The world's farmers face soaring fertilizer and fuel prices as the war in the Middle East escalates, leaving some scrambling for supplies as the spring planting season approaches and causing…

U.S. May Forfeit A Bit of “Soft Power” as Share of Global Grain Exports Recedes, While Mississippi Water Levels Still a Concern

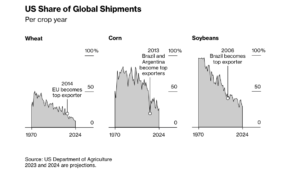

Bloomberg writers Isis Almeida, Gerson Freitas Jr, and Michael Hirtzer reported yesterday that, “Today the source of America’s agripower is rapidly dwindling.

The world’s top exporter of corn, soy and wheat for much of the past seven decades, the US is now facing a future of persistent agricultural trade deficits.

“The shortfall for the fiscal year ending Sept. 30 is estimated at $19 billion and is expected to balloon to almost $28 billion in fiscal 2024, according to Agriculture Department forecasts.

“This is an historic reversal: Since 1974 the only other annual deficits were in 2019 and 2020, during President Donald Trump’s trade war with China. The trend is driven in part by a shift in Americans’ eating habits—for instance, households today consume more imported produce, such as Mexican avocados and Indian mangoes—but stagnating grain and oilseed exports are also a factor.”

Almeida, Freitas, and Hirtzer explained that, “What does a country lose when it stops being the world’s leading food supplier? A bit of its identity: For decades, Archer-Daniels-Midland Co. (ADM), the Chicago-based commodities-trading powerhouse, advertised itself as the ‘supermarket to the world.’ But also global influence: Foreign governments and enterprises reliant on US commodity crops were motivated to play nice to keep the foodstuffs flowing. Yet gradually, as America’s grip on vital agricultural supply chains has slipped, nations with different agendas and alliances have emerged to take its place. ‘It has diminished US soft power around the world,’ says Scott Reynolds Nelson, a history professor at the University of Georgia and author of Oceans of Grain: How American Wheat Remade the World.”

The Bloomberg article pointed out that, “By and large, America’s loss has been Brazil’s gain. The South American nation already had the prerequisites for becoming an agricultural superpower in the form of plentiful arable land and a good climate. After a decade’s worth of investments in export infrastructure—including railways, port terminals and barge fleets, some led by Chinese companies, others by global trading houses—it now costs roughly the same to ship a ton of soybeans to China from Mato Grosso state as it does from Iowa.”

Yesterday’s article added that, “So where does that leave the US? Well, its influence isn’t fully tapped out. It remains the largest donor to the United Nations World Food Programme, and global prices for grains and oilseeds are still set via contracts traded on the Chicago Board of Trade. Also, while US shipments of bulk commodities have declined, its exports of more valuable processed foods are still growing.”

Meanwhile, Dow Jones writer Kirk Maltais reported yesterday that, “Planting for the next crop of corn and soybeans in South America got underway this month, and will have optimal weather conditions in the coming days, said DTN in its updated weather forecast. The firm said a front entering Brazil has introduced new rainfall to planting areas, but overall conditions remain good. In Argentina, DTN says that dryness this weekend will allow farmers into their fields, but rainfall coming next week looks well-timed to provide much-needed soil moisture to nascent crops, the chief competitors to U.S. crops on the export market.”

Maltais also indicated that, “Low water levels on the Mississippi River are creating issues for navigating barges, which in turn is driving up farmers’ transportation costs and may affect demand for U.S. grain exports. In order to compensate for lower water levels, barge loads are down by roughly 25%, and average tow sizes are reduced by as much as over a third.

#Drought Monitor- River Basins

— FarmPolicy (@FarmPolicy) September 28, 2023

* #MississippiRiver pic.twitter.com/OeVloAugKt

“‘Combined, this means more barges will be needed to move the same quantity of products…pressuring capacity and slowing downstream user efficiency,’ said the American Farm Bureau Federation in a note, adding that this is ‘especially problematic’ as farmers move into the heart of harvest season.”

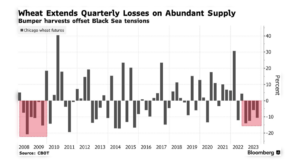

Elsewhere, Reuters News reported today that, “CBOT wheat has lost 37% of its value in four quarters of losses, while corn is down 28% and soybeans have dropped nearly 15% in three quarters.”

More narrowly, with respect to wheat, Bloomberg writer Keira Wright reported yesterday that, “Wheat headed for the worst run of quarterly losses in 14 years as bumper harvests in parts of the Northern Hemisphere offset ongoing tension in the Black Sea after the collapse of a grain agreement.”

The Bloomberg article stated that, “‘What the events around the start of the Ukraine conflict showed is that in this day and age, the world by and large has a way of getting grain to the people who need it,’ said Michael Whitehead, the head of agribusiness insights at ANZ Group Holdings Ltd. ‘This may be the new, low price level for wheat.'”

And today, Reuters writer Anna Pruchnicka reported that, “Ukraine, a major global grain producer, has harvested 41.7 million metric tons of grain and oilseeds from the new 2023 harvest so far, the agriculture ministry said on Friday.

“The ministry gave no comparative data.”

The article noted that, “[The ministry] has said Ukraine is likely to harvest 56.4 million tons of grain this year, up from 55.3 million in 2022.”