Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

U.S. Corn, Soybean Conditions Slightly Lower; El Niño Weather Variables, and Danube River Transport in Focus

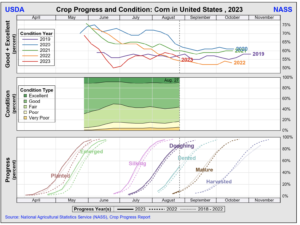

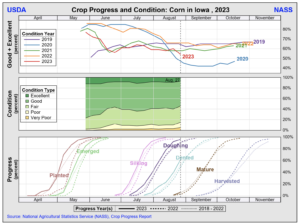

Reuters writer Julie Ingwersen reported yesterday that, “Weekly condition ratings for the U.S. soybean and corn crops declined in the past week after a spell of sweltering heat in the Midwest, government data showed on Monday, but not by as much as most analysts expected.

“The U.S. Department of Agriculture (USDA) in a weekly crop progress report rated 56% of the corn crop as good to excellent, down 2 percentage points from 58% a week ago, while 13 analysts surveyed by Reuters on average had expected a 3-point decline.

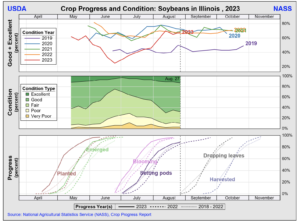

“The USDA rated 58% of the soybean crop as good to excellent, down a point from 59% last week. Analysts on average had expected a 3-point decline in soybeans to 56%.”

Ingwersen explained that, “The relatively modest drop in ratings could ease fears about crop stress, particularly for soybeans, which are in their critical pod-setting phase.”

“The good-to-excellent rating for corn is the third-lowest for this time of year since 2012, a historic drought year. Yet for soybeans, even with this week’s decline, the good-to-excellent ratings are the highest for this time of year since 2020,” the article said.

30- Day Departure From Normal Precipitation pic.twitter.com/BtU4KY1mJD

— FarmPolicy (@FarmPolicy) August 28, 2023

A separate Reuters News article from today reported that, “Temperatures have cooled but below-normal rainfall is forecast over the next two weeks. Soybeans are in their critical pod-setting phase and rely on August moisture to maximize yields.”

Sept. 5th - 11th, Outlook. pic.twitter.com/grPkPavC2S

— FarmPolicy (@FarmPolicy) August 28, 2023

#Illinois topsoil moisture, @usda_nass pic.twitter.com/LtfESBC1cD

— FarmPolicy (@FarmPolicy) August 28, 2023

Elsewhere, Dow Jones writer Kirk Maltais reported yesterday that, “U.S. grain export inspections inched up for the week ended Aug. 24 versus the previous week, according to government data.

“In its latest grain export inspections report from the U.S. Agriculture Department, corn export inspections totaled 597,144 metric tons, soybean inspections totaled 322,149 tons, and wheat inspections totaled 390,364 tons.

For the 2022/23 marketing year, corn inspections are down 33% from the prior year, while soybean inspections are down over 8% and wheat is down over 21%.

In other news, Financial Times writer George Steer reported yesterday that, “This year’s El Niño weather event is expected to compound the effects on global food prices of India’s rice export ban and Russia’s withdrawal from the Black Sea grain deal, potentially stoking inflation across emerging markets.

“Starting in September, the natural temperature fluctuation in the Pacific Ocean known as El Niño is forecast to bring months of extreme heat to parts of South Asia and Central America, as well as heavy rainfall over the Andes.

“The phenomenon typically disrupts crop cycles and is likely to add further strain to global food output and prices after heavy rainfall forced India to ban exports of non-basmati white rice and Russia bombarded Ukrainian grain terminals.”

The FT article explained that, “Combined, the three shocks could boost household inflation expectations in poorer countries where food typically comprises around 30 per cent of typical spending on consumer goods and services — double the figure for developed economies.”

Regarding the Black Sea Grain Initiative, Bloomberg writers Firat Kozok and Selcan Hacaoglu reported yesterday that, “Turkey’s President Recep Tayyip Erdogan is expected to meet Vladimir Putin in Russia next week to discuss reviving the Black Sea grain deal.”

And New York Times writers Jenny Gross and Valerie Hopkins reported today that, “For months, ships traversed the Black Sea and the Danube River without incident to load Ukrainian grain and deliver it around the world, even as Russia’s invasion of Ukraine intensified. Then in mid-July, when Russia withdrew from an agreement that allowed passage of those cargoes, everything changed.”

The Times article explained that, “Since Russia pulled out of the United Nations-backed agreement that had guaranteed the safe passage of grain shipments from Ukraine’s Black Sea ports, commercial vessels have increasingly relied on Ukraine’s much smaller ports on the Danube. They are thought to be a safer alternative because of their proximity to Romania, a NATO member.

“In July, more than two million metric tons of Ukrainian agricultural products were shipped through these ports, up from a monthly average of 1.8 million during the first half of this year, said Alexis Ellender, a global analyst at Kpler, a commodities analytics firm.

“At a meeting of European and American officials in the Romanian port of Galati this month, James C. O’Brien, the Biden administration’s sanctions coordinator, said the United States was committed to helping Ukraine expand the capacity of its Danube ports.”

Gross and Hopkins noted that, “But in recent weeks, Russia’s relentless attacks on these ports — including one on Wednesday — have caused significant damage;” and added that: “Given these risks and the threat of a Russian attack, shipowners may choose to buy grain and other agricultural products from countries like Brazil, Canada or Australia instead of Ukraine. That shift would undercut a cornerstone of Ukraine’s economy and deprive world markets of one of its largest agricultural producers, pushing prices higher.”