Bloomberg's Leah Nylen reported Thursday that "a Colorado judge issued an order temporarily blocking the proposed $25 billion merger of Kroger Co. and Albertsons Cos., which has been challenged by…

AMIS Fertilizer Outlook- Prices “Mostly Up in September,” While Russia Lifts Ban on Diesel Exports

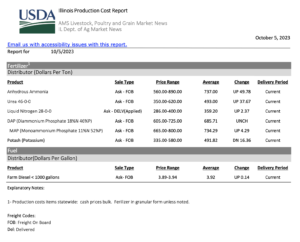

In its October Market Monitor report, the Agricultural Market Information System (AMIS) indicated that, “Fertilizer prices were mostly up in September along with prices for main fertilizer inputs. Price movements for several fertilizer categories were influenced by strength in the Indian market and uncertainty around exports from China. Market develop- ments in the near term will be impacted by these two major actors as well as by demand for the fall application season in the Northern Hemisphere.”

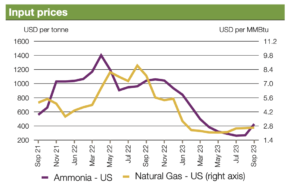

The AMIS report noted that, “Fertilizer input prices increased in September. In the case of natural gas, the previous concerns on liquified natural gas (LNG) exports out of Australia have dissipated but extensions of the maintenance schedule for plants in Norway supported European gas futures. Markets should be focused on monitoring stock levels in Europe, currently near capacity. Following an upward trend that started in August, ammonia prices surged in September, supported by major plant outages, while buyers showed unusually strong interest during this normally rather quiet time of the year.”

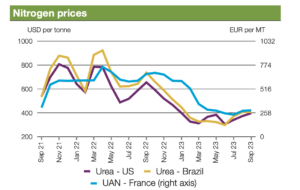

The Market Monitor stated that, “Nitrogen fertilizer prices increased in September. Urea price increases were driven by uncertainty around the Chinese export levels, as authorities limited the distribution of export licenses to control domestic pricing. In this context, the unexpected purchase tender of Indian Potash Ltd. (IPL) on 15 September also provided support. Developments in China and India will continue shaping market sentiment in other nitrogen markets around the globe.”

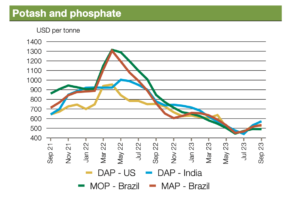

The Monitor added that, “Phosphorus fertilizer prices increased in several major markets with particular strength in the Indian market and uncertainty around export restrictions from China linked to the customs inspection process. On the other hand, the earthquake in Morocco did not trigger major supply issues as initially anticipated. Current discussions on the nutrient-based subsidy rates in India are a major factor to watch, while demand is slow in Brazil and uncertain in the United States in view of the phosphate to grain price ratio that will determine application rates in the fall.”

The AMIS report also explained that, “Potash prices in major importer Brazil were down slightly in September due to abundant availabilities. Global values show signs of stability.”

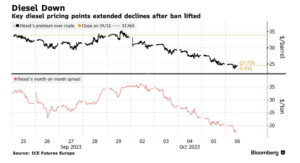

With respect diesel fuel, an additional agricultural production input cost, Financial Times writer David Sheppard reported on Friday that, “Russia has lifted a ban on diesel exports that had threatened to tighten global supplies of the crucial industrial fuel and raised concerns that Moscow was shifting its energy war to the oil market.

“Moscow said in a statement on Friday that seaborne exports could resume as long as manufacturers sent half of the diesel they produce to the domestic market, roughly the historical norm. The Kremlin had said it had imposed the ban because of domestic shortages.

“The move on Friday triggered a sell-off in diesel markets with prices in Europe falling more than 3 per cent, as fears over shortages eased. Prices had initially surged when the ban was brought in two weeks ago, although they had already slipped lower amid a wider decline in energy markets.”

The FT article explained that,

Diesel is the workhorse fuel of the global economy, playing a crucial role in freight, shipping and aviation.

And Bloomberg News reported on Friday that, “Russia allowed a return to seaborne exports of diesel just weeks after imposing a ban that roiled global markets, taking other steps instead to keep sufficient fuel supplies at home.”

“The ban drove up European prices in an already tight market. Refiners around the world are struggling to produce enough of the fuel after Russia and Saudi Arabia cut supply of crudes rich in diesel, causing inventories to dwindle,” the Bloomberg article said.

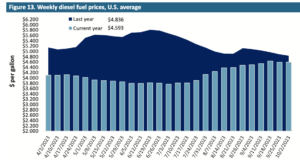

Elsewhere, in its weekly Grain Transportation Report on Thursday, the USDA’s Agricultural Marketing Service indicated that, “For the week ending October 2, the U.S. average diesel fuel price increased 0.7 cents from the previous week to $4.593 per gallon, 24.3 cents below the same week last year.”