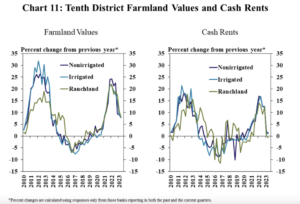

In a closer look at farmland values, Cowley and Kreitman indicated that, “Growth in farm real estate values remained relatively strong despite the rapid rise in interest rates and some moderation in the farm economy. Values for all types of farmland grew by almost 8 percent in the second quarter.

“Although the average rate of growth for nonirrigated cropland declined from more than 20 percent a year earlier, continued strength in farmland markets has occurred alongside more pronounced softening in cash rents. Cash rents for ranchland declined slightly for the first time since 2020 in the second quarter, and rents for cropland increased by only 1 percent.”

Federal Reserve Bank of Dallas

Last month, in its Agricultural Survey, the Dallas Fed noted that, “Bankers responding to the second-quarter survey reported overall better conditions across most regions of the Eleventh District.”

The Survey added that, “Ranchland, irrigated cropland and dryland values increased this quarter. According to bankers who responded in both this quarter and second quarter 2022, ranchland, irrigated cropland and dryland values rose at least 5 percent year over year in Texas, with cropland seeing much higher increases.

“The anticipated trend in farmland values index slipped into negative territory, suggesting respondents expect farmland values to fall.”