Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

Kansas City Fed: Farmland Values Remain Strong, as Interest Rates Climb and Farm Income Tempers

In a recent update from the Federal Reserve Bank of Kansas City (“Farmland Values Stay Resilient as Farm Economy Moderates“), Francisco Scott and Ty Kreitman indicated that, “Strength in farm real estate values persisted in the second quarter despite some moderation in the farm economy and higher interest rates.

Growth in farmland values eased from the surge of recent years, but remained strong through the first half of 2022.

Scott and Kreitman noted that, “Farm income moderated in all the participating Districts during the second quarter. Following nearly two years of considerable strength, improvement in farm income waned according to Federal Reserve Surveys of Agricultural Credit Conditions.”

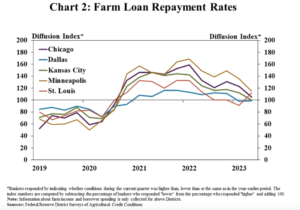

“Improvement in farm loan performance also softened alongside a moderation in farm income,” the update said.

The Kanas City Fed also pointed out that, “Loan demand remained soft for many lenders alongside a rise in farm loan interest rates. The average fixed interest rate on farm loans across all regions was above 8%, a 30 basis point increase from the previous quarter.”

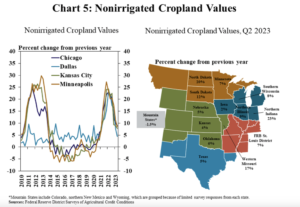

Scott and Kreitman added that, “Farm real estate markets remained resilient despite moderation in the farm economy and higher interest rates. The value of nonirrigated cropland increased from a year ago by an average of about 7% in all participating regions.

“Growth in land values has eased from recent years, but remained steady in most states and considerably stronger in some areas.”