A new 10% tariff on goods from around the world took effect Tuesday — with a list of exemptions including beef. Other exemptions affecting the food and agriculture industries include…

China Approves “Dozens” of Genetically Modified Corn, Soybean Varieties- Potentially Advancing Production

Bloomberg writer Hallie Gu reported yesterday that, “China has approved dozens of genetically modified corn and soybean seed varieties for planting, in a breakthrough move that could eventually boost production and reduce dependence on foreign supplies.

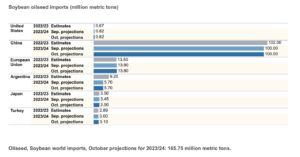

“The country is the world’s top importer of soybeans and corn.

Large-scale marketing of GM crops would support the government’s drive for food self-sufficiency and security, a top priority for President Xi Jinping.

“A national committee set up by the agriculture ministry has approved 37 GM corn seed and 14 soybean seed varieties, after a preliminary review, the ministry said on Tuesday.”

The Bloomberg article explained that, “The acreage designated for planting the GM crops is still very small, however, reaching just 4 million mu (267,000 hectares) this year, state media reported.

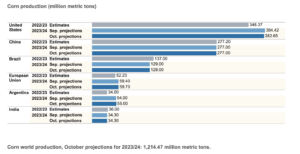

“Corn area alone in China is about 44 million hectares, with output of over 288 million tons likely in the 2023-24 year, according to the agriculture ministry. While productivity lags far behind the US, where GM varieties are widely grown, such seeds can increase yields in China by as much as 12%, the ministry said.”

In other news developments regarding China, Reuters writer Tom Polansek reported yesterday that, “Arkansas ordered Syngenta to sell 160 acres (65 hectares) of farmland in the U.S. state within two years on Tuesday because the company is Chinese-owned, drawing a sharp rebuke from the global seeds producer.

“U.S. farm groups and lawmakers are increasingly scrutinizing foreign land ownership due to concerns about national security.”

Bloomberg writer Gerson Freitas Jr. reported yesterday that, “The move is another demonstration of how rising US-China tensions has reverberated across state and local politics in Middle America, sowing angst about Chinese investment. In a similar development, a $700 million corn mill project in Grand Forks, North Dakota, was scrapped earlier this year after facing growing opposition from local politicians over its Chinese owner.

“The Arkansas order is a ‘shortsighted action that fails to account for the effects of such an action, intended or not, on the U.S. agricultural market,’ Saswato Das, a Syngenta spokesman, said in an e-mailed statement. The farmland targeted by the decision has been owned by Syngenta, which is headquartered in Switzerland, since 1988 and is primarily used for research and product development for the US market, according to Das. ‘No one from China has ever directed any Syngenta executive to buy, lease, or otherwise engage in land acquisition in the United States.'”

Meanwhile, Dow Jones writer Kirk Maltais reported yesterday that, “Wheat for December delivery fell 1% to $5.71 1/4 a bushel, on the Chicago Board of Trade on Tuesday, with China apparently looking to Australia for grain purchases.”

A recent USDA transportation report pointed out that, “China was the fifth-largest importer of U.S wheat in MY 2022-23, accounting for 7 percent of total U.S. wheat shipments for that year.”

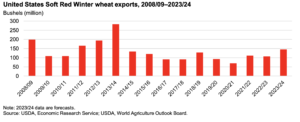

In a related note, the USDA’s Economic Research Service (ERS) indicated in its monthly Wheat Outlook report on Monday that, “U.S. Soft Red Winter (SRW) exports are forecast up 10 million bushels this month to 145 million bushels, the largest since 2013/14.

“SRW [which accounts for about 15 percent of U.S. wheat production and is grown mainly along the Mississippi River and in eastern States. Flour used for cakes, cookies, and crackers] production this year is up 34 percent from the previous year based on record yield and a 21-percent expansion in area harvested. This class of wheat has benefited from multiple years of favorable weather and bumper yields, with production the largest in 9 years. This is in contrast to U.S. Hard Red Winter (HRW) [which accounts for about 40 percent of U.S. wheat production and is grown mainly in Great Plains. Principally used to make bread flour] supplies, which are historically tight following back-to-back droughts. If the current forecasts are realized, SRW exports will be equal to HRW exports for the first time since official records began (by-class historical records extend to 1973/74).

“SRW is priced competitively for export into many markets, supporting a brisk pace of sales and shipments. Notably, USDA, Foreign Agricultural Service reported on October 3 that China had purchased 220,000 metric tons of SRW or more than 8 million bushels.

China was also a major buyer of SRW in 2013/14, when total exports of that class reached 283 million bushels.

And on October 13th, USDA reported, “181,000 metric tons of soft red winter wheat for delivery to China during the 2023/2024 marketing year.”

More broadly with respect to China, Financial Times writers Edward White, Sun Yu, Cheng Leng and Hudson Lockett reported today that, “China’s gross domestic product grew 4.9 per cent year on year in the third quarter, beating market expectations as Beijing steps up support for the world’s second-biggest economy.

“The economy expanded 1.3 per cent on a quarterly basis, China’s National Bureau of Statistics said, regaining some momentum after growth of just 0.5 per cent in the April-June period.”