The world's farmers face soaring fertilizer and fuel prices as the war in the Middle East escalates, leaving some scrambling for supplies as the spring planting season approaches and causing…

Russian Drones Again Target Port Infrastructure in Danube River Area, as China Soybean Demand in Focus

Reuters writer Pavel Polityuk reported today that, “Russia targeted Ukrainian ports in the southern Odesa region and the Danube River area in overnight drone attacks, setting at least one grain storage facility on fire, Ukraine’s military and local authorities said on Wednesday.

“The attacks were the Russia’s latest on port infrastructure on the Danube, which Ukraine uses to move grain to the Romanian port of Constanta, since Moscow quit a U.N.-brokered deal that allowed Kyiv to ship grain via the Black Sea.

‘The enemy hit grain storage facilities and a production and transhipment complex in the Danube region. A fire broke out in the warehouses and was quickly contained. Firefighters continue to work,’ the Ukrainian military said in a post on the Telegram messaging app.

Today’s article pointed out that, “An industry source told Reuters that Ukrainian Danube ports were the main targets. Ukraine operates two major ports on Danube – Izmail and Reni.”

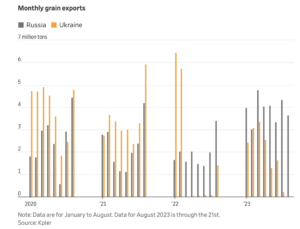

Also today, Bloomberg writers Megan Durisin and Kateryna Choursina reported that, “River channels have become increasingly important to shipping [Ukraine’s] crops following the collapse of the Black Sea pact last month. More than 60% of Ukraine’s crop exports are now flowing via the Danube, with rail and trucks accounting for most of the rest, according to a UkrAgroConsult report.

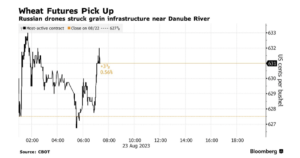

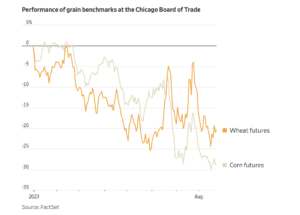

“Wheat futures in Chicago rose 0.6%, heading for a second daily gain. Still, large crops in other major shippers — including Russia itself— have pressured the market this year, with prices down about 20% since the end of December.”

Wall Street Journal writers Anna Hirtenstein and Jared Malsin reported today that, “Kyiv is devising a plan with global insurers to reopen a crucial grain-export route for vessels navigating the Black Sea, a shipping lane blockaded by Russia for the past month.”

“Ukrainian officials are now in discussions with global insurance firms and commodity traders to create a government-backed program to enable ships to travel to Ukraine’s ports, according to Marcus Baker, head of marine, cargo and logistics at brokerage Marsh, and other people who participated in the talks.”

The Journal article added that, “Turkish President Recep Tayyip Erdogan said Monday that he could meet Russian President Vladimir Putin in September to discuss a possible resumption of the agreement.”

Lynsey Chutel reported yesterday at The New York Times Online that, “President Vladimir V. Putin did not travel to South Africa for the gathering of the five-member group of nations known as BRICS because he is wanted by an international court on accusations of war crimes, but he sent a prerecorded speech that seemed to be aimed at blaming the West for the global grain shortages that his 18-month-old invasion of Ukraine has caused.”

Niki Kitsantonis and Paul Sonne reported in yesterday’s New York Times that, “In Athens on Monday, with Russian hostilities disrupting Ukrainian grain exports to hungry nations, [President Volodymyr Zelensky of Ukraine] also asked Greece for help transferring agricultural products from Black Sea ports. Prime Minister Mitsotakis said that Greek ships were already carrying more than 50 percent of Ukrainian grain exports.”

Also yesterday, Reuters News reported that, “The European Commission’s decision to compensate for the costs of delivering Ukrainian grain to European seaports will improve the ability to export Ukrainian food without interruption, a senior Ukrainian official said on Tuesday.”

The article pointed out that, “Sources told Reuters that the European Commission had no immediate funds in the budget and no clear way to help finance the extra transport costs Ukrainian grain exports will face with the end of the Black Sea deal.”

Reuters writer Pavel Polityuk reported today that, “Ukraine’s grain exports have reached 3.83 million metric tons so far in the 2023/24 July-June season, Agriculture Ministry data showed on Wednesday.

“The ministry gave no comparative figures for the same period a year earlier, but said shipments stood at 3.3 million tons as of Aug. 25, 2022.”

Meanwhile, Bloomberg writer Gerson Freitas Jr. reported yesterday that, “Chinese soybean demand growth is expected to wane in the next few years amid slower population growth and a change in the nation’s consuming habits, according to meat producer Wellhope Foods Co.

“Soybean purchases by the world’s largest importer should stabilize at roughly 100 million metric tons at least for the next five years, Vice President Sun Lige said in an interview during a US Soybean Export Council conference in New York. That’s 1 million metric tons more than the US Department of Agriculture’s projection for the 2023-24 season.”

The Bloomberg article stated that, “Chinese imports of soybean, a key ingredient to animal feed, soared roughly fivefold since the early 2000s as rapid economic growth created an expanding middle class that can afford more protein in their diets. But China’s $18 trillion economy is now slowing, with JPMorgan Chase & Co., Barclays Plc and Morgan Stanley downgrading their projections for economic growth this year to below the government’s 5% target.”

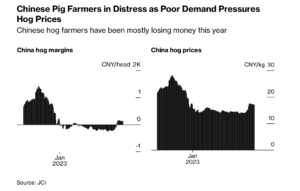

A separate Bloomberg article from yesterday reported that, “The reopening of the [Chinese] economy after the government’s stringent measures to control the pandemic didn’t quite deliver the celebratory feasting on China’s favorite meat [pork] that many had expected. Instead, households conserved cash as economic uncertainties mounted.”

“The disappointing recovery has left pig farmers mostly loss-making for the year, and the pork market in surplus,” the article said.