As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Bloomberg: As EVs Dent Gasoline and Ethanol Demand, Focus Turns to “Green Jet Fuel”

Bloomberg writers Kim Chipman and Tarso Veloso Ribeiro reported yesterday that, “For US corn farmers, the rise of green jet fuel is their best hope of staving off an existential threat.

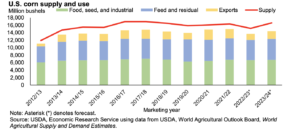

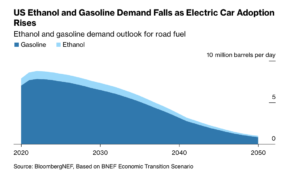

With battery-powered cars poised to slash gasoline demand by 2040, corn-ethanol makers need to find new markets, and fast. After all, roughly 40% of the country’s output of the grain is used to make the biofuel that’s blended into gasoline.

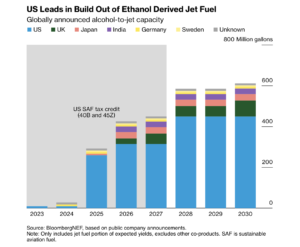

“That’s why some producers are betting on a nascent technology that promises to use ethanol to power planes.”

Ates, A.M., & Williams, A. (2023). Feed outlook: September 2023 (Report No. FDS-23i). U.S. Department of Agriculture, Economic Research Service.

Chipman and Ribeiro explained that, “The search for new uses for ethanol represents a pivot for an industry that has been powered by the force of the US government for almost half a century. Even with disputed environmental credentials, the federal government has subsidized corn ethanol as a way to curb tailpipe emissions and promote energy security.

“Now President Joe Biden is throwing his weight behind electric vehicles, prompting biofuel makers and crop traders like Archer-Daniels-Midland Co. to pursue investments in sustainable aviation fuel, or SAF.”

The Bloomberg article pointed out that, “But for now, ethanol has yet to be used for aviation fuel at commercial scale, and it’s not even clear whether ethanol-derived SAF will be eligible for tax breaks.”

“The clock is ticking. Ethanol consumption is set to plummet 12% by the end of this decade and almost 90% by 2050, according to BNEF, mirroring a drop in gasoline demand as EVs become more popular and gasoline engines more efficient,” the Bloomberg article said.

Yesterday’s article added that, “If ethanol demand for aviation fuel takes off, the market has potential to ‘more than make up‘ for the forecast decline in motor fuel demand amid the transition to EVs, Scott Irwin, an agricultural economist at the University of Illinois, said in an interview.”

Chipman and Ribeiro indicated that, “US tax breaks make SAF producers potentially eligible for a credit of $1.25 per gallon, as long as their fuel cuts greenhouse gases by half compared with conventional aviation fuel. It’s not clear whether corn-derived SAF can reach that threshold, however. Currently, it has a carbon intensity only 15% lower than regular jet fuel.”

Meanwhile, Reuters writer Naveen Thukral reported today that, “Chicago corn futures rose on Wednesday, recouping the previous session’s losses on bargain buying and positioning ahead of U.S. government stock data due later this week, although expectations of large global supplies kept a lid on the market.”

“‘The market is just waiting for the U.S. stocks report with some buying interest at these levels,’ said one Singapore-based trader. ‘Global supplies are looking comfortable.'”

The article noted that, “Russian attacks on Ukrainian ports are raising concerns over wheat supplies, although plentiful Russian supplies are weighing on the market.”

“A weekly USDA report released late on Monday showed 50% of the U.S. soybean crop rated ‘good’ or ‘excellent,’ down from 52% in the previous week and the lowest for this time of year since 2013,” the article said.

And Dow Jones writer Kirk Maltais reported yesterday that, “Analysts surveyed by The Wall Street Journal are forecasting U.S. corn stocks to be reported higher by the USDA than this time last year. Corn stocks are expected to total 1.43 billion bushels as of Sept. 1, up from 1.38 billion bushels reported at this time last year. However, soybean and wheat stocks are expected to fall off from the previous year, particularly soybeans — which is forecast to fall back 30 million bushels to 244 million bushels. Expectations for the report look to be a driver for trading for the rest of the week.”

Elsewhere, New York Times writer Constant Méheut reported today that, “Russia has held sway over the Black Sea for much of the war. But Ukraine is increasingly managing to gain a degree of control over part of its disputed waters, aided by an intensifying military campaign, experts say.

“In recent weeks, seven cargo vessels have successfully sailed a new shipping corridor established by Ukraine to evade Russia’s de facto blockade of its Black Sea ports, Ukraine’s Navy says. Analysts say that may stem from Kyiv’s new ability to hit Russian warships and potentially deter them from approaching Ukrainian waters, as well as its efforts to degrade Moscow’s surveillance capacities in the Black Sea.”

Today’s article added that, “To be sure, the Russian Navy may be reluctant to target civilian ships sailing near the shores of members of the North Atlantic Treaty Organization, along the Black Sea’s west coast, which would most likely prompt widespread condemnation, and risk escalating the war.”