President Donald Trump on Friday signed an executive order temporarily expanding the amount of beef the U.S. can import from Argentina, a move the White House says is aimed at…

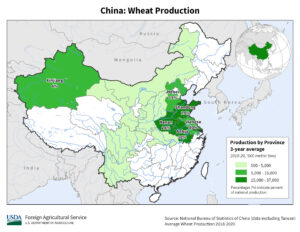

China Wheat Imports Could Set Record This Year

Reuters writers Naveen Thukral and Dominique Patton reported yesterday that, “China is set to import record volumes of wheat this year, trading sources say, with rain damage to its crop and worries over dry weather in exporting nations fuelling Beijing’s appetite to buy while prices are low.

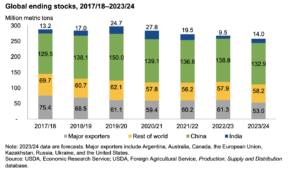

“Traders said China’s frantic buying is likely to support global prices, which have dropped more than a quarter this year – based on the Chicago futures benchmark price – amid abundant supplies from top exporter Russia.”

The Reuters article explained that, “The world’s biggest wheat producer and consumer, China bought around two million metric tons of new-crop Australian wheat in October, for shipments starting in December, trading sources told Reuters. It has also booked about 2.5 million metric tons of French wheat since September, for December-March shipment, they said, noting these were unusually large volumes for this time of year.

Overall, China’s 2023 imports are likely to reach around 12 million tons, two Singapore-based traders said, topping 2022’s record 9.96 million tons, and the avid buying is expected to continue into 2024.

Thukral and Patton added that, “China’s January-September wheat imports jumped 53.6% to 10.17 million metric tons, customs data showed, including 6.4 million tons from Australia and 1.8 million tons from Canada. Those figures don’t reflect orders made for future delivery, such as recent purchases of U.S. soft red winter wheat.

“Beijing’s heavy buying from Australia could force rival importers such as Indonesia and Japan to seek alternatives from North America and the Black Sea region, traders said.”

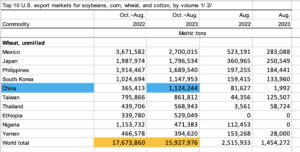

A recent USDA transportation report pointed out that, “China was the fifth-largest importer of U.S wheat in MY 2022-23, accounting for 7 percent of total U.S. wheat shipments for that year.”

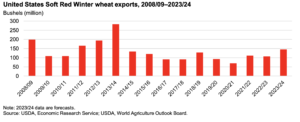

In a related note, the USDA’s Economic Research Service (ERS) indicated in its Wheat Outlook report this month that, “U.S. Soft Red Winter (SRW) exports are forecast up 10 million bushels this month to 145 million bushels, the largest since 2013/14.”

“China was also a major buyer of SRW in 2013/14, when total exports of that class reached 283 million bushels,” ERS said.

A Reuters News article from today reported that, “In the United States, the Department of Agriculture (USDA) rated 47% of the U.S. winter wheat crop in good to excellent condition, the highest for this time of year since 2020.

“Improved prospects in the world’s No. 4 wheat exporter could ease concerns about tightening global grain supplies, but U.S. winter wheat won’t be harvested until mid-2024.”

And yesterday, Dow Jones writer Kirk Maltais reported that, “Rainfall came to South American growing areas over the weekend, which hit CBOT grains throughout the day. Rainfall in parched areas of Brazil and Argentina are expected to quell any drought issues the nascent crop may be struggling with, which in turn may allow these countries to field bumper crops dragging export prices lower.”

Also yesterday, Reuters writer Pavel Polityuk reported that, “The success of Ukraine’s new Black Sea export corridor has led to a sharp increase in the number of rail wagons heading to the ports of Odesa region, a senior railways official said on Monday.

“Valeriy Tkachov, deputy director of the commercial department at Ukrainian Railways, said on Facebook that over the last week the number of grain wagons heading to Odesa ports increased by more than 50% to 4,032 from 2,676.

“In August, Ukraine launched a ‘humanitarian corridor’ for ships bound for African and Asian markets to try to circumvent a de facto blockade in the Black Sea after Russia quit a deal that had guaranteed Kyiv’s seaborne exports during the war.”