Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

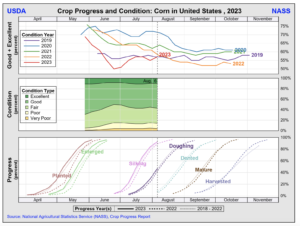

U.S. Corn, Soybean Conditions Climb Two Percentage Points Each

DTN Managing Editor Anthony Greder reported yesterday that, “Beneficial widespread rains this past weekend and a break from the extreme heat across much of the country helped corn and soybean conditions rebound from the previous week, USDA NASS reported in its weekly Crop Progress report on Monday.

Month To Date Observed Precipitation pic.twitter.com/1m8CDnU6HH

— FarmPolicy (@FarmPolicy) August 7, 2023

Greder noted that, “Nationally, corn was rated 57% good to excellent, up 2 percentage points from 55% the previous week but still slightly below 58% a year ago at this time. ‘Illinois and Iowa are rated 58% and 59% good to excellent, respectively,’ said DTN Senior Analyst Dana Mantini.”

The DTN article added that, “Soybeans were rated 54% good to excellent as of Sunday, up 2 percentage points from 52% last week but still below 59% a year ago at this time. ‘Illinois and Iowa soybeans are rated 58% and 53% good to excellent, respectively,’ Mantini said.”

Yesterday’s article added that, “‘We saw some good rainfall over a lot of the country over the past weekend with a system that moved through, and that burst of energy is really opening the door up for a much more beneficial weather pattern across most of the primary agricultural areas for the next two weeks,” [DTN Ag Meteorologist John Baranick] said.”

#Illinois topsoil moisture pic.twitter.com/UkDfJBXyFU

— FarmPolicy (@FarmPolicy) August 7, 2023

30- Day Departure From Normal Precipitation pic.twitter.com/5FQs245zib

— FarmPolicy (@FarmPolicy) August 7, 2023

Reuters writer Naveen Thukral reported today that, “Chicago soybean and corn futures lost more ground on Tuesday with improved condition of both crops in the U.S. Midwest and forecasts of beneficial weather weighing on prices.”

The article noted that, “‘U.S. weather has been positive for soybean and corn development,’ said one Singapore-based trader. ‘There are forecasts for more rains, which is likely to further improve crop prospects.'”

7-Day Total Precipitation Outlook, Aug. 8th - 15th. pic.twitter.com/M7kYJLYht4

— FarmPolicy (@FarmPolicy) August 7, 2023

Thukral also explained that, “China imported 9.73 million metric tons of soybeans in July, up 23.5% from a year ago, customs data showed on Tuesday.

“Imports in the first seven months of the year by the world’s top soybean buyer came to 62.3 million tons, up 15% from the year-ago period, the data showed.”

Meanwhile, Dow Jones writer Kirk Maltais reported yesterday that, “U.S. grain export inspections dropped back for the week ended Aug. 3, with yearly inspection totals continuing to lag behind the previous year’s pace.

“In its latest grain export inspections report from the U.S. Agriculture Department, corn export inspections totaled 376,623 metric tons, soybean inspections totaled 281,857 tons, and wheat inspections totaled 275,067 tons.

For the 2022/23 marketing year, corn inspections are down 33% from the prior year, while soybean inspections are down 6.9% and wheat is down 14.1%.

Elsewhere, Reuters writers Jonathan Saul and Nigel Hunt reported today that, “Russia’s lack of ships and Western grain traders’ shrinking appetite for business with Moscow are adding to rising costs of moving Russian wheat, at a time when the war in Ukraine has spilled perilously close to vital Black Sea supply routes.

The footprint of Vladimir Putin’s war on Ukraine is growing fast after a weekend in which sea drones crippled a Russian naval vessel and oil tanker https://t.co/GfJFvFDTnv pic.twitter.com/jWUBsESyxc

— Bloomberg TV (@BloombergTV) August 7, 2023

“President Vladimir Putin promised to replace Ukrainian grain with Russian shipments to Africa after Moscow in July ended an arrangement that gave Ukraine’s food cargo safe passage in the Black Sea, imposing a de-facto blockade on its neighbour and attacking storage facilities, in an escalation of the war.

“Ukraine’s response, sea-drone attacks on a Russian oil tanker and a warship at its Novorossiysk naval base, next door to a major grain and oil port, has added to these new dangers for transport in the Black Sea.”