Bloomberg's Clarice Couto reported this past Friday that "a surprising tax change in agriculture powerhouse Brazil has the potential to make soy grown in the world’s largest bean exporter less…

Second Ship Sails From Odesa Through Black Sea “Humanitarian Corridor,” While China Economic News in Focus

Reuters writer Dan Peleschuk reported yesterday that, “A vessel carrying steel products to Africa has left Ukraine’s Odesa port through a temporary Black Sea corridor, the second ship to do so since Russia withdrew last month from a U.N.-brokered deal that allowed for grain to be safely exported, a senior Ukrainian government official said on Sunday.

“Deputy Prime Minister Oleksandr Kubrakov said the Liberian-flagged ship PRIMUS had begun sailing through a temporary corridor set up for civilian vessels, confirming a report on Saturday by a Ukrainian lawmaker.

The 2nd vessel blocked due to the war has left the port of Odesa and is now sailing through a temporary corridor.

— Oleksandr Kubrakov (@OlKubrakov) August 27, 2023

The Liberian-flagged bulk carrier PRIMUS of a Singaporean operator has left the port of Odesa and is sailing through the temporary corridor established for civilian…

The Reuters article pointed out that, “Russia threatened to treat all vessels as potential military targets after pulling out of the deal last month.

“In response, Ukraine announced a ‘humanitarian corridor’ hugging the western Black Sea coast near Romania and Bulgaria.”

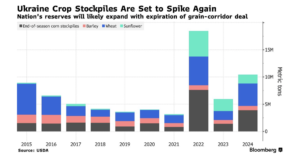

Also yesterday, Bloomberg writer Sophie Caronello reported that, “With fewer routes to the market — and many of those under threat amid the ongoing war with Russia — Ukraine’s grain stockpiles are expected to swell through next year, according to the US Department of Agriculture. Shipments that do succeed are facing delays and higher transport costs, adding further risks to a key component of its economy. On the flip side, Russia continues to benefit from Ukraine’s weakness: exports are booming and are expected to make up nearly a quarter of global wheat trade in the 2023-24 season.”

Meanwhile, Lydia DePillis reported in today’s New York Times that, “The news about China’s economy over the past few weeks has been daunting, to put it mildly.

“The country’s growth has fallen from its usual brisk 8 percent annual pace to more like 3 percent. Real estate companies are imploding after a decade of overbuilding. And China’s citizens, frustrated by lengthy coronavirus lockdowns and losing confidence in the government, haven’t been able to consume their way out of the country’s pandemic-era malaise.”

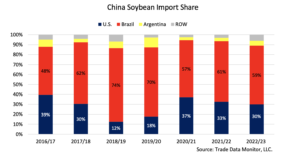

DePillis explained that, “American businesses have long sought to further develop the Chinese market, especially for agricultural products such as pork and rice, but success has been underwhelming. In 2018, the Trump administration negotiated a compact under which China would buy billions more dollars in products from U.S. farmers.

“Those targets were never met. With appetite fading in China, they may never be. That could mean lower food prices globally, but farmers would be hurt.”

Also in today’s New York Times, Ana Swanson, Alan Rappeport and Keith Bradsher reported that, “Gina Raimondo, the secretary of commerce, began meeting Chinese officials on Monday as the latest Biden administration emissary seeking to stabilize ties between the world’s two largest economies. In working toward that goal, she has a lot of ground to cover.

“During meetings with government officials and business leaders in Beijing and Shanghai this week, Ms. Raimondo is expected to tackle a range of challenging issues in the U.S.-China relationship, from explaining the controls the United States is rolling out on China’s access to advanced chips and other technology, to promoting ties in less sensitive areas.”

Welcome to China @SecRaimondo ! @CommerceGov pic.twitter.com/eEGaywM3QU

— Ambassador Nicholas Burns (@USAmbChina) August 27, 2023

Today’s article added that, “Despite a chillier atmosphere, Ms. Raimondo and other officials insist that there is still plenty of potential for trade between the world’s two largest economies. China remains America’s third-largest export market, buying more than $150 billion of products from U.S. farms and businesses.”

Recall that earlier this month, the USDA’s Foreign Agricultural Service indicated that, “This month, USDA raised 2022/23 (Oct-Sep) China soybean imports to a new record of 100.0 million tons. Imports are expected to remain high in the last quarter of the year as the world’s top buyer sources competitively-priced soybeans from South America as well as clears the customs backlog of cargoes that have already arrived.”

And Financial Times writers Aime Williams and Joe Leahy reported yesterday that, “Raimondo, the fourth senior Biden administration official to visit Beijing this summer, said she would stress that the US did not want to ‘decouple’ from China’s economy. But she insisted protecting national security was ‘the top priority, period.'”

Top 10 U.S. export🚢 markets for #soybeans, by volume, https://t.co/uLkBR0QRB2

— FarmPolicy (@FarmPolicy) August 11, 2023

* #China🇨🇳 pic.twitter.com/CmgZ0Khopk

Elsewhere, Reuters writer Dominique Patton reported today that, “China’s sow herd in July fell 0.6% against the prior month to 42.71 million, according to data published by the Ministry of Agriculture and Rural Affairs on Monday.”

“The number of pigs slaughtered at big facilities was 26.7% higher in July than a year earlier,” the article said.