As a result of the attack on Iran, nitrogen fertilizer at the port of New Orleans has seen an increase in price this week. Urea prices for barges in New…

Anhydrous Prices Climb; Mississippi Hits Record Low at Memphis, and China “Scoops Up Wheat”

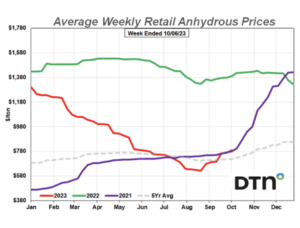

DTN writer Russ Quinn reported yesterday that, “Retail fertilizer prices continued to be evenly split the first week of October 2023 with half lower and half higher compared to last month, according to sellers surveyed by DTN.

“Prices for four of the eight major fertilizers were higher than last month while the other four were lower. DTN designates a significant move as anything 5% or more.

Anhydrous was 14% higher compared to last month with an average price of $790 per ton. Once again, both MAP and UAN32 were 6% more expensive compared to last month. MAP had an average price of $791/ton, while UAN32 was $414/ton.

Quinn indicated that, “One fertilizer was just slightly higher in price compared to last month. Urea had an average price of $573/ton.

“Prices for the other four fertilizers were just slightly lower compared to the prior month. DAP had an average price of $705/ton, potash $508/ton, 10-34-0 $609/ton and UAN28 $354/ton.”

Earlier this week, Bloomberg writer Kim Chipman reported that, “Fertilizer makers jumped after Hamas’ surprise attack on Israel raised concerns over how the conflict could impact global supplies of nutrients used to grow crucial food crops.

“Israel’s Port of Ashdod, just north of Gaza and a key hub for the country’s potash fertilizer exports, is in emergency mode amid the deadly conflict. That’s putting as much as 3% of global potash supply at possible risk, Ben Isaacson, a Scotiabank analyst, said in a note Monday.”

“Further, if Iran, a critical nitrogen exporter in the region, is drawn into the conflict, Isaacson said prices of the nutrient needed for grain production could spike due to limited supply and potential premiums in benchmark Dutch TTF natural gas, a commodity used to make nitrogen-based fertilizers.”

Chipman pointed out that, “Global fertilizer prices had significantly cooled this year after surging in 2022 due to supply disruptions from the war in Ukraine.”

Elsewhere, on Tuesday, the National Weather Service Memphis, Tennessee Office stated on the X social media platform that, “Preliminary data shows the Mississippi River at Memphis has hit an all-time record low stage of -11.01′ this afternoon. This data will need to be verified by the USACE.”

Preliminary data shows the Mississippi River at Memphis has hit an all-time record low stage of -11.01' this afternoon. This data will need to be verified by the USACE.

— NWS Memphis (@NWSMemphis) October 10, 2023

And its Daily U.S. Agricultural Weather Highlights report on Wednesday, the USDA’s Office of the Chief Economist indicated that, “Meanwhile, the Mississippi River at Memphis, Tennessee, fell to a record-low level early today, approximately 8 inches below the low-water mark established on October 21, 2022.”

.@usda_oce Wx: ...The #Mississippi River at Memphis, Tennessee, fell to a record-low level early today, approximately 8 inches below the low-water mark established on October 21, 2022...

— FarmPolicy (@FarmPolicy) October 11, 2023

More broadly, Washington Post writer Brady Dennis reported late last week that, “As a mass of salt water from the Gulf of Mexico has forced its way nearly 70 miles up the drought-stricken Mississippi, the problem has drawn national attention, triggered a presidential emergency declaration and ignited a feverish effort to protect the drinking water supply for roughly a million people around greater New Orleans.”

The Post article added that, “Two years in a row now, crippling drought has severely weakened the flow of the Mississippi, which in more normal times is strong enough to prevent salt water from intruding very far upstream.”

Recall that the USDA’s Agricultural Marketing Service recently pointed out that, “From the week ending July 8 to the week ending September 30, downbound barged grain volumes on the [Mississippi River System] totaled 3.9 million tons—35 percent lower than the third quarter last year and 53 percent lower than the previous 5-year average.”

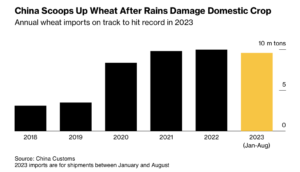

Meanwhile, Bloomberg writer Hallie Gu reported today that, “China is scouring the globe for wheat, with annual imports on track to hit record levels, as buyers scoop up cheap supplies after heavy rains damaged the domestic crop.

“Following a splurge on Australian wheat earlier in the year, large quantities have been booked this month from some of the other main exporters, including the US, Canada and France, according to traders, who declined to be identified discussing private business.

“The buying spree comes after international wheat prices dropped to a three-year low at the end of September. Although that signals supplies are ample for now, China’s growing appetite adds an element of uncertainty to supply chains that have become increasingly vulnerable to war and protectionist trade policies.”